Question: Intermediate 1 FSR Project Part #3: Current Liabilities To practice recording contingent liabilities and reporting them in the financial statements. (See Topic Guides LE 6,

Intermediate 1 FSR Project Part #3: Current Liabilities

To practice recording contingent liabilities and reporting them in the financial statements. (See Topic Guides LE 6, 7, 8).

Information:

At the beginning of 2021, Saola was informed that a new city ordinance would require them to restore the woods behind their main factory if they intend to keep using it. The estimated cost of the restoration will be approximately $690,000 and must be done within the next 5 years or the factory will be shut down. When the notice was received, Saolas board decided to wait until the beginning of 2025 to start the restoration.

Although the notice was received and the boards decision made at the beginning of the year, no journal entries have yet been made for this obligation. The factory was built 3 years ago when Saola was still a privately held company and is being depreciated using SL depreciation using the original estimate of a 15 year useful life. The depreciation for the building has already been recorded for 2021. The restoration will not change the factorys salvage value.

Saolas management would like to know the effect of your adjustment on the following ratios:

Current Ratio ROA

Assignment:

Calculations

Make the appropriate journal entries, if any, to account for the new liability (including any necessary changes to income tax expense). In making your entries, assume that Saolas Internal Rate of Return is 6%.

Make any necessary changes to the financial statements.

Critical Thinking

Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes).

In past years legal requirements were the primary reasons for companies to recognize an ARO like this one. However, there has been a recent push by companies to improve their social responsibility without waiting for government intervention. How do you think investors would have reacted to this adjustment if Saola had made the decision to clean up the environment around their facility on their own? Do you think the drop in net income would have been considered less negative if the decision had been Saola's? Defend your answer.

5. Saolas CEO argued that they should wait until they had to actually satisfy the obligation to record it, after all they werent going to have to actually pay anything until then. What are the possible consequences of this decision and who is likely to be affected?

Hints:

An obligation that will be paid more than 1 year out should be recorded at its present value, not its face value.

You will need to make two journal entries in addition to the initial recognition of the obligation (not including taxes). When you make the estimates for these adjusting entries, you only need to use the information from the initial recognition of this obligation. You wont need to redo any other estimates or other adjusting entries from earlier Saola problems.

-

When working on the Statement of Cash Flows, pay close attention to the actual cash amounts in your journal entries. The total change in cash should change by that amount. Any non-cash changes to NI will need to be removed from the CFO section to correctly make your statement to balance (just like we remove Depreciation because it doesn't have a real cash effect). When making those adjustments, the common line title when adjusting for interest on an ARO is 'Accretion Expense.'

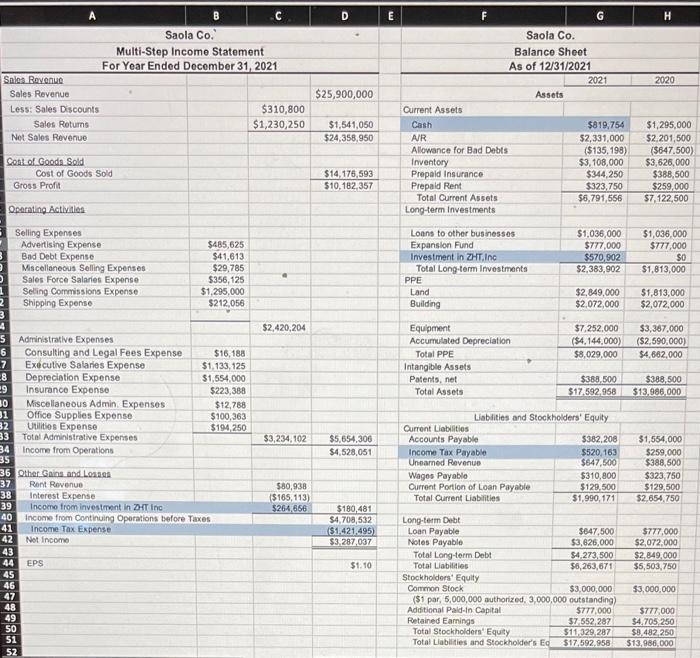

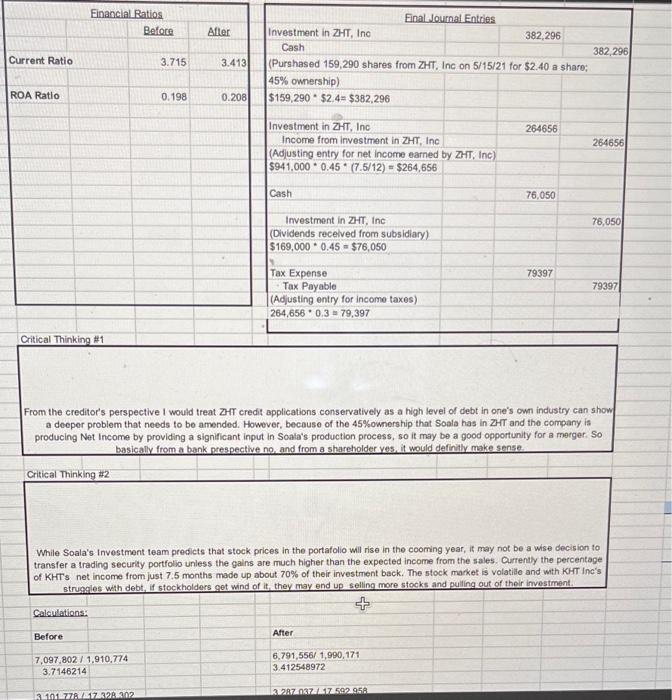

From the creditor's perspective I would treat ZrT credit applications conservatively as a high level of debt in one's own industry can show a doeper problem that needs to be amended. However, because of the 45% ownership that Soala has in ZHT and the compary is producing Net income by providing a significant input in Soala's production process, so it may be a good opportunity for a merger. So basically from a bank prespective no, and from a shareholder yes, it would definitly make sense. Critical Thinking H2 While Soala's Investment team predicts that stock prices in the portafolio will rise in the cooming year, it may not be a wise decision to transfer a trading security portfolio unless the gains are much higher than the expected income from the sales. Currently the percentage of KHT's net income from just 7.5 months mado up about 70% of their investment back. The stock market is volatillo and with KHT Inc's struagles with debt, if stockholders get wind of it, they may end up selling more stocks and pulling out of their investment. \begin{tabular}{l|l|} \hline Coloulations: & \\ \hline Before & After \\ \hline 7,097,802/1,910,774 & 6,791,556/1,990,171 \\ \hline 3.7146214 & 3.412548972 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts