Question: international Finance question. put also reference book that can help me as I study QUESTION FIVE College student Sarah wants a summer break. An estimated

international Finance question. put also reference book that can help me as I study

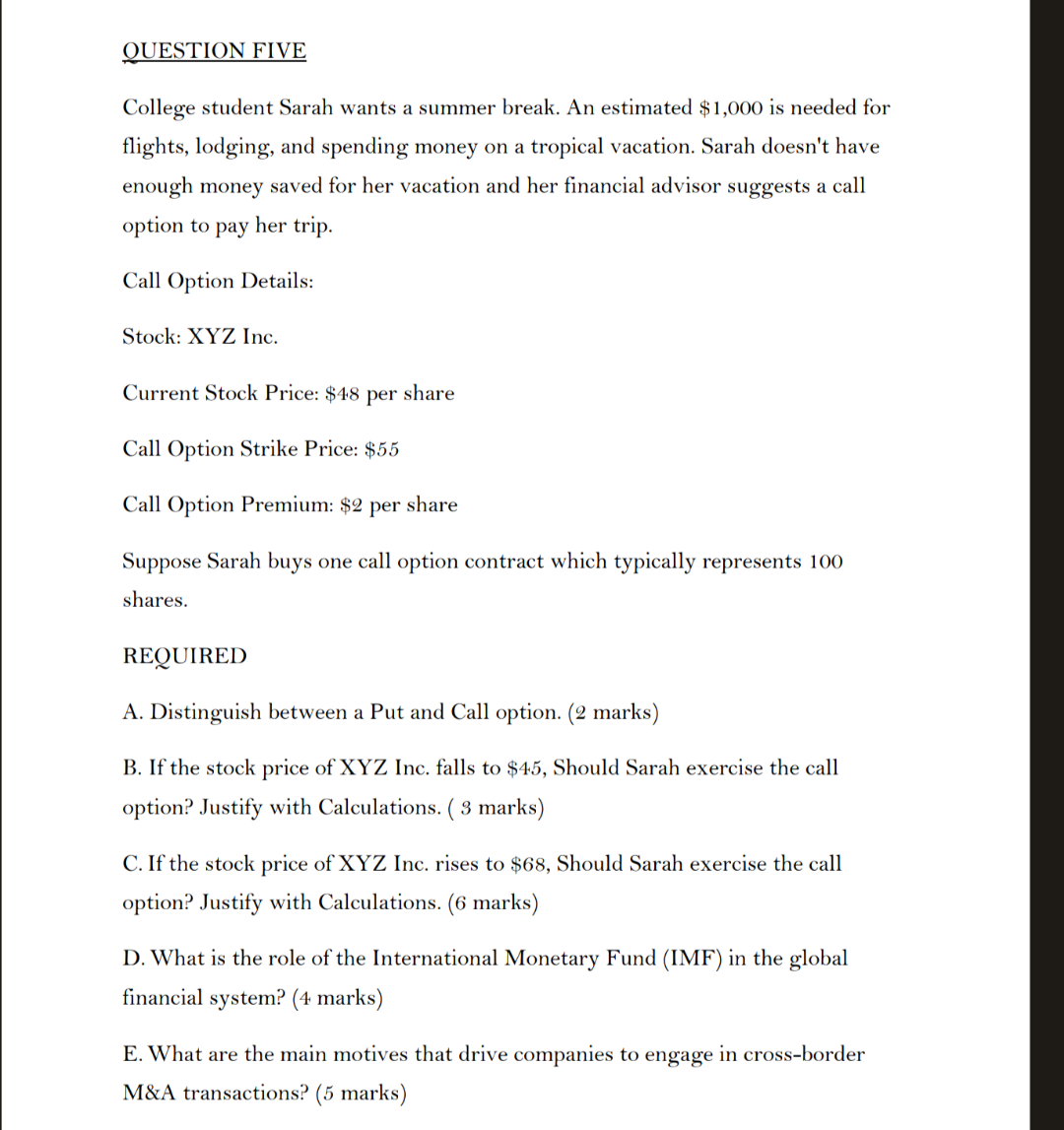

QUESTION FIVE College student Sarah wants a summer break. An estimated $1,000 is needed for flights, lodging, and spending money on a tropical vacation. Sarah doesn't have enough money saved for her vacation and her financial advisor suggests a call option to pay her trip. Call Option Details: Stock: XYZ Inc. Current Stock Price: $48 per share Call Option Strike Price: $55 Call Option Premium: $2 per share Suppose Sarah buys one call option contract which typically represents 100 shares. REQUIRED A. Distinguish between a Put and Call option. ( 2 marks) B. If the stock price of XYZ Inc. falls to $45, Should Sarah exercise the call option? Justify with Calculations. ( 3 marks) C. If the stock price of XYZ Inc. rises to $68, Should Sarah exercise the call option? Justify with Calculations. (6 marks) D. What is the role of the International Monetary Fund (IMF) in the global financial system? (4 marks) E. What are the main motives that drive companies to engage in cross-border M\&A transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts