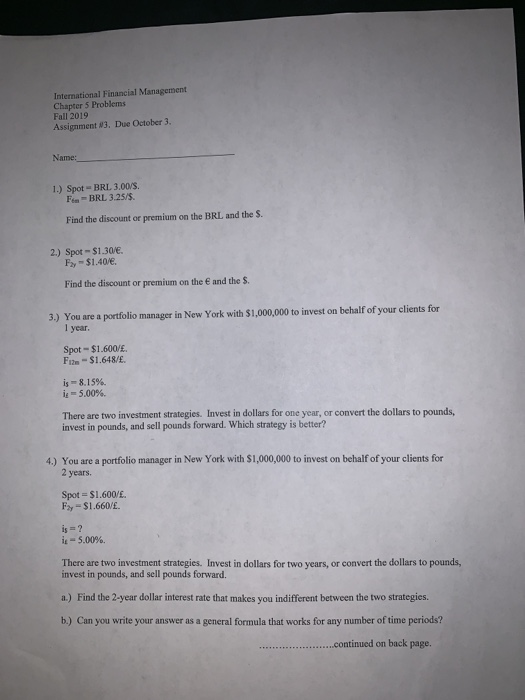

Question: International Financial Management Chapter 5 Problems Fall 2019 Assignment #3. Due October 3. Name: 1.) Spot - BRL 3.00/S. F -BRL 3.25/5. Find the discount

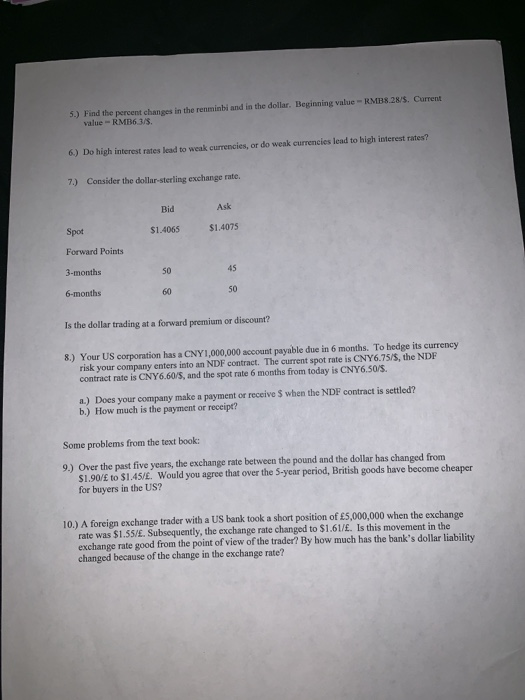

International Financial Management Chapter 5 Problems Fall 2019 Assignment #3. Due October 3. Name: 1.) Spot - BRL 3.00/S. F -BRL 3.25/5. Find the discount or premium on the BRL and the $. 2.) Spot -$1.30/. F - $1.40/. Find the discount or premium on the and the S. 3.) You are a portfolio manager in New York with $1,000,000 to invest on behalf of your clients for 1 year. Spot - $1.600/. F1 -$1.648/. is-8.15% i-5.00%. There are two investment strategies. Invest in dollars for one year, or convert the dollars to pounds, invest in pounds, and sell pounds forward. Which strategy is better? 4.) You are a portfolio manager in New York with $1,000,000 to invest on behalf of your clients for 2 years. Spot = $1.600/. Fy-$1.660/. is ? it -5.00%. There are two investment strategies. Invest in dollars for two years, or convert the dollars to pounds, invest in pounds, and sell pounds forward. a.) Find the 2-year dollar interest rate that makes you indifferent between the two strategies. b.) Can you write your answer as a general formula that works for any number of time periods? ......continued on back page. 5.) Find the percent changes in the renminbi and in the dollar. Beginning value - RMB8.28/5. Current value-RM16 3/5 6) Do high interest rates lead to weak currencies, or do weak currencies lead to high interest rates 7.) Consider the dollar-sterling exchange rate. Ask Bid $1.4065 Spot $1.4075 Forward Points 3-months 50 6-months 60 Is the dollar trading at a forward premium or discount? 8.) Your US corporation has a CNY 1,000,000 account payable due in 6 months. To hedge its currency risk your company enters into an NDF contract. The current spot rate is CNY6.75/5, the NDF contract rate is CNY6.60/5, and the spot rate 6 months from today is CNY 6.50/S. a.) Does your company make a payment or receive $ when the NDF contract is settled? b.) How much is the payment or receipt? Some problems from the text book: 9.) Over the past five years, the exchange rate between the pound and the dollar has changed from $1.90/ to $1.45/. Would you agree that over the 5-year period, British goods have become cheaper for buyers in the US? 10.) A foreign exchange trader with a US bank took a short position of 5,000,000 when the exchange rate was $1.55/. Subsequently, the exchange rate changed to $161/. Is this movement in the exchange rate good from the point of view of the trader? By how much has the bank's dollar liability changed because of the change in the exchange rate? International Financial Management Chapter 5 Problems Fall 2019 Assignment #3. Due October 3. Name: 1.) Spot - BRL 3.00/S. F -BRL 3.25/5. Find the discount or premium on the BRL and the $. 2.) Spot -$1.30/. F - $1.40/. Find the discount or premium on the and the S. 3.) You are a portfolio manager in New York with $1,000,000 to invest on behalf of your clients for 1 year. Spot - $1.600/. F1 -$1.648/. is-8.15% i-5.00%. There are two investment strategies. Invest in dollars for one year, or convert the dollars to pounds, invest in pounds, and sell pounds forward. Which strategy is better? 4.) You are a portfolio manager in New York with $1,000,000 to invest on behalf of your clients for 2 years. Spot = $1.600/. Fy-$1.660/. is ? it -5.00%. There are two investment strategies. Invest in dollars for two years, or convert the dollars to pounds, invest in pounds, and sell pounds forward. a.) Find the 2-year dollar interest rate that makes you indifferent between the two strategies. b.) Can you write your answer as a general formula that works for any number of time periods? ......continued on back page. 5.) Find the percent changes in the renminbi and in the dollar. Beginning value - RMB8.28/5. Current value-RM16 3/5 6) Do high interest rates lead to weak currencies, or do weak currencies lead to high interest rates 7.) Consider the dollar-sterling exchange rate. Ask Bid $1.4065 Spot $1.4075 Forward Points 3-months 50 6-months 60 Is the dollar trading at a forward premium or discount? 8.) Your US corporation has a CNY 1,000,000 account payable due in 6 months. To hedge its currency risk your company enters into an NDF contract. The current spot rate is CNY6.75/5, the NDF contract rate is CNY6.60/5, and the spot rate 6 months from today is CNY 6.50/S. a.) Does your company make a payment or receive $ when the NDF contract is settled? b.) How much is the payment or receipt? Some problems from the text book: 9.) Over the past five years, the exchange rate between the pound and the dollar has changed from $1.90/ to $1.45/. Would you agree that over the 5-year period, British goods have become cheaper for buyers in the US? 10.) A foreign exchange trader with a US bank took a short position of 5,000,000 when the exchange rate was $1.55/. Subsequently, the exchange rate changed to $161/. Is this movement in the exchange rate good from the point of view of the trader? By how much has the bank's dollar liability changed because of the change in the exchange rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts