Question: Intermediate Accounting 3 Problem on Non-current Assets held for sale On January 1,2020 , an entity acquired an equipment at a cost of P4,000,0000 to

Intermediate Accounting 3

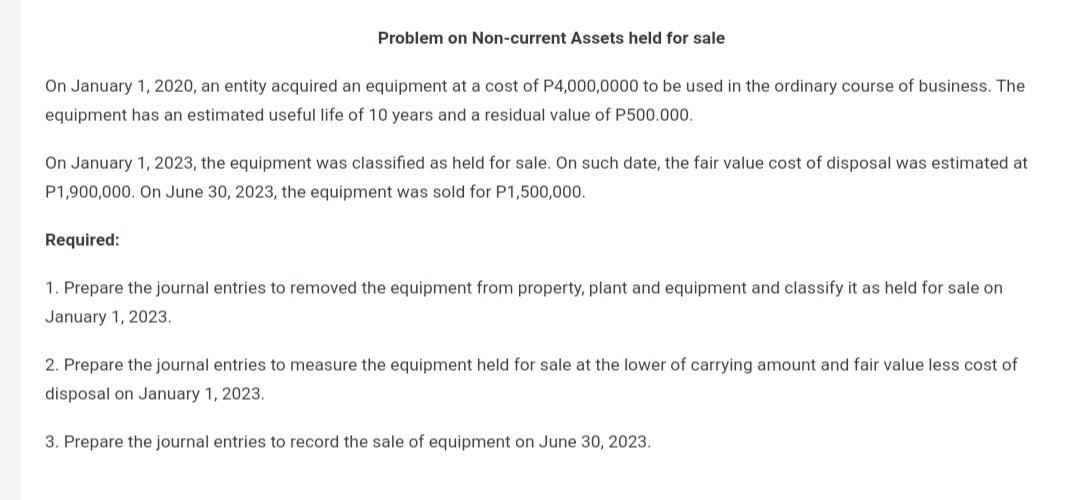

Problem on Non-current Assets held for sale On January 1,2020 , an entity acquired an equipment at a cost of P4,000,0000 to be used in the ordinary course of business. The equipment has an estimated useful life of 10 years and a residual value of P500.000. On January 1, 2023, the equipment was classified as held for sale. On such date, the fair value cost of disposal was estimated at P1,900,000. On June 30,2023 , the equipment was sold for P1,500,000. Required: 1. Prepare the journal entries to removed the equipment from property, plant and equipment and classify it as held for sale on January 1,2023 2. Prepare the journal entries to measure the equipment held for sale at the lower of carrying amount and fair value less cost of disposal on January 1,2023. 3. Prepare the journal entries to record the sale of equipment on June 30,2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts