Question: Intermediate accounting Information . x Use the information from the previous tabs to finish preparing The Indiana J 1 Part One On December 31st, 2020,

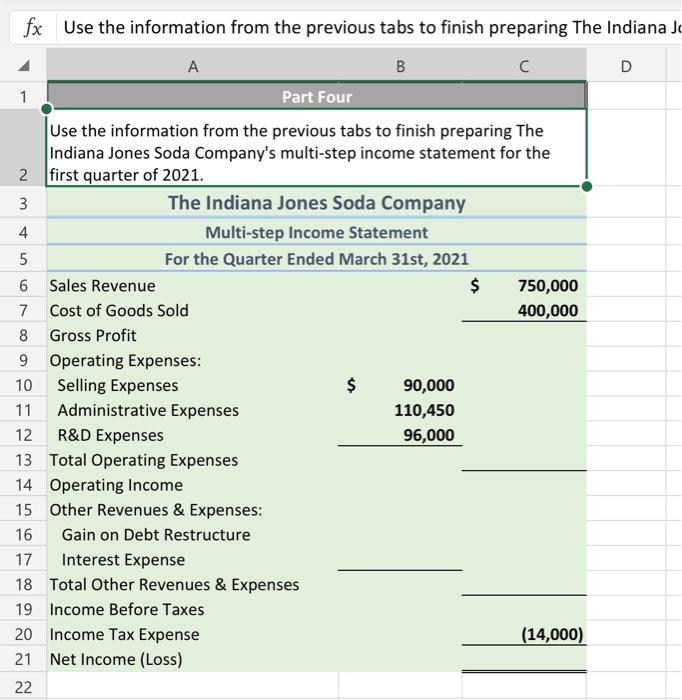

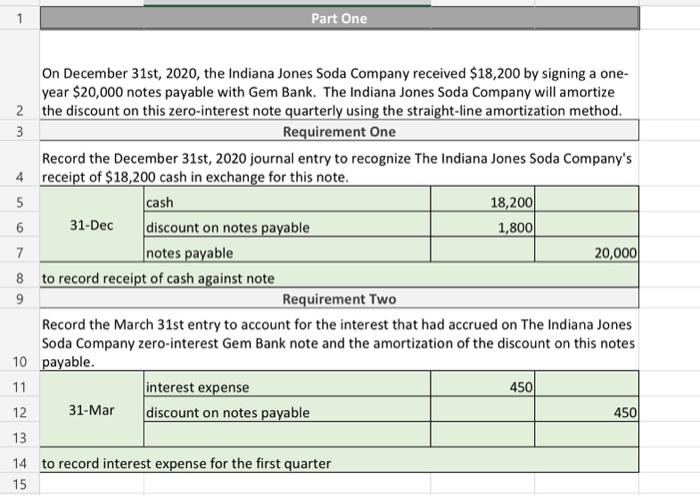

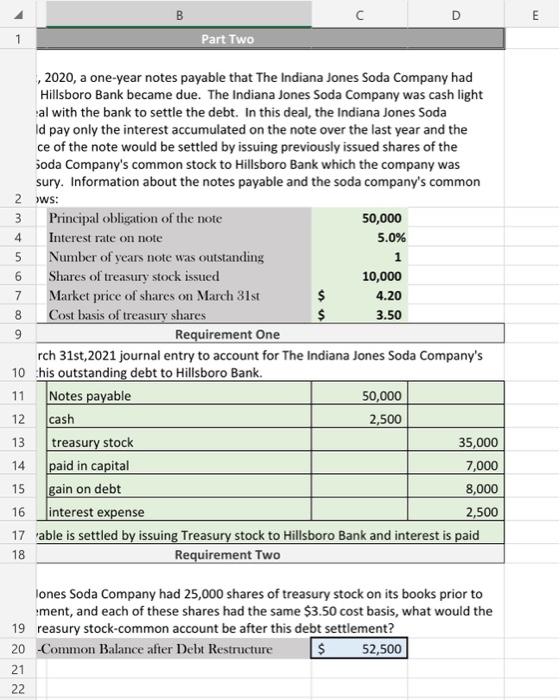

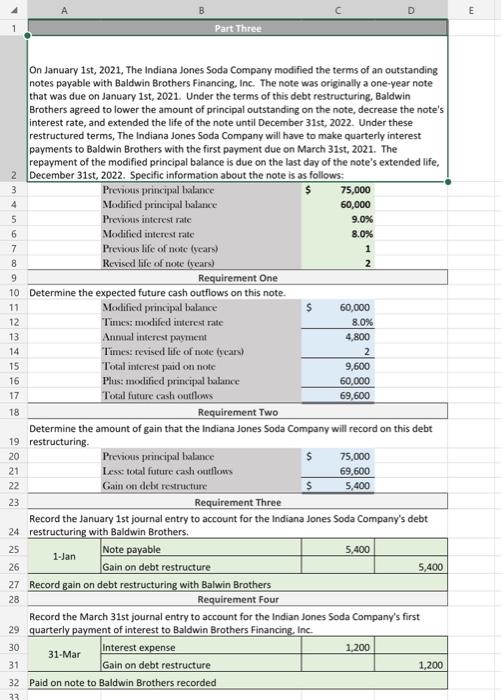

x Use the information from the previous tabs to finish preparing The Indiana J 1 Part One On December 31st, 2020, the Indiana Jones Soda Company received $18,200 by signing a oneyear $20,000 notes payable with Gem Bank. The Indiana Jones Soda Company will amortize 2 the discount on this zero-interest note quarterly using the straight-line amortization method. Requirement One Record the December 31st, 2020 journal entry to recognize The Indiana Jones Soda Company's 4 receipt of $18,200 cash in exchange for this note. Record the March 31st entry to account for the interest that had accrued on The Indiana Jones Soda Company zero-interest Gem Bank note and the amortization of the discount on this notes 10 payable. \begin{tabular}{cccc} & B & C & D \\ \hline & Part Two \\ \hline \hline \end{tabular} , 2020, a one-year notes payable that The Indiana Jones Soda Company had Hillsboro Bank became due. The Indiana Jones Soda Company was cash light al with the bank to settle the debt. In this deal, the Indiana Jones Soda Id pay only the interest accumulated on the note over the last year and the ce of the note would be settled by issuing previously issued shares of the joda Company's common stock to Hillsboro Bank which the company was sury. Information about the notes payable and the soda company's common 2 WS: Iones Soda Company had 25,000 shares of treasury stock on its books prior to ment, and each of these shares had the same $3.50 cost basis, what would the 19 reasury stock-common account be after this debt settlement? 20 -Common Balance after Debt Restructure $55,500 10 Determine the expected future cash outflows on this note. \begin{tabular}{lrr} Modificd principal balance & $5,000 \\ Tumes: modifed interest rate & 8.0% \\ \hline Annual interest payment & 4,800 \\ Times: revised life of note (vears) & 2 \\ \hline Total interest paid on note & 9,600 \\ Plus: modified principal balance & 60,000 \\ \hline Total future cash outllons & 69,600 \\ \hline \end{tabular} Requirement Two Determine the amount of gain that the Indiana Jones Soda Company will record on this debt restructuring. \begin{tabular}{lrr} Previons principal halance & $ & 75,000 \\ Less: total future cash outflows & & 69,600 \\ \hline Giain on debs restructure & $ & 5,400 \\ \hline \end{tabular} Requirement Three Record the January 1st journal entry to account for the Indiana Jones Soda Company's debt 24 restructuring with Baldwin Brothers. \begin{tabular}{|l|l|r|r|} \hline \multirow{2}{*}{ 1-Jan } & Note payable & 5,400 & \\ \cline { 2 - 4 } 26 & Gain on debt restructure & & 5,400 \\ \hline 27 & Record gain on debt restructuring with Balwin Brothers \\ \hline 28 & Requirement Four & & \\ \hline \end{tabular} Record the March 31st journal entry to account for the Indian Jones Soda Company's first 29 quarterly payment of interest to Baldwin Brothers Financing, Inc. x Use the information from the previous tabs to finish preparing The Indiana J 1 Part One On December 31st, 2020, the Indiana Jones Soda Company received $18,200 by signing a oneyear $20,000 notes payable with Gem Bank. The Indiana Jones Soda Company will amortize 2 the discount on this zero-interest note quarterly using the straight-line amortization method. Requirement One Record the December 31st, 2020 journal entry to recognize The Indiana Jones Soda Company's 4 receipt of $18,200 cash in exchange for this note. Record the March 31st entry to account for the interest that had accrued on The Indiana Jones Soda Company zero-interest Gem Bank note and the amortization of the discount on this notes 10 payable. \begin{tabular}{cccc} & B & C & D \\ \hline & Part Two \\ \hline \hline \end{tabular} , 2020, a one-year notes payable that The Indiana Jones Soda Company had Hillsboro Bank became due. The Indiana Jones Soda Company was cash light al with the bank to settle the debt. In this deal, the Indiana Jones Soda Id pay only the interest accumulated on the note over the last year and the ce of the note would be settled by issuing previously issued shares of the joda Company's common stock to Hillsboro Bank which the company was sury. Information about the notes payable and the soda company's common 2 WS: Iones Soda Company had 25,000 shares of treasury stock on its books prior to ment, and each of these shares had the same $3.50 cost basis, what would the 19 reasury stock-common account be after this debt settlement? 20 -Common Balance after Debt Restructure $55,500 10 Determine the expected future cash outflows on this note. \begin{tabular}{lrr} Modificd principal balance & $5,000 \\ Tumes: modifed interest rate & 8.0% \\ \hline Annual interest payment & 4,800 \\ Times: revised life of note (vears) & 2 \\ \hline Total interest paid on note & 9,600 \\ Plus: modified principal balance & 60,000 \\ \hline Total future cash outllons & 69,600 \\ \hline \end{tabular} Requirement Two Determine the amount of gain that the Indiana Jones Soda Company will record on this debt restructuring. \begin{tabular}{lrr} Previons principal halance & $ & 75,000 \\ Less: total future cash outflows & & 69,600 \\ \hline Giain on debs restructure & $ & 5,400 \\ \hline \end{tabular} Requirement Three Record the January 1st journal entry to account for the Indiana Jones Soda Company's debt 24 restructuring with Baldwin Brothers. \begin{tabular}{|l|l|r|r|} \hline \multirow{2}{*}{ 1-Jan } & Note payable & 5,400 & \\ \cline { 2 - 4 } 26 & Gain on debt restructure & & 5,400 \\ \hline 27 & Record gain on debt restructuring with Balwin Brothers \\ \hline 28 & Requirement Four & & \\ \hline \end{tabular} Record the March 31st journal entry to account for the Indian Jones Soda Company's first 29 quarterly payment of interest to Baldwin Brothers Financing, Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts