Question: INTERNAL MEMORANDUM Date: April 1 , 2 0 2 4 To: Intern From: V . P . of Investments Our Investment Committee is considering allocating

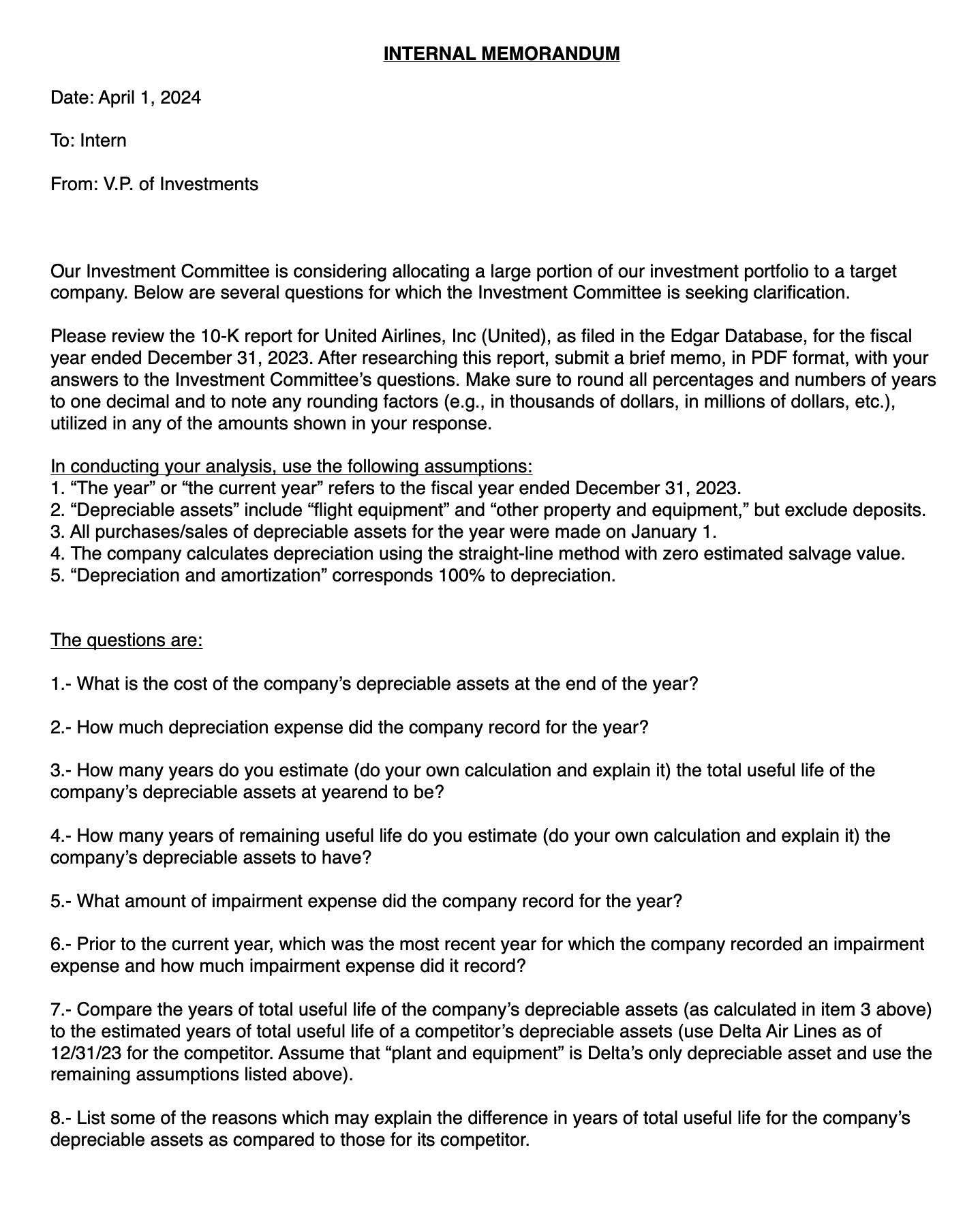

INTERNAL MEMORANDUM

Date: April

To: Intern

From: VP of Investments

Our Investment Committee is considering allocating a large portion of our investment portfolio to a target company. Below are several questions for which the Investment Committee is seeking clarification.

Please review the K report for United Airlines, Inc United as filed in the Edgar Database, for the fiscal year ended December After researching this report, submit a brief memo, in PDF format, with your answers to the Investment Committee's questions. Make sure to round all percentages and numbers of years to one decimal and to note any rounding factors eg in thousands of dollars, in millions of dollars, etc. utilized in any of the amounts shown in your response.

In conducting your analysis, use the following assumptions:

"The year" or "the current year" refers to the fiscal year ended December

"Depreciable assets" include "flight equipment" and "other property and equipment," but exclude deposits.

All purchasessales of depreciable assets for the year were made on January

The company calculates depreciation using the straightline method with zero estimated salvage value.

"Depreciation and amortization" corresponds to depreciation.

The questions are:

What is the cost of the company's depreciable assets at the end of the year?

How much depreciation expense did the company record for the year?

How many years do you estimate do your own calculation and explain it the total useful life of the company's depreciable assets at yearend to be

How many years of remaining useful life do you estimate do your own calculation and explain it the company's depreciable assets to have?

What amount of impairment expense did the company record for the year?

Prior to the current year, which was the most recent year for which the company recorded an impairment expense and how much impairment expense did it record?

Compare the years of total useful life of the company's depreciable assets as calculated in item above to the estimated years of total useful life of a competitor's depreciable assets use Delta Air Lines as of for the competitor. Assume that "plant and equipment" is Delta's only depreciable asset and use the remaining assumptions listed above

List some of the reasons which may explain the difference in years of total useful life for the company's depreciable assets as compared to those for its competitor.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock