Question: Intermediate Accounting II Take-home 9- Chapter 21 10 Points NAME Please show all supporting computations. Points will be deducted if you do not show your

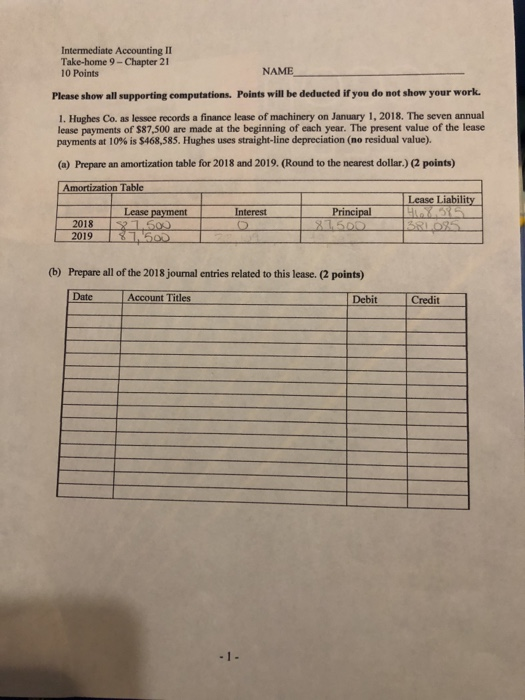

Intermediate Accounting II Take-home 9- Chapter 21 10 Points NAME Please show all supporting computations. Points will be deducted if you do not show your work. 1. Hughes Co. as lessee records a finance lease of machinery on January 1, 2018. The seven annual lease payments of $87,500 are made at the beginning of each year. The present value of the lease payments at 10% is $468,585, Hughes uses straight-line depreciation (no residual value). (a) Prepare an amortization table for 2018 and 2019. (Round to the nearest dollar.) (2 points) Amortization Table Lease Liability Principal Interest Lease payment 2018 2019 1500 (b) Prepare all of the 2018 journal entries related to this lease. (2 points) Date Account Titles Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts