Question: intermediate financial management Section 2: Problem sets (20 Points) 1. To increase sales from their present annual SR 48 million, Nasser & Company, a wholesaler,

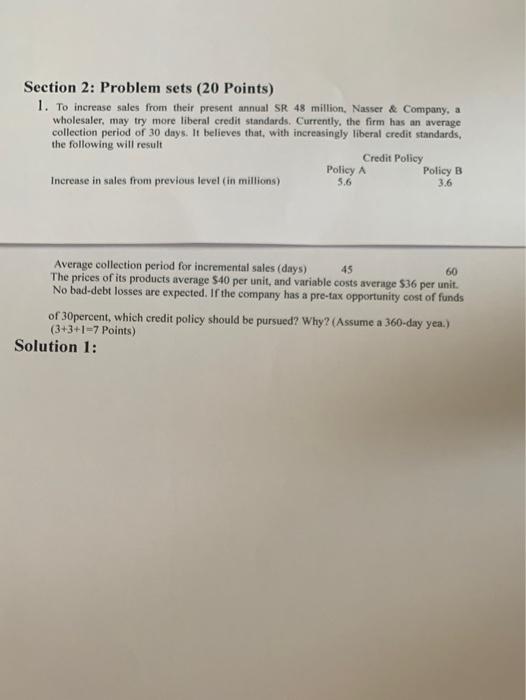

Section 2: Problem sets (20 Points) 1. To increase sales from their present annual SR 48 million, Nasser & Company, a wholesaler, may try more liberal credit standards. Currently, the firm has an average collection period of 30 days. It believes that with increasingly liberal credit standards, the following will result Credit Policy Policy A Policy B Increase in sales from previous level (in millions) 5.6 3.6 Average collection period for incremental sales (days) 45 60 The prices of its products average $40 per unit, and variable costs average $36 per unit. No bad-debt losses are expected. If the company has a pre-tax opportunity cost of funds of 3Opercent, which credit policy should be pursued? Why? (Assume a 360-day yea.) (3+3+1=7 Points) Solution 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts