Question: Intermediate accounting )An improvement made to a machine increased its fair value and its production ca capacity by 25% without extending the machine's useful life.

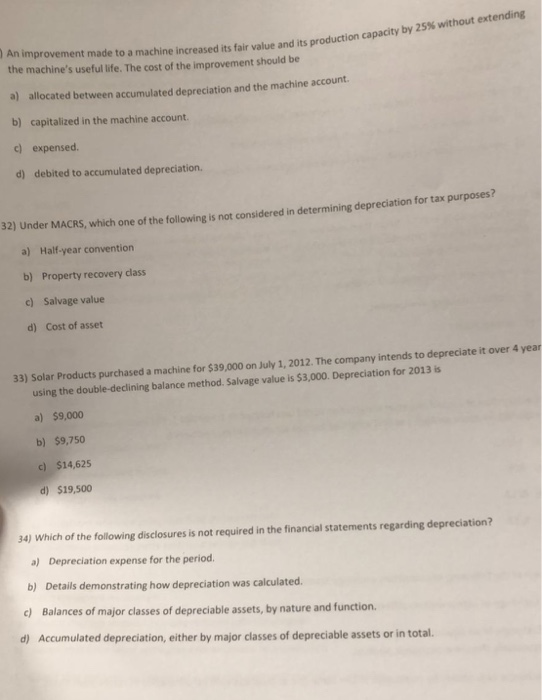

)An improvement made to a machine increased its fair value and its production ca capacity by 25% without extending the machine's useful life. The cost of the improvement should be a) allocated between accumulated depreciation and the machine account. b) capitalized in the machine account c) expensed d) debited to accumulated depreciation. 32) Under MACRS, which one of the following is not considered in determining depreciation for tax purposes? a) Half-year convention b) Property recovery class c) Salvage value d) Cost of asset 33) Solar Products purchased a machine for $39,000 on July 1, 2012. The company intends to depreciate it over 4 yea using the double-declining balance method. Salvage value is $3,000. Depreciation for 2013 is a) $9,000 b) $9,750 c) $14,625 d) $19,500 34) Which of the foillowing disclosures is not required in the financial statements regarding depreciation? a) Depreciation expense for the period. b) Details demonstrating how depreciation was calculated. c) Balances of major classes of depreciable assets, by nature and function. d) Accumulated depreciation, either by major classes of depreciable assets or in total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts