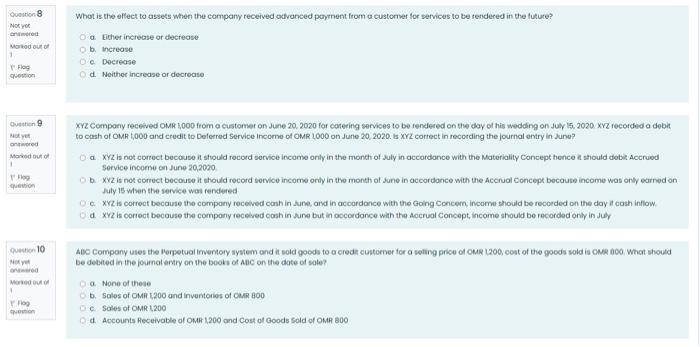

Question: intermediate Accounting Question NO YOR Morted to What is the effect to assets when the company received advanced payment from a customer for services to

intermediate Accounting

Question NO YOR Morted to What is the effect to assets when the company received advanced payment from a customer for services to be rendered in the future? a tither increase or decrease b. Increase O Decrease d. Neither increase or decrease Flas Question Not and Moto xyz Company received OMR 1,000 from a customer on June 20, 2020 for careeing services to be rendered on the day of his wedding on July 15, 2020. XYZ recorded a debit to cash of OMR 1,000 and credit to Deferred Service Income of OMR 1000 on June 20, 2020. s XYZ correct in recording the journal entry in June? Da XYZ is not correct because it should record service income only in the month of July in accordance with the Materiality Concept hence should debit Accrued Service income on June 20,2020 O.XYZ is not correct because it should record service income only in the month of June in accordance with the Accrual Concept because income was only earned on July 15 when the service was rendered De XYZ is correct because the company received cash in June and in accordance with the Going Concem income should be recorded on the day it cash inflow. Od XYZ la corect because the company recolved cash in un but in accordance with the Accrual Concept, income should be recorded only in July GO 10 NO More ABC Company wies the perpetual Inventory system and it sold goods to a credit customer for a voting price of OMRL200, cost of the goods sold is OMR 600 What should be detsted in the journal art on the books of ABC on the date of sole? Co None of these b. Salos of OMR 1200 and inventories of OMR 800 CC Soles of OMR 1200 od Accounts Receivable of OMR 1.200 and cost of Goods sold of OMR 800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts