Question: Intermediate Accounting I Exercise ( Review ) - ACCT 3 3 2 1 Consulting Co Post the transactions to the appropriate T - Accounts based

Intermediate Accounting I

Exercise Review ACCT Consulting Co

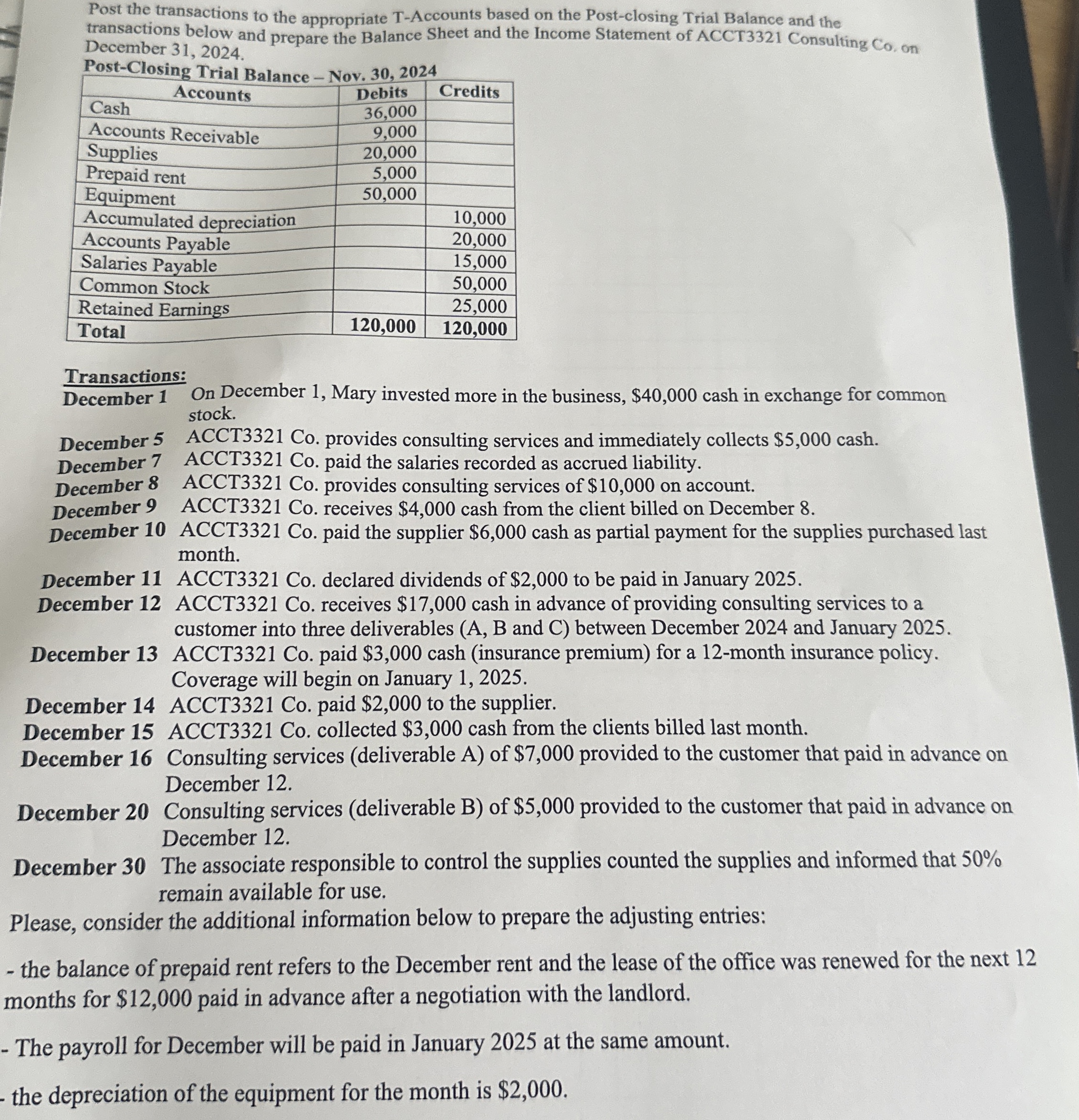

Post the transactions to the appropriate TAccounts based on the Postclosing Trial Balance and the transactions below and prepare the Balance Sheet and the Income Statement of ACCT Consulting Co on December

PostClosing Trial Balance Nov.

tableAccountsDebits,CreditsCashAccounts Receivable,SuppliesPrepaid rent,EquipmentAccumulated depreciation,,Accounts Payable,,Salaries Payable,,Common Stock,,Retained Earnings,,Total

Transactions:

December On December Mary invested more in the business, $ cash in exchange for common stock.

December ACCT Co provides consulting services and immediately collects $ cash.

December ACCT Co paid the salaries recorded as accrued liability.

December ACCT Co provides consulting services of $ on account.

December ACCT Co receives $ cash from the client billed on December

December ACCT Co paid the supplier $ cash as partial payment for the supplies purchased last month.

December ACCT Co declared dividends of $ to be paid in January

December ACCT Co receives $ cash in advance of providing consulting services to a customer into three deliverables A B and C between December and January

December ACCT Co paid $ cash insurance premium for a month insurance policy. Coverage will begin on January

December ACCT Co paid $ to the supplier.

December ACCT Co collected $ cash from the clients billed last month.

December Consulting services deliverable A of $ provided to the customer that paid in advance on December

December Consulting services deliverable B of $ provided to the customer that paid in advance on December

December The associate responsible to control the supplies counted the supplies and informed that remain available for use.

Please, consider the additional information below to prepare the adjusting entries:

the balance of prepaid rent refers to the December rent and the lease of the office was renewed for the next months for $ paid in advance after a negotiation with the landlord.

The payroll for December will be paid in January at the same amount.

the depreciation of the equipment for the month is $

Post the transactions to the appropriate TAccounts based on the Postclosing Trial Balance and the transactions below and prepare the Balance Sheet and the Income Statement of ACCT Consulting Co on December

PostClosing Trial Balance Nov.

tableAccountsDebits,CreditsCashAccounts Receivable,SuppliesPrepaid rent,EquipmentAccumulated depreciation,,Accounts Payable,,Salaries Payable,,Common Stock,,Retained Earnings,,Total

Transactions:

December On December Mary invested more in the business, $ cash in exchange for common stock.

December ACCT Co provides consulting services and immediately collects $ cash.

December ACCT Co paid the salaries recorded as accrued liability.

December ACCT Co provides consulting services of $ on account.

December ACCT Co receives $ cash from the client billed on December

December ACCT Co paid the supplier $ cash as partial payment for the supplies purchased last month.

December ACCT Co declared dividends of $ to be paid in January

December ACCT Co receives $ cash in advance of providing consulting services to a customer into three deliverables A B and C between December and January

December ACCT Co paid $ cash insurance premium for a month insurance policy. Coverage will begin on January

December ACCT Co paid $ to the supplier.

December ACCT Co collected $ cash from the clients billed last month.

December Consulting services deliverable A of $ provided to the customer that paid in advance on December

De

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock