Question: intermediate-term bonds. (2 points) (2) Based on your answer in (1), what will happen to the equilibrium price of Westeros' intermediate-term bonds? What will happen

intermediate-term bonds. (2 points)

(2) Based on your answer in (1), what will happen to the equilibrium price of Westeros' intermediate-term bonds? What will happen to the equilibirum interest rate on Westeros' intermediate-term bonds? What will happen to the equilibrium quantity of Westeros' intermediate-term bonds? (3 points)

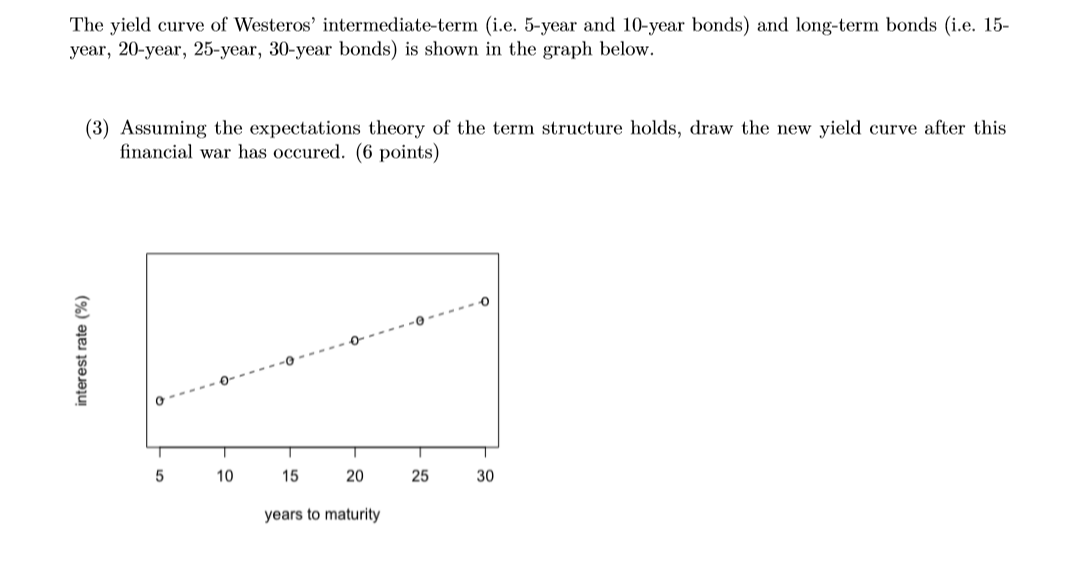

The yield curve of Westeros' intermediate-term (i.e. 5-year and 10-year bonds) and long-term bonds (i.e. 15year, 20-year, 25-year, 30-year bonds) is shown in the graph below.

(3) Assuming the expectations theory of the term structure holds, draw the new yield curve after this ?nancial war has occured. (6 points)

3

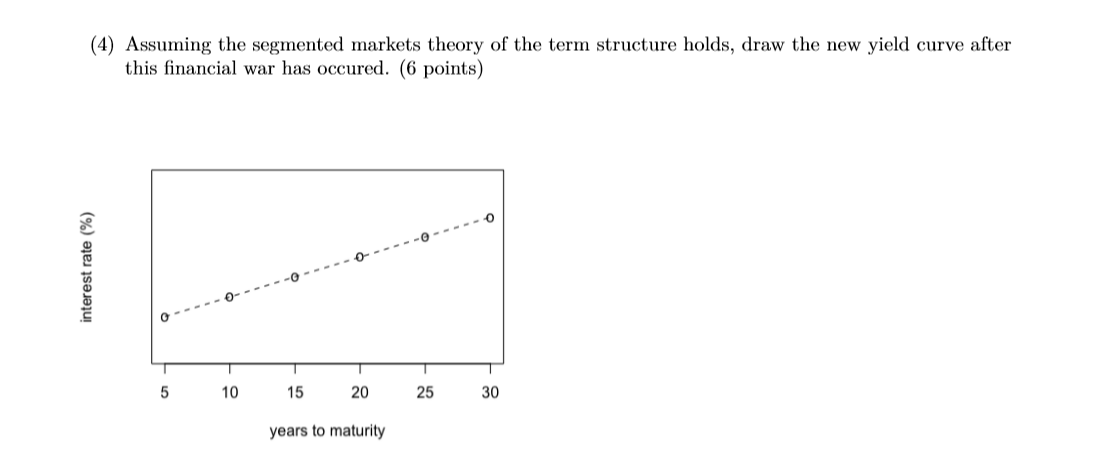

(4) Assuming the segmented markets theory of the term structure holds, draw the new yield curve after this ?nancial war has occured. (6 points

The two largest countries in the world, Westeros and Essos, enter a financial war. Essos decides to stop buying more of Westeros' intermediate-term bonds while sell off its current holdings of Westeros' intermediate-term bonds. (1) Use supply and demand curves to graphically illustrate the impact of Essos's action on Westeros' intermediate-term bonds. (2 points) (2) Based on your answer in (1), what will happen to the equilibrium price of Westeros' intermediate-term bonds? What will happen to the equilibram interest rate on Westeros' intermediate-term bonds? What will happen to the equilibrium quantity of Westeros' intermediate-term bonds? (3 points)The yield curve of Westeros' intermediate-term (i.e. 5-year and 10-year bonds) and long-term bonds (i.e. 15- year, 20-year, 25-year, 30-year bonds) is shown in the graph below. (3) Assuming the expectations theory of the term structure holds, draw the new yield curve after this financial war has occured. (6 points) interest rate (%) 5 10 15 20 25 30 years to maturity(4) Assuming the segmented markets theory of the term structure holds, draw the new yield curve after this financial war has occured. (6 points) interest rate (%) 5 10 15 20 25 30 years to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts