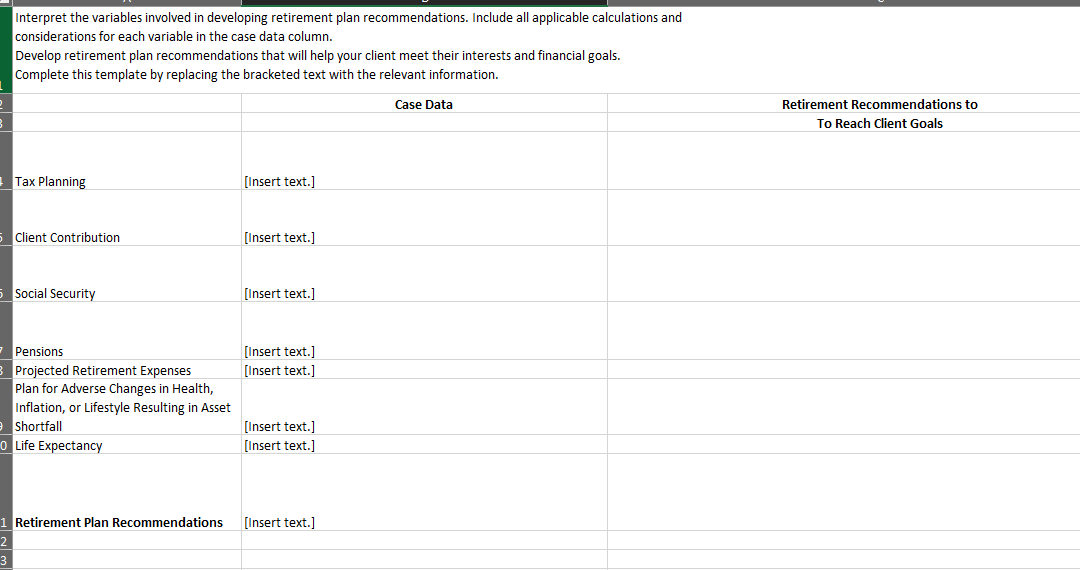

Question: Interpret the variables involved in developing retirement plan recommendations. Include all applicable calculations and considerations for each variable in the case data column. Develop retirement

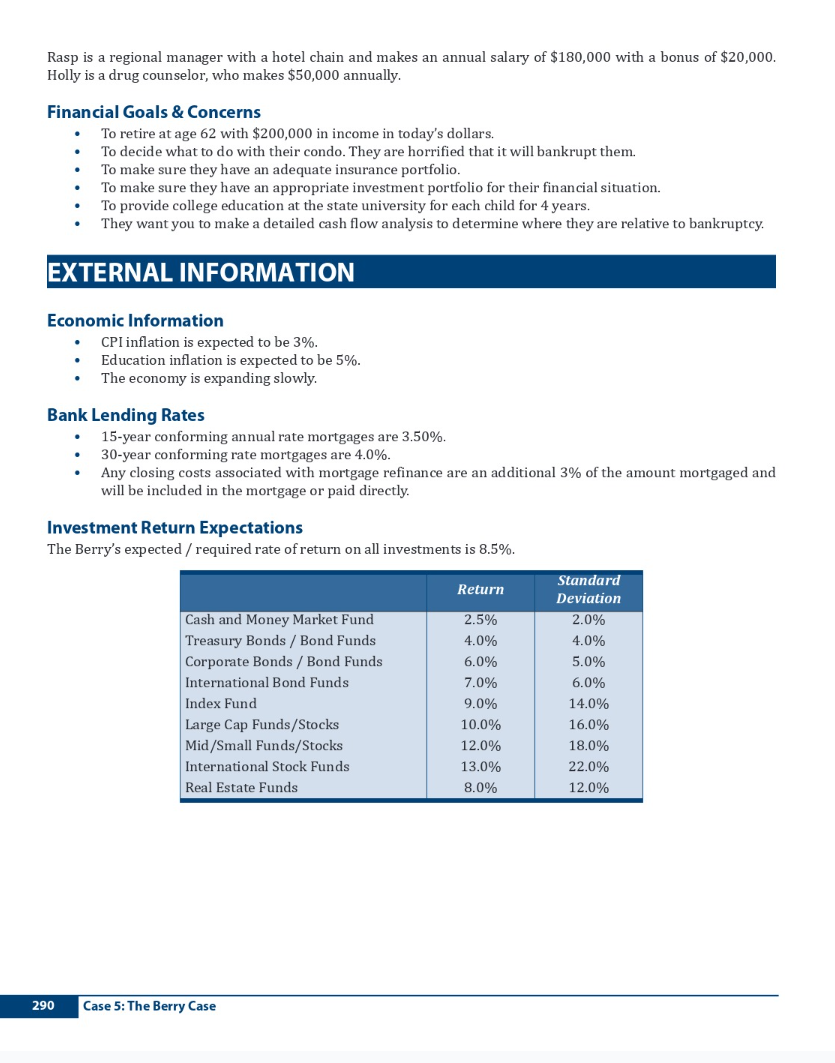

Interpret the variables involved in developing retirement plan recommendations. Include all applicable calculations and considerations for each variable in the case data column. Develop retirement plan recommendations that will help your client meet their interests and financial goals. Complete this template by replacing the bracketed text with the relevant information. Rasp is a regional manager with a hotel chain and makes an annual salary of $180,000 with a bonus of $20,000. Holly is a drug counselor, who makes $50,000 annually. Financial Goals \& Concerns - To retire at age 62 with $200,000 in income in today's dollars. - To decide what to do with their condo. They are horrified that it will bankrupt them. - To make sure they have an adequate insurance portfolio. - To make sure they have an appropriate investment portfolio for their financial situation. - To provide college education at the state university for each child for 4 years. - They want you to make a detailed cash flow analysis to determine where they are relative to bankruptcy. EXTERNAL INFORMATION Economic Information - CPI inflation is expected to be 3%. - Education inflation is expected to be 5%. - The economy is expanding slowly. Bank Lending Rates - 15-year conforming annual rate mortgages are 3.50%. - 30-year conforming rate mortgages are 4.0%. - Any closing costs associated with mortgage refinance are an additional 3% of the amount mortgaged and will be included in the mortgage or paid directly. Investment Return Expectations The Berry's expected / required rate of return on all investments is 8.5%. Interpret the variables involved in developing retirement plan recommendations. Include all applicable calculations and considerations for each variable in the case data column. Develop retirement plan recommendations that will help your client meet their interests and financial goals. Complete this template by replacing the bracketed text with the relevant information. Rasp is a regional manager with a hotel chain and makes an annual salary of $180,000 with a bonus of $20,000. Holly is a drug counselor, who makes $50,000 annually. Financial Goals \& Concerns - To retire at age 62 with $200,000 in income in today's dollars. - To decide what to do with their condo. They are horrified that it will bankrupt them. - To make sure they have an adequate insurance portfolio. - To make sure they have an appropriate investment portfolio for their financial situation. - To provide college education at the state university for each child for 4 years. - They want you to make a detailed cash flow analysis to determine where they are relative to bankruptcy. EXTERNAL INFORMATION Economic Information - CPI inflation is expected to be 3%. - Education inflation is expected to be 5%. - The economy is expanding slowly. Bank Lending Rates - 15-year conforming annual rate mortgages are 3.50%. - 30-year conforming rate mortgages are 4.0%. - Any closing costs associated with mortgage refinance are an additional 3% of the amount mortgaged and will be included in the mortgage or paid directly. Investment Return Expectations The Berry's expected / required rate of return on all investments is 8.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts