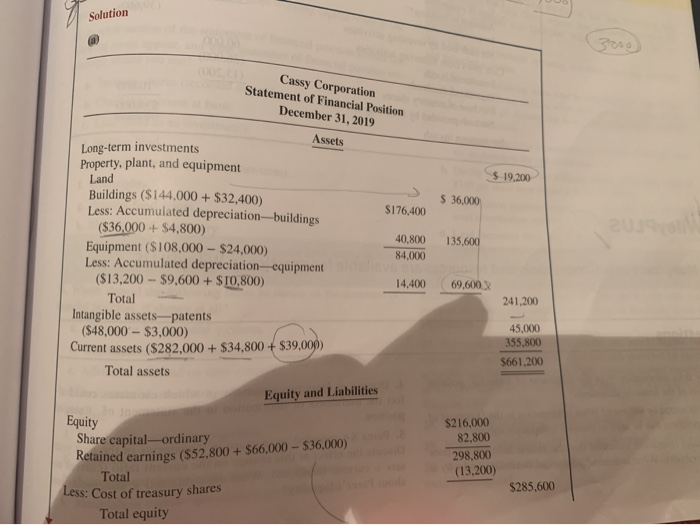

Question: intermediate accounting 3rd . why we added 39000 for the curesst asset? i meant current * Solution 300 Cassy Corporation Statement of Financial Position December

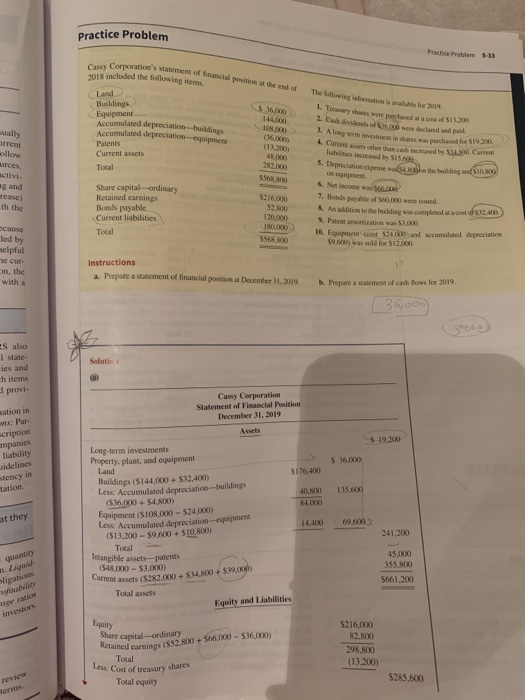

Solution 300 Cassy Corporation Statement of Financial Position December 31, 2019 Assets $-19.200 S 36,000 SI76,400 SUR 135,600 Long-term investments Property, plant, and equipment Land Buildings ($144,000 + $32,400) Less: Accumulated depreciation-buildings ($36,000+ $4,800) Equipment ($108,000 - $24,000) Less: Accumulated depreciation equipment ($13,200 - $9,600 + $10,800) Total Intangible assets-patents (S48,000 - $3,000) Current assets ($282,000+ $34.800 + $39,000) Total assets 40,800 84.000 14.400 69,600 241,200 45,000 355,800 $661.200 Equity and Liabilities Equity Share capital-ordinary Retained earnings ($52,800 + $66,000 - $36,000) Total Less: Cost of treasury shares Total equity $216,000 82.800 298,800 (13,200) $285,600 Practice Problem 33 2018 included the following items. 5 3.000 The following information is for 2019 1. Tyres were purchased at a cost of 513.300 2. Csidents of twee declared and paid 3. Along terminie w purchased 519.00 Accumulated depreciation-buildings Accumulated depreciation equipment (16,000 wally urrent ollow urces activi- gand Tease) th the 18.00 22.30 556800 5. Depreciation experts the building and10.30 $216.000 130.000 ted by nelpful 36,000 30 Cassy Corporation's statement of financial position at the end of Retained earnings (532.800 + 566,000 - $36.000) Low Cost of treasury shares Practice Problem Land Buildings Equipment Patents Current assets Total Share capital-ordinary Retained earnings 7. Bonds payable of so were issued Bonds payable & Analition to the building was completed a cost of $13.400 Current liabilities %. Palentamination was $3,000 Total 10. Equipment cost $34.000 and accumulated depreciation $9.609) was sold for $12.000 he cur Instructions on, the with a a. Prepare a statement of financial position at December 31, 2019. b. Prepare a statement of cash flows for 2019. ES also I state- Soluti les and ch items provi Cassy Corporation Statement of Financial Position December 31, 2019 5 19.200 Long-term investments Property, plant, and equipment $ 16.000 Land $176.400 Buildings ($144,000+ $32,400) Les Accumulated depreciation-buildings 40,000 135.00 (54,000+ $4.800) 84.000 Equipment ($100.000 - 524.000) Less: Accumulated depreciation-equipment (513.200 - 59.600 + SIO 800) 241.200 Total Intangible assets-patents 45,000 1848.000 - $3.000) 355,800 S661.200 Total assets $216.000 Share capital-ordinary 82.800 298,800 Total (13.200) Total equity mation in Par ecription mpanies uidelines tency in at they quantity Current assets (5282.000 + 554.800 + $39.000) Equity and liabilities Equity $285.600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts