Question: Interview Notes Emma is 45 years old and single. . Emma has two children, Poppy, age 17 and Sebastian, age 25, who lived with her

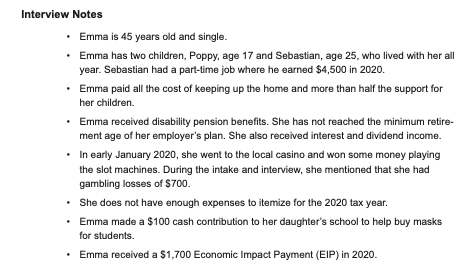

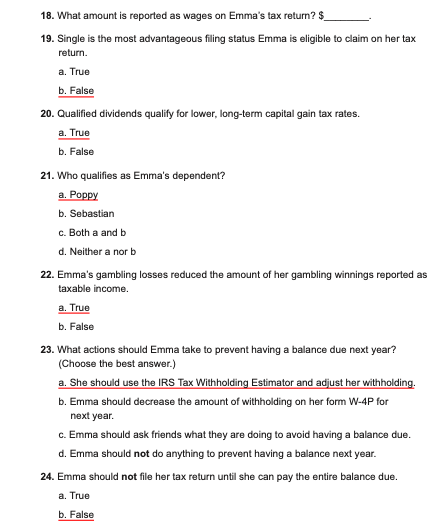

Interview Notes Emma is 45 years old and single. . Emma has two children, Poppy, age 17 and Sebastian, age 25, who lived with her all year. Sebastian had a part-time job where he earned $4,500 in 2020. Emma paid all the cost of keeping up the home and more than half the support for her children. Emma received disability pension benefits. She has not reached the minimum retire- ment age of her employer's plan. She also received interest and dividend income. In early January 2020, she went to the local casino and won some money playing the slot machines. During the intake and interview, she mentioned that she had gambling losses of $700. She does not have enough expenses to itemize for the 2020 tax year. Emma made a $100 cash contribution to her daughter's school to help buy masks for students. . Emma received a $1,700 Economic Impact Payment (EIP) in 2020. 18. What amount is reported as wages on Emma's tax return? $_ 19. Single is the most advantageous filing status Emma is eligible to claim on her tax return a. True b. False 20. Qualified dividends qualify for lower, long-term capital gain tax rates. a. True b. False 21. Who qualifies as Emma's dependent? a. Poppy b. Sebastian c. Both a and b d. Neither a norb 22. Emma's gambling losses reduced the amount of her gambling winnings reported as taxable income. a. True b. False 23. What actions should Emma take to prevent having a balance due next year? (Choose the best answer.) a. She should use the IRS Tax Withholding Estimator and adjust her withholding. b. Emma should decrease the amount of withholding on her form W-4P for next year. C. Emma should ask friends what they are doing to avoid having a balance due. d. Emma should not do anything to prevent having a balance next year. 24. Emma should not file her tax return until she can pay the entire balance due. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts