Question: Interstate Manufacturing is considering either overhauling an old machine or replacing it with a new machine. Information about the two alternatives follows. Management requires a

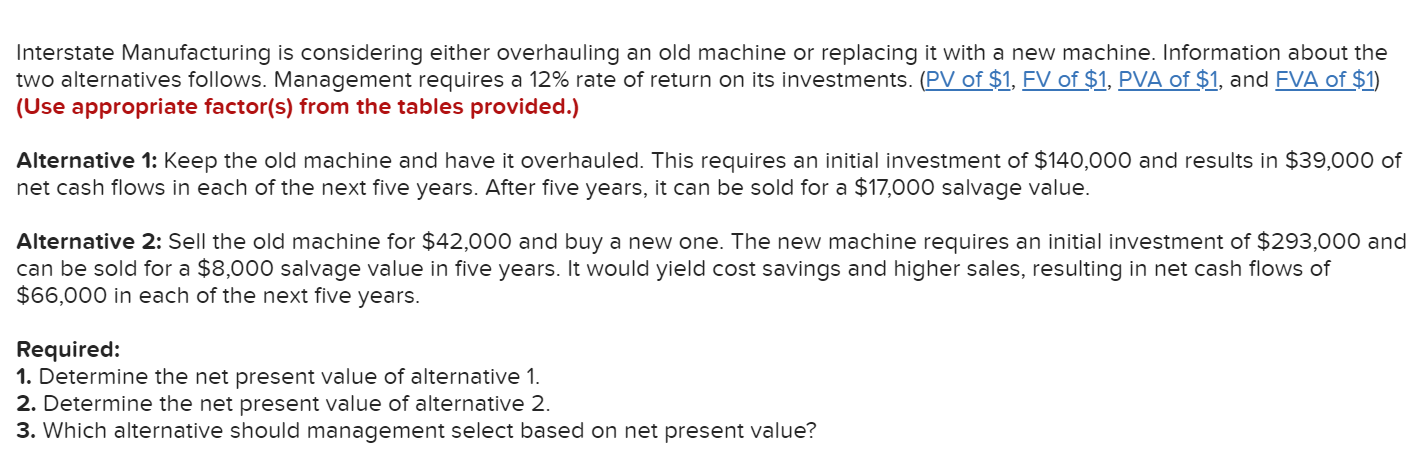

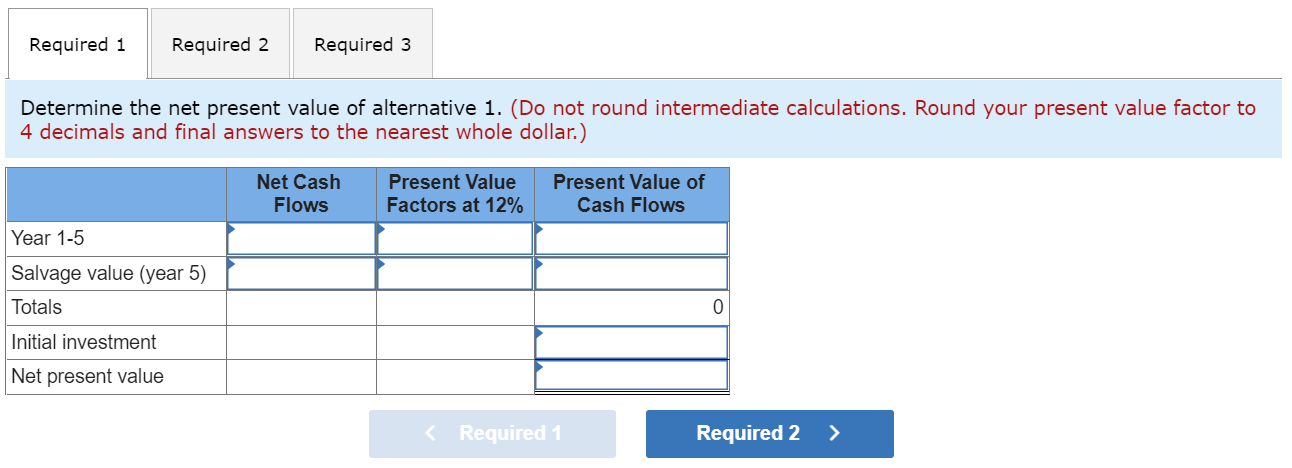

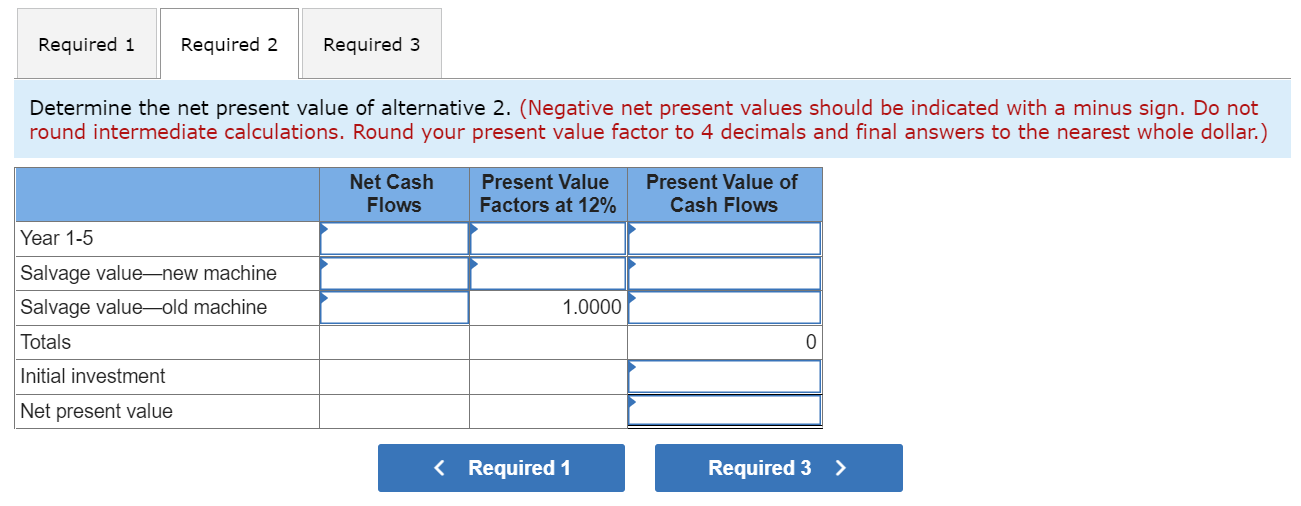

Interstate Manufacturing is considering either overhauling an old machine or replacing it with a new machine. Information about the two alternatives follows. Management requires a 12% rate of return on its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Alternative 1: Keep the old machine and have it overhauled. This requires an initial investment of $140,000 and results in $39,000 of net cash flows in each of the next five years. After five years, it can be sold for a $17,000 salvage value. Alternative 2: Sell the old machine for $42,000 and buy a new one. The new machine requires an initial investment of $293,000 and can be sold for a $8,000 salvage value in five years. It would yield cost savings and higher sales, resulting in net cash flows of $66,000 in each of the next five years. Required: 1. Determine the net present value of alternative 1. 2. Determine the net present value of alternative 2. 3. Which alternative should management select based on net present value? Required 1 Required 2 Required 3 Determine the net present value of alternative 1. (Do not round intermediate calculations. Round your present value factor to 4 decimals and final answers to the nearest whole dollar.) Net Cash Flows Present Value Factors at 12% Present Value of Cash Flows Year 1-5 Salvage value (year 5) Totals 0 Initial investment Net present value Required 1 Required 2 > Required 1 Required 2 Required 3 Determine the net present value of alternative 2. (Negative net present values should be indicated with a minus sign. Do not round intermediate calculations. Round your present value factor to 4 decimals and final answers to the nearest whole dollar.) Net Cash Flows Present Value Factors at 12% Present Value of Cash Flows Year 1-5 Salvage value-new machine Salvage value-old machine 1.0000 Totals 0 Initial investment Net present value Required 1 Required 2 Required 3 Which alternative should management select based on net present value? Management should select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts