Question: Interview Notes - Owen, age 69 and Kimberly, age 64 elect to file Married Filing Jointly. Neither taxpayer is blind. - Owen is retired. He

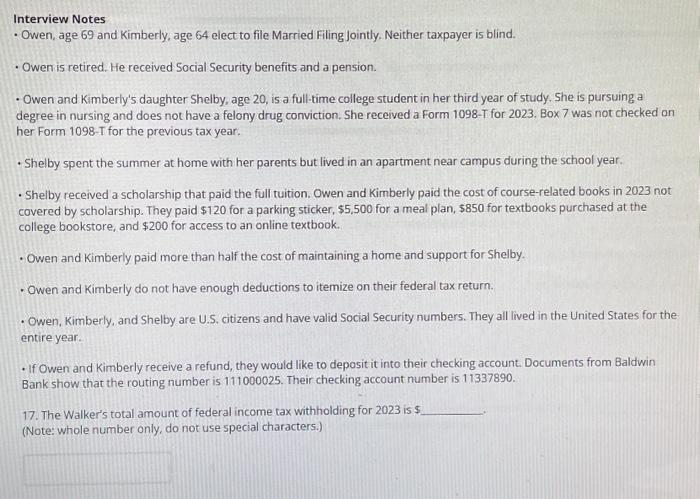

Interview Notes - Owen, age 69 and Kimberly, age 64 elect to file Married Filing Jointly. Neither taxpayer is blind. - Owen is retired. He received Social Security benefits and a pension. - Owen and Kimberly's daughter Shelby, age 20, is a full-time college student in her third year of study. She is pursuing a degree in nursing and does not have a felony drug conviction. She received a Form 1098-T for 2023. Box 7 was not checked on her Form 1098-T for the previous tax year. - Shelby spent the summer at home with her parents but lived in an apartment near campus during the school year. - Shelby received a scholarship that paid the full tuition. Owen and Kimberly paid the cost of course-related books in 2023 not covered by scholarship. They paid $120 for a parking sticker, $5,500 for a meal plan, $850 for textbooks purchased at the college bookstore, and $200 for access to an online textbook. - Owen and Kimberly paid more than half the cost of maintaining a home and support for Shelby. - Owen and Kimberly do not have enough deductions to itemize on their federal tax return. - Owen, Kimberly, and Shelby are U.S. citizens and have valid Social Security numbers. They all lived in the United States for the entire year. - If Owen and Kimberly receive a refund, they would like to deposit it into their checking account. Documents from Baldwin Bank show that the routing number is 111000025 . Their checking account number is 11337890 . 17. The Walker's total amount of federal income tax withholding for 2023 is $ (Note: whole number only, do not use special characters.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts