Question: Interview Notes - Henry and Charlotte are both 28 years old. - Henry and Charlotte separated in 2018 and their divorce was finalized in January

Interview Notes

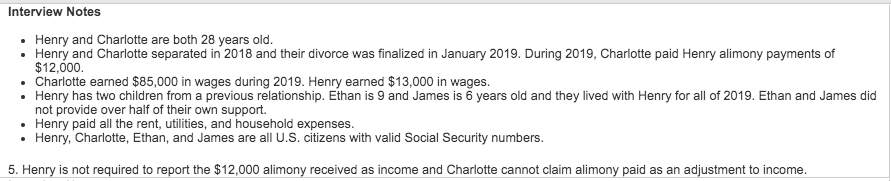

- Henry and Charlotte are both 28 years old.

- Henry and Charlotte separated in 2018 and their divorce was finalized in January 2019. During 2019, Charlotte paid Henry alimony payments of $12,000.

- Charlotte earned $85,000 in wages during 2019. Henry earned $13,000 in wages.

- Henry has two children from a previous relationship. Ethan is 9 and James is 6 years old and they lived with Henry for all of 2019. Ethan and James did not provide over half of their own support.

- Henry paid all the rent, utilities, and household expenses. Henry, Charlotte, Ethan, and James are all U.S. citizens with valid Social Security numbers.

5. Henry is not required to report the $12,000 alimony received as income and Charlotte cannot claim alimony paid as an adjustment to income. True or False?

Interview Notes Henry and Charlotte are both 28 years old. Henry and Charlotte separated in 2018 and their divorce was finalized in January 2019. During 2019, Charlotte paid Henry alimony payments of $12,000. Charlotte earned $85,000 in wages during 2019. Henry earned $13,000 in wages. Henry has two children from a previous relationship. Ethan is 9 and James is 6 years old and they lived with Henry for all of 2019. Ethan and James did not provide over half of their own support. Henry paid all the rent, utilities, and household expenses. Henry, Charlotte, Ethan, and James are all U.S. citizens with valid Social Security numbers. 5. Henry is not required to report the $12,000 alimony received as income and Charlotte cannot claim alimony paid as an adjustment to income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts