Question: INTERMEDIATE ACCOUNTING I HANDOUT PROBLEM 13 Score_ Name_ Section Problem (10 points). Hickory Holdings, Inc. invests in various companies'stocks with the intent of receiving both

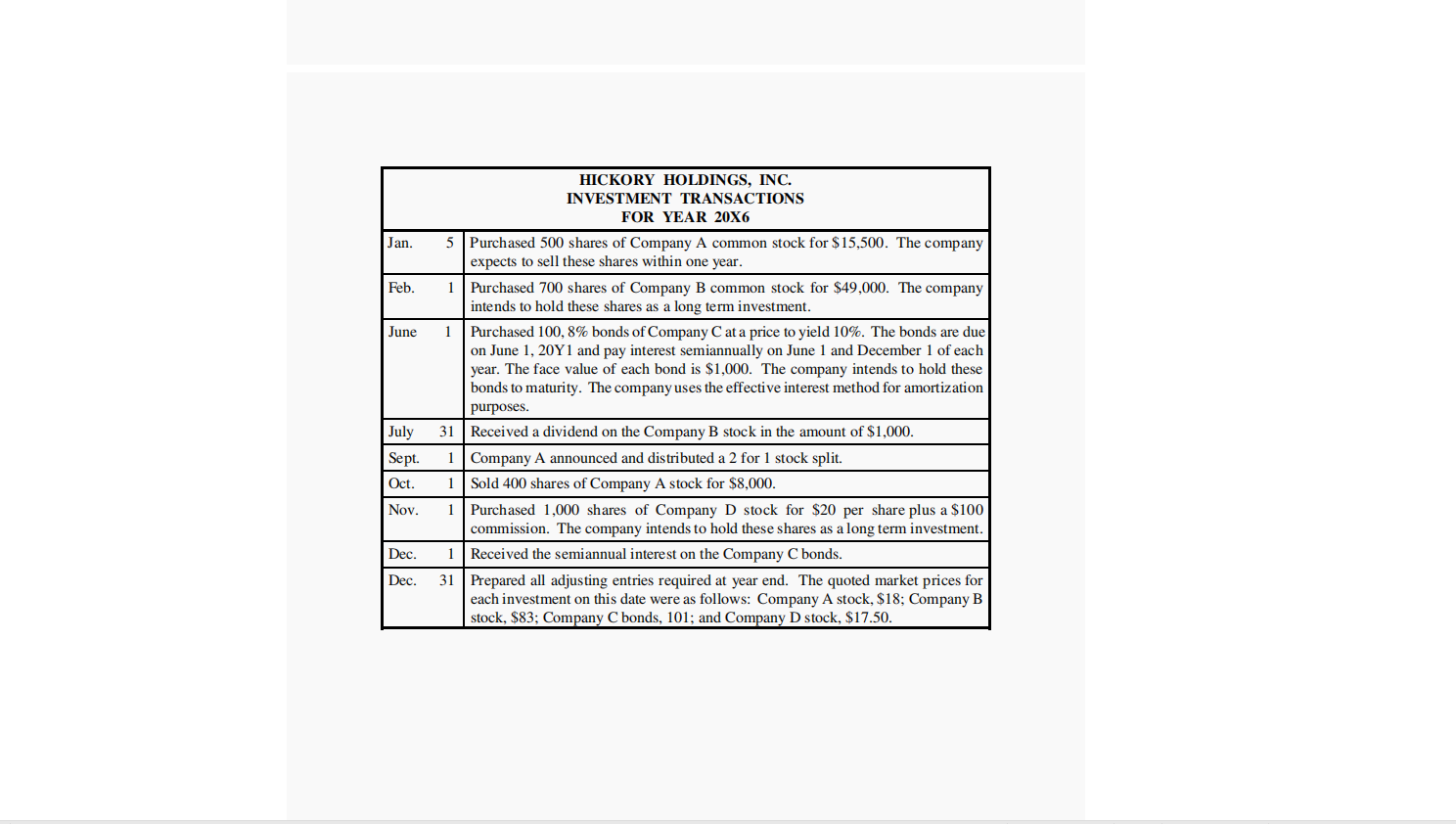

INTERMEDIATE ACCOUNTING I HANDOUT PROBLEM 13 Score_ Name_ Section Problem (10 points). Hickory Holdings, Inc. invests in various companies'stocks with the intent of receiving both income and growth in value of the companies over time. The company made the attached investments during 20X6. REQUIRED: (1) (2) Prepare all required journal entries, in proper general journal form, to record the attached information for the year ending December 31, 20X6. Round all calculations to the nearest whole dollar. Omit explanations. Prepare the appropriate sections of the balance sheet, in proper form, to reflect the effect of the attached information for the year ending December 31, 20X6. Show the impact of the attached information on the income statement for the year ending December 31, 20X6. Jan. Feb. June HICKORY HOLDINGS, INC. INVESTMENT TRANSACTIONS FOR YEAR 20X6 5 Purchased 500 shares of Company A common stock for $15,500. The company expects to sell these shares within one year. 1 Purchased 700 shares of Company B common stock for $49,000. The company intends to hold these shares as a long term investment. 1 Purchased 100,8% bonds of Company C at a price to yield 10%. The bonds are due on June 1, 20Y1 and pay interest semiannually on June 1 and December 1 of each year. The face value of each bond is $1,000. The company intends to hold these bonds to maturity. The company uses the effective interest method for amortization purposes. 31 Received a dividend on the Company B stock in the amount of $1,000. i Company A announced and distributed a 2 for 1 stock split. Sold 400 shares of Company A stock for $8,000. 1 Purchased 1,000 shares of Company D stock for $20 per share plus a $100 commission. The company intends to hold these shares as a long term investment. Received the semiannual interest on the Company C bonds. 31 Prepared all adjusting entries required at year end. The quoted market prices for each investment on this date were as follows: Company A stock, $18; Company B stock, $83; Company C bonds, 101; and Company D stock, $17.50. July Sept. Oct. Nov. Dec. Dec. INTERMEDIATE ACCOUNTING I HANDOUT PROBLEM 13 Score_ Name_ Section Problem (10 points). Hickory Holdings, Inc. invests in various companies'stocks with the intent of receiving both income and growth in value of the companies over time. The company made the attached investments during 20X6. REQUIRED: (1) (2) Prepare all required journal entries, in proper general journal form, to record the attached information for the year ending December 31, 20X6. Round all calculations to the nearest whole dollar. Omit explanations. Prepare the appropriate sections of the balance sheet, in proper form, to reflect the effect of the attached information for the year ending December 31, 20X6. Show the impact of the attached information on the income statement for the year ending December 31, 20X6. Jan. Feb. June HICKORY HOLDINGS, INC. INVESTMENT TRANSACTIONS FOR YEAR 20X6 5 Purchased 500 shares of Company A common stock for $15,500. The company expects to sell these shares within one year. 1 Purchased 700 shares of Company B common stock for $49,000. The company intends to hold these shares as a long term investment. 1 Purchased 100,8% bonds of Company C at a price to yield 10%. The bonds are due on June 1, 20Y1 and pay interest semiannually on June 1 and December 1 of each year. The face value of each bond is $1,000. The company intends to hold these bonds to maturity. The company uses the effective interest method for amortization purposes. 31 Received a dividend on the Company B stock in the amount of $1,000. i Company A announced and distributed a 2 for 1 stock split. Sold 400 shares of Company A stock for $8,000. 1 Purchased 1,000 shares of Company D stock for $20 per share plus a $100 commission. The company intends to hold these shares as a long term investment. Received the semiannual interest on the Company C bonds. 31 Prepared all adjusting entries required at year end. The quoted market prices for each investment on this date were as follows: Company A stock, $18; Company B stock, $83; Company C bonds, 101; and Company D stock, $17.50. July Sept. Oct. Nov. Dec. Dec

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts