Question: Interview Notes - Zoe is single and 47 years old. - Zoe has two children. Yvonne, age 19, has a job and earned wages of

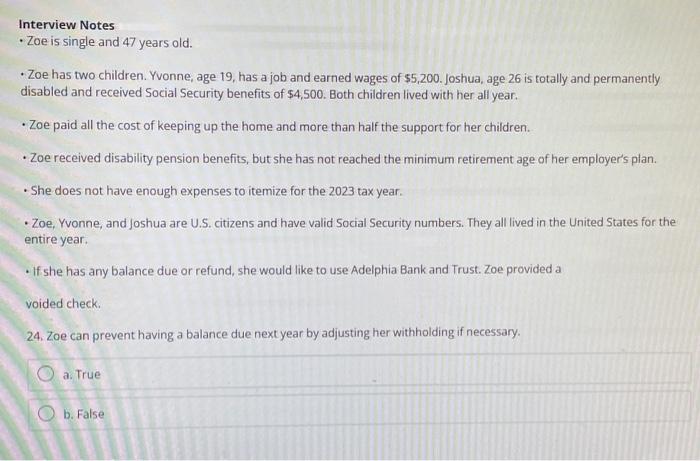

Interview Notes - Zoe is single and 47 years old. - Zoe has two children. Yvonne, age 19, has a job and earned wages of $5,200. Joshua, age 26 is totally and permanently disabled and received Social Security benefits of $4,500. Both children lived with her all year. - Zoe paid all the cost of keeping up the home and more than half the support for her children. - Zoe received disability pension benefits, but she has not reached the minimum retirement age of her employer's plan. - She does not have enough expenses to itemize for the 2023 tax year. - Zoe, Yvonne, and Joshua are U.S. citizens and have valid Social Security numbers. They all lived in the United States for the entire year. - If she has any balance due or refund, she would like to use Adelphia Bank and Trust. Zoe provided a voided check. 24. Zoe can prevent having a balance due next year by adjusting her withholding if necessary. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts