Question: intermedate accouting , please show your work step by step and show the equastion used for each qustion Answer the following two questions Question 1:

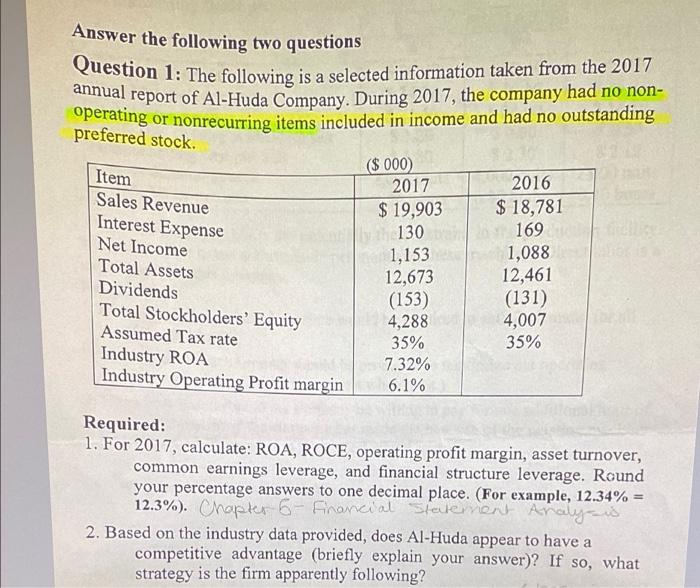

Answer the following two questions Question 1: The following is a selected information taken from the 2017 operating or nonrecurring items included in income and had no outstanding annual report of Al-Huda Company. During 2017, the company had no non- preferred stock. Item Sales Revenue Interest Expense Net Income Total Assets Dividends Total Stockholders' Equity Assumed Tax rate Industry ROA Industry Operating Profit margin ($ 000 2017 $ 19,903 130 1,153 12,673 (153) 4,288 35% 7.32% 6.1% 2016 $ 18,781 169 1,088 12,461 (131) 4,007 35% Required: 1. For 2017, calculate: ROA, ROCE, operating profit margin, asset turnover, common earnings leverage, and financial structure leverage. Round your percentage answers to one decimal place. (For example, 12.34% = 12.3%). Chapter 6 Chancial State viene Avaly 2. Based on the industry data provided, does Al-Huda appear to have a competitive advantage (briefly explain your answer)? If so, what strategy is the firm apparently following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts