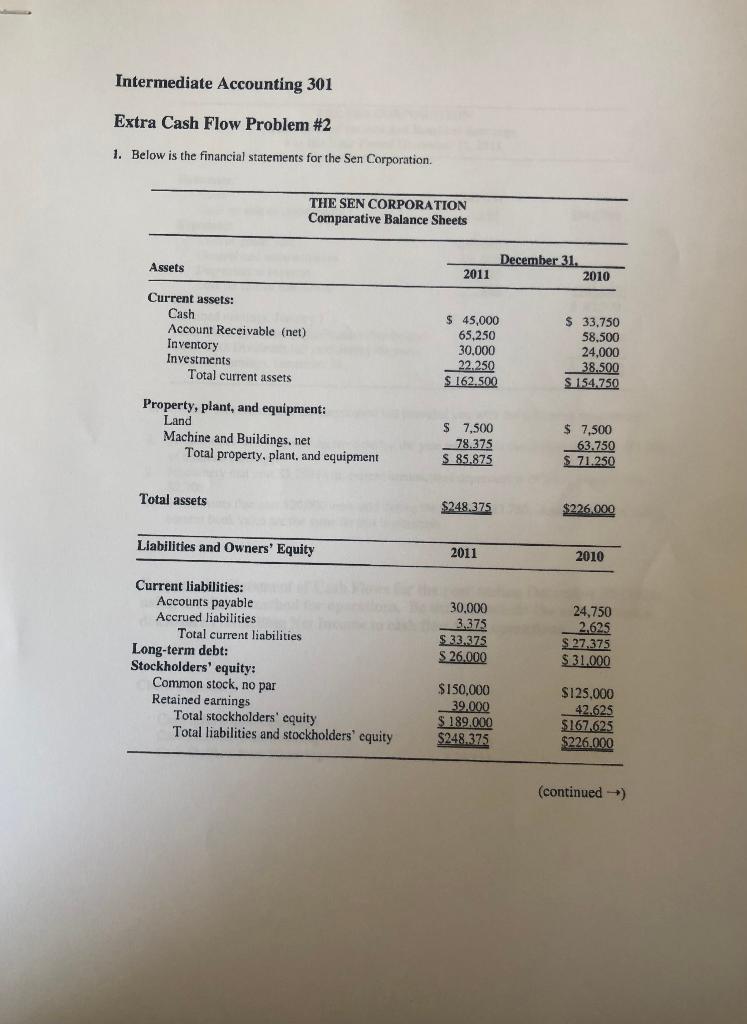

Question: Intermediate Accounting 301 Extra Cash Flow Problem #2 1. Below is the financial statements for the Sen Corporation THE SEN CORPORATION Comparative Balance Sheets Assets

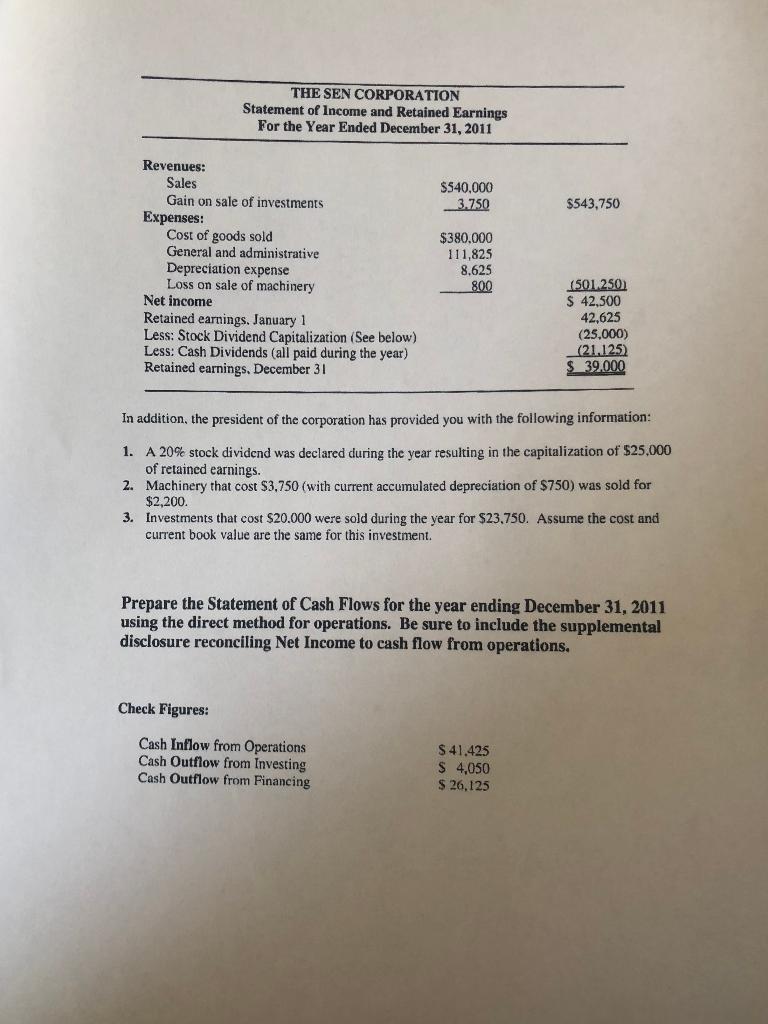

Intermediate Accounting 301 Extra Cash Flow Problem #2 1. Below is the financial statements for the Sen Corporation THE SEN CORPORATION Comparative Balance Sheets Assets December 31. 2010 2011 Current assets: Cash Account Receivable (net) Inventory Investments Total current assets $ 45,000 65.250 30.000 22.250 $ 162.500 $ 33.750 58.500 24,000 38.500 $ 154.750 Property, plant, and equipment: Land Machine and Buildings, net Total property, plant, and equipment $ 7,500 78.375 S 85.875 $ 7,500 63.750 $ 71.250 Total assets $248.375 $226,000 Liabilities and Owners' Equity 2011 2010 Current liabilities: Accounts payable Accrued liabilities Total current liabilities Long-term debt: Stockholders' equity: Common stock, no par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 30,000 3.375 $ 33.375 $26.000 24,750 2,625 $ 27.375 $ 31,000 $150,000 39.000 $ 189.000 $125.000 42.625 $167.625 $226.000 $248,375 (continued) THE SEN CORPORATION Statement of Income and Retained Earnings For the Year Ended December 31, 2011 $540,000 3.750 $543,750 Revenues: Sales Gain on sale of investments Expenses: Cost of goods sold General and administrative Depreciation expense Loss on sale of machinery Net income Retained earnings. January 1 Less: Stock Dividend Capitalization (See below) Less: Cash Dividends (all paid during the year) Retained earnings, December 31 $380.000 111,825 8.625 800 (501.250) $ 42.500 42,625 (25.000) (21.125) $ 39,000 In addition, the president of the corporation has provided you with the following information: 1. A 20% stock dividend was declared during the year resulting in the capitalization of $25,000 of retained earnings. 2. Machinery that cost $3,750 (with current accumulated depreciation of $750) was sold for $2,200. 3. Investments that cost $20.000 were sold during the year for $23.750. Assume the cost and current book value are the same for this investment. Prepare the Statement of Cash Flows for the year ending December 31, 2011 using the direct method for operations. Be sure to include the supplemental disclosure reconciling Net Income to cash flow from operations. Check Figures: Cash Inflow from Operations Cash Outflow from Investing Cash Outflow from Financing $ 41.425 $ 4,050 $ 26,125

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts