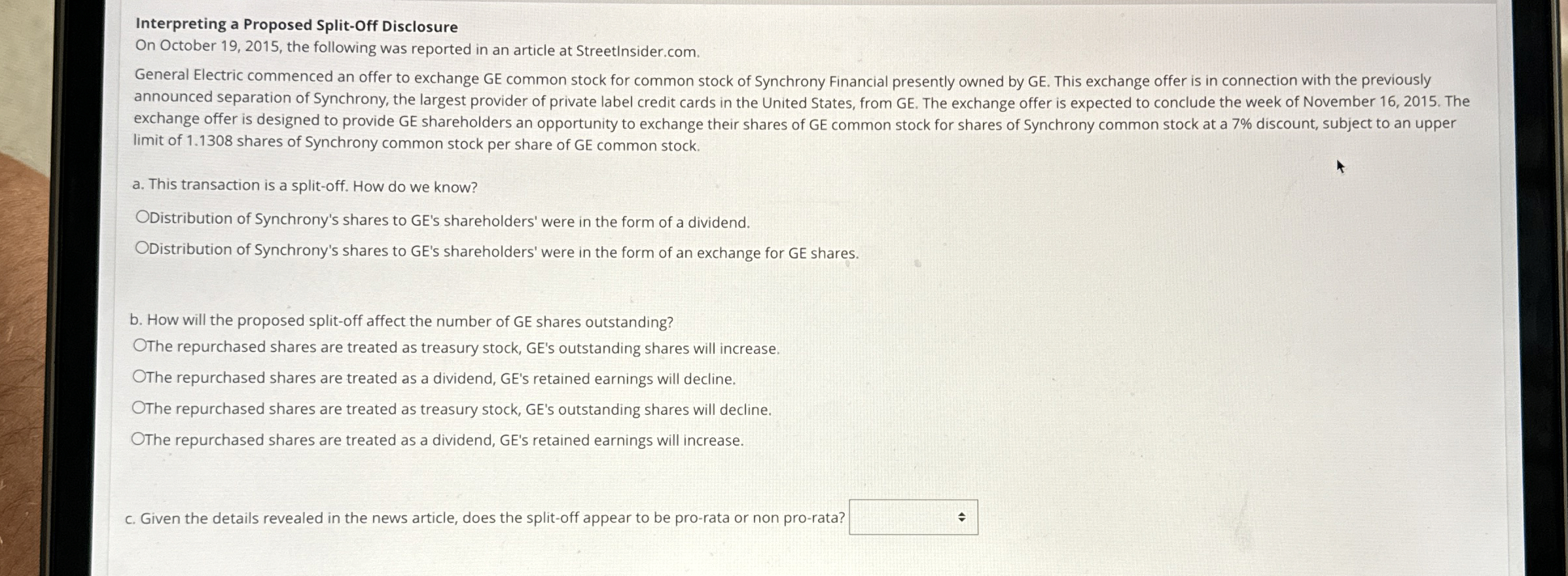

Question: Interpreting a Proposed Split - Off Disclosure On October 1 9 , 2 0 1 5 , the following was reported in an article at

Interpreting a Proposed SplitOff Disclosure

On October the following was reported in an article at

StreetInsider.com.

General Electric commenced an offer to exchange GE common stock for common stock of Synchrony Financial presently owned by GE This exchange offer is in connection with the previously limit of shares of Synchrony common stock per share of GE common stock.

a This transaction is a splitoff. How do we know?

ODistribution of Synchrony's shares to GE's shareholders' were in the form of a dividend.

ODistribution of Synchrony's shares to GE's shareholders' were in the form of an exchange for GE shares.

b How will the proposed splitoff affect the number of GE shares outstanding?

The repurchased shares are treated as treasury stock, GE's outstanding shares will increase.

The repurchased shares are treated as a dividend, GE's retained earnings will decline.

The repurchased shares are treated as treasury stock, GE's outstanding shares will decline.

The repurchased shares are treated as a dividend, GE's retained earnings will increase.

c Given the details revealed in the news article, does the splitoff appear to be prorata or non prorata?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock