Question: Intrigue Inc. is considering Projects S and L , whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable.

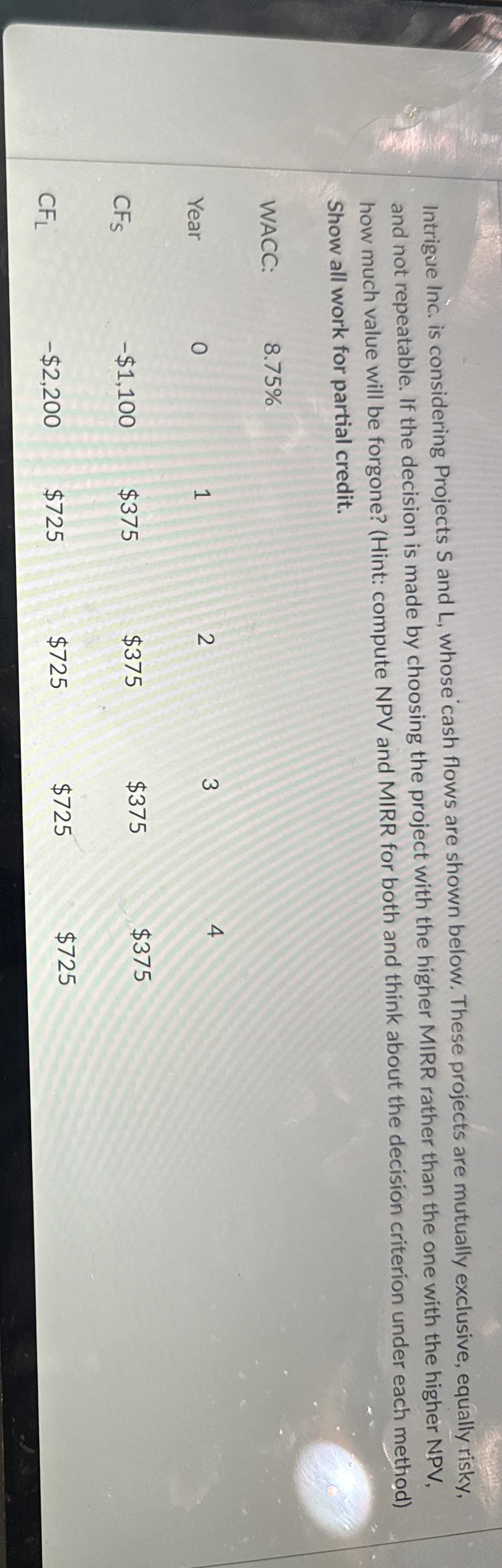

Intrigue Inc. is considering Projects and whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV how much value will be forgone? Hint: compute NPV and MIRR for both and think about the decision criterion under each method Show all work for partial credit.

WACC:

tableYear$$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock