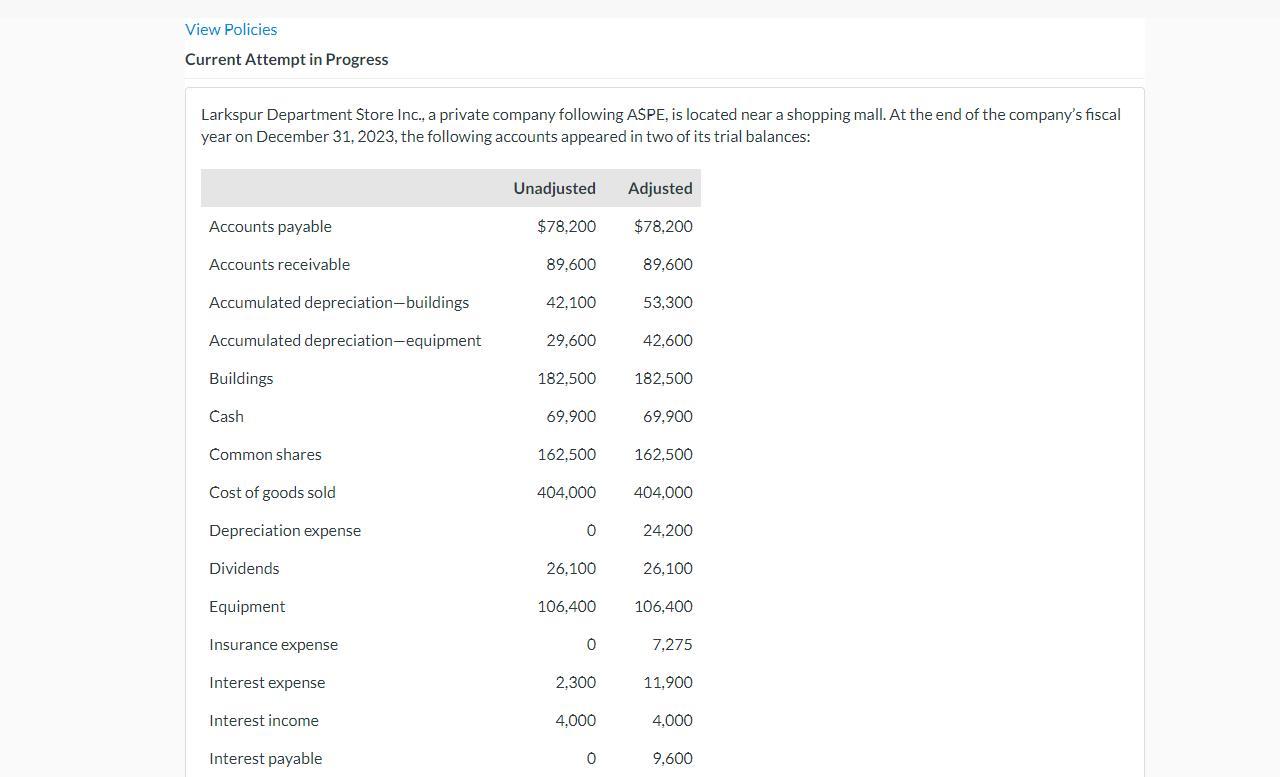

Question: Intermediate Accouting 1A View Policies Current Attempt in Progress Larkspur Department Store Inc., a private company following ASPE, is located near a shopping mall. At

Intermediate Accouting

1A

1A

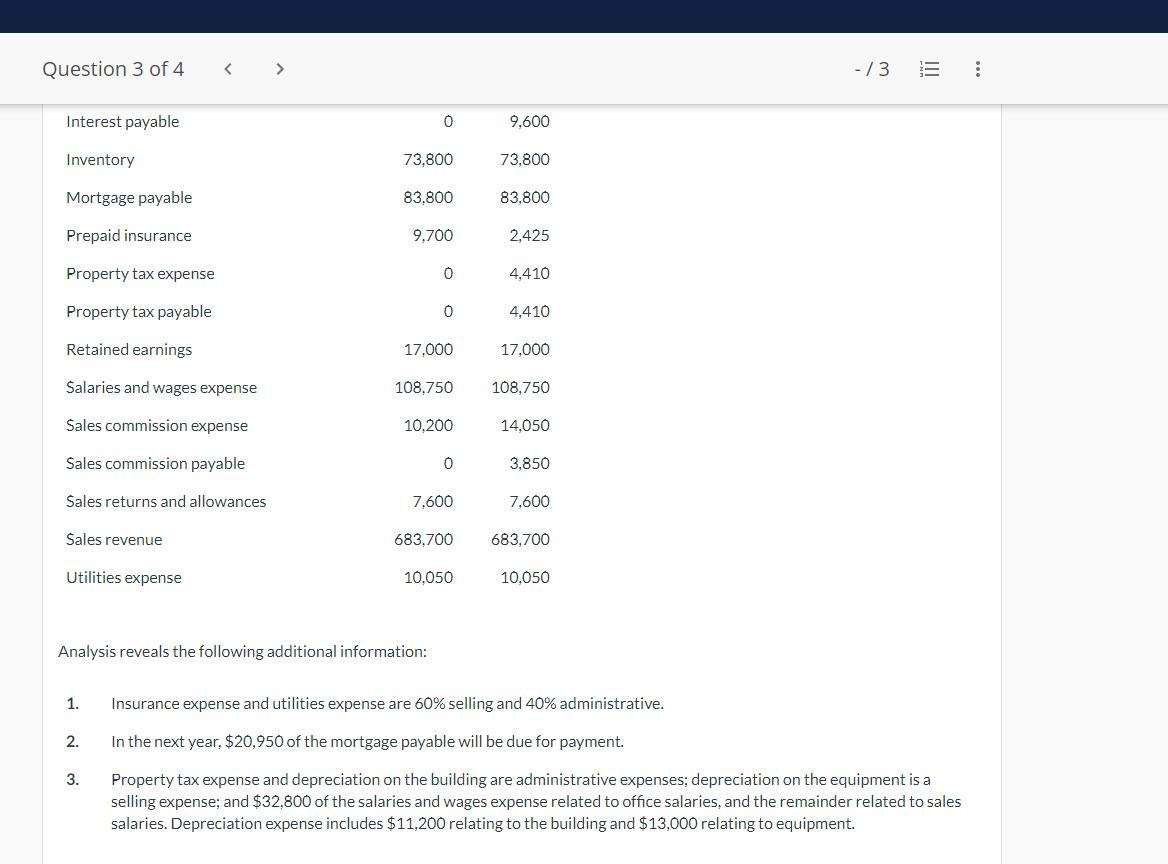

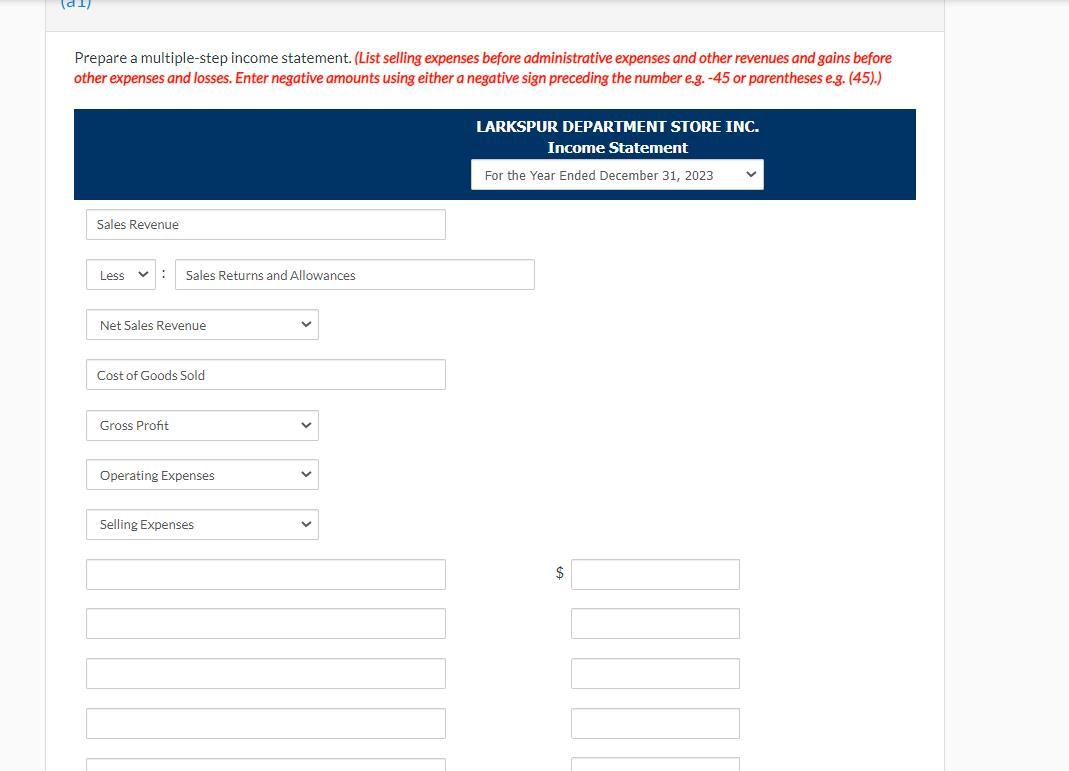

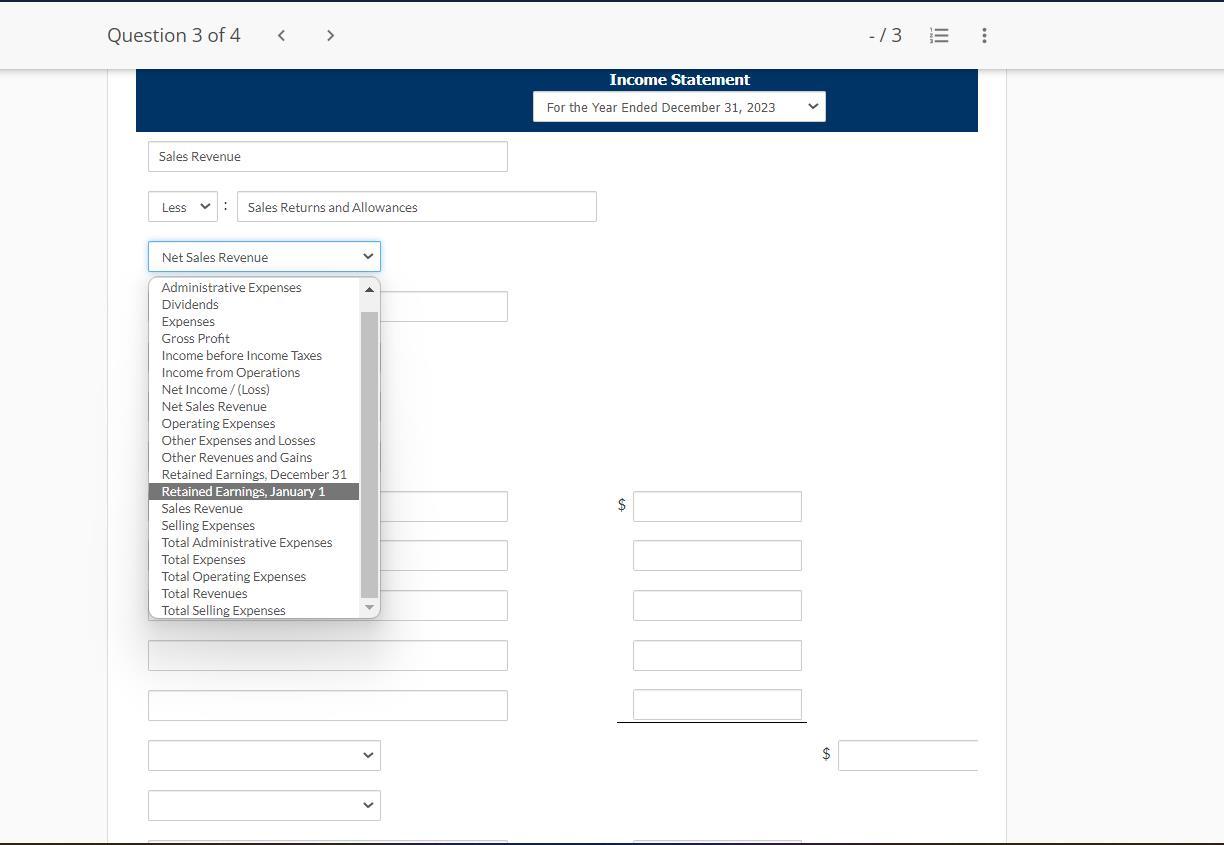

View Policies Current Attempt in Progress Larkspur Department Store Inc., a private company following ASPE, is located near a shopping mall. At the end of the company's fiscal year on December 31,2023 , the following accounts appeared in two of its trial balances: Analysis reveals the following additional information: 1. Insurance expense and utilities expense are 60% selling and 40% administrative. 2. In the next year, $20,950 of the mortgage payable will be due for payment. 3. Property tax expense and depreciation on the building are administrative expenses; depreciation on the equipment is a selling expense; and $32,800 of the salaries and wages expense related to office salaries, and the remainder related to sales salaries. Depreciation expense includes $11,200 relating to the building and $13,000 relating to equipment. Prepare a multiple-step income statement. (List selling expenses before administrative expenses and other reven and other expenses and losses. Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45).) LARKSPUR DEPARTMENT STORE INC. Income Statement For the Year Ended December 31, 2023 Sales Revenue Less : Sales Returns and Allowances Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Selling Expenses $ Question 3 of 4 Sales Revenue Less v: Sales Returns and Allowances Income Statement Vear Ended December 31,2023 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts