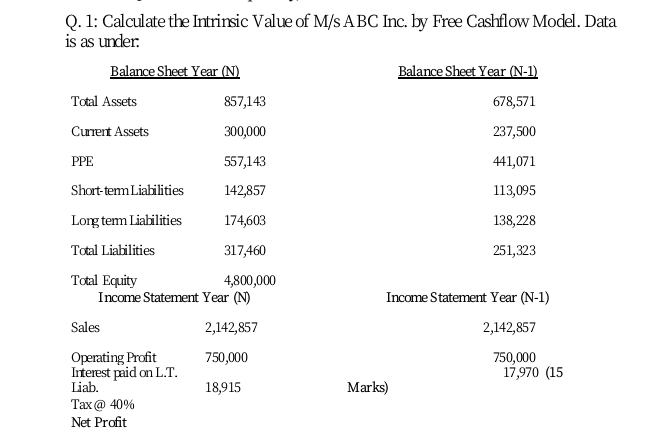

Question: Intrinsic value calculation using free cashflow method. Q.1: Calculate the Intrinsic Value of M/s ABC Inc. by Free Cashflow Model. Data is as under Balance

Intrinsic value calculation using free cashflow method.

Q.1: Calculate the Intrinsic Value of M/s ABC Inc. by Free Cashflow Model. Data is as under Balance Sheet Year (N) Balance Sheet Year (N-1) Total Assets 857,143 678,571 Current Assets 300,000 237,500 PPE 557,143 441,071 Short-term Liabilities 142,857 113,095 Long term Liabilities 174,603 138,228 Total Liabilities 317,460 251,323 Total Equity 4,800,000 Income Statement Year (N) Income Statement Year (N-1) Sales 2,142,857 2,142,857 750,000 750,000 17,970 (15 Operating Profit Interest paid on L.T. Liab. Tax @ 40% Net Profit 18,915 Marks) Q.1: Calculate the Intrinsic Value of M/s ABC Inc. by Free Cashflow Model. Data is as under Balance Sheet Year (N) Balance Sheet Year (N-1) Total Assets 857,143 678,571 Current Assets 300,000 237,500 PPE 557,143 441,071 Short-term Liabilities 142,857 113,095 Long term Liabilities 174,603 138,228 Total Liabilities 317,460 251,323 Total Equity 4,800,000 Income Statement Year (N) Income Statement Year (N-1) Sales 2,142,857 2,142,857 750,000 750,000 17,970 (15 Operating Profit Interest paid on L.T. Liab. Tax @ 40% Net Profit 18,915 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts