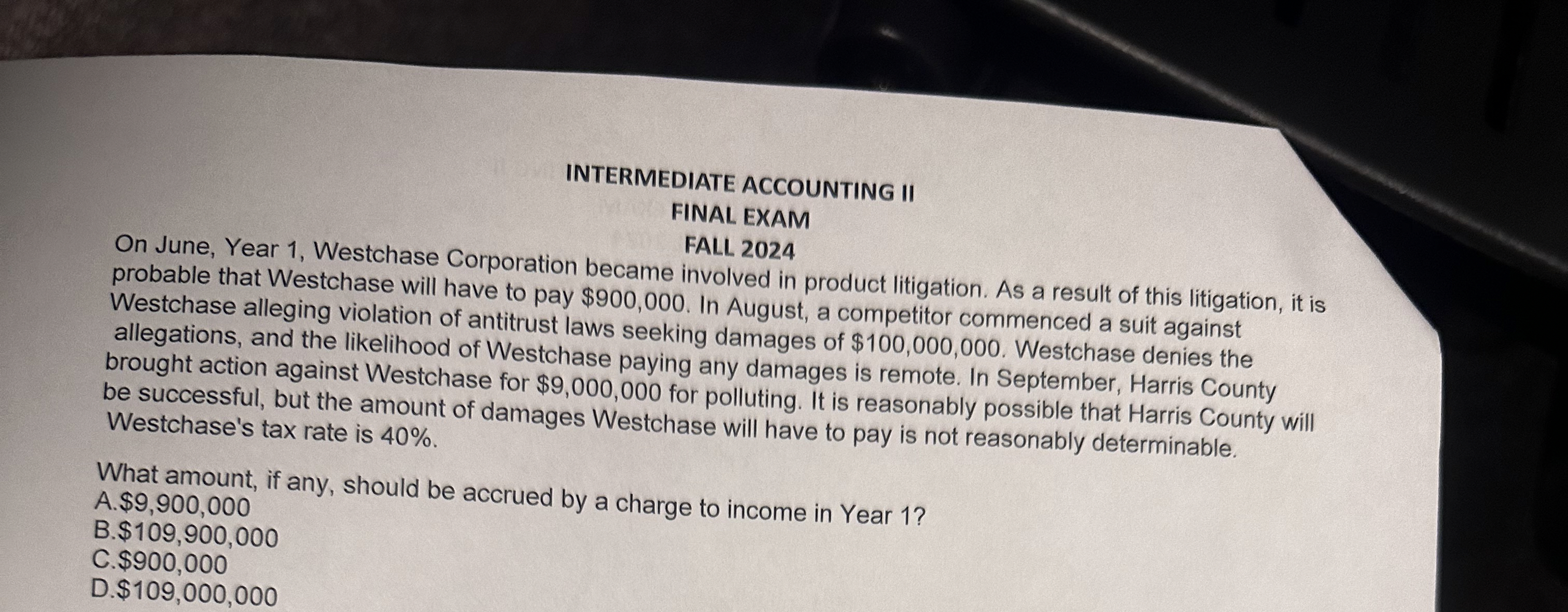

Question: INTERMEDIATE ACCOUNTING II FINAL EXAM FALL 2 0 2 4 On June, Year 1 , Westchase Corporation became involved in product litigation. As a result

INTERMEDIATE ACCOUNTING II

FINAL EXAM

FALL

On June, Year Westchase Corporation became involved in product litigation. As a result of this litigation, it is probable that Westchase will have to pay $ In August, a competitor commenced a suit against Westchase alleging violation of antitrust laws seeking damages of $ Westchase denies the allegations, and the likelihood of Westchase paying any damages is remote. In September, Harris County brought action against Westchase for $ for polluting. It is reasonably possible that Harris County will be successful, but the amount of damages Westchase will have to pay is not reasonably determinable. Westchase's tax rate is

What amount, if any, should be accrued by a charge to income in Year

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock