Question: Intro Consider a new project proposal. Unit sales are expected to reach 15,000 per year the price per unit is expected to be $60, variable

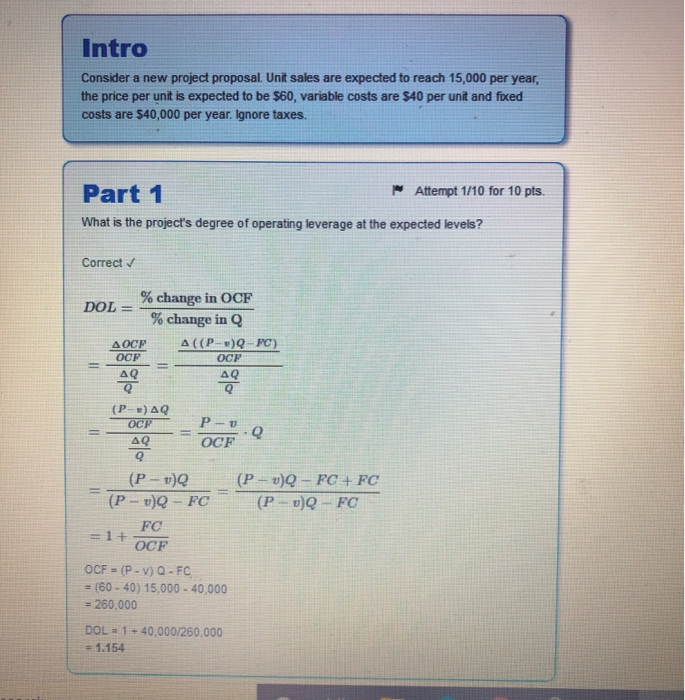

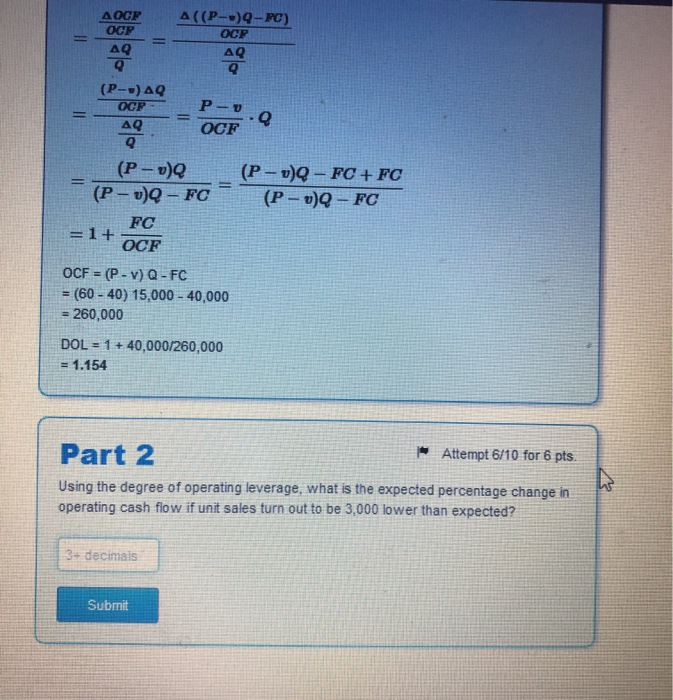

Intro Consider a new project proposal. Unit sales are expected to reach 15,000 per year the price per unit is expected to be $60, variable costs are 540 per unit and fixed costs are 540,000 per year. Ignore taxes. Part 1 Attempt 1/10 for 10 pts. What is the project's degree of operating leverage at the expected levels? Correct % change in OCF DOL = % change in Q A OCF ((P-u)Q-FC) OCP (P- 40 -.Q CR (P - u)Q - FC + FC ( P uQ - FC (P - u)Q (P - u)Q - FC FC TOCF OCF = (P-V) Q-FC = (60 - 40) 15,000 - 40,000 = 260,000 DOL = 1 + 40,000/260,000 = 1.154 A OCP A(P--9-PC) CP (P-AQ ec (P - v) (P - u)Q - FC FC (P - v)Q - FC + FC (P - u)Q - FC =1+ OCF OCF = (P-V) Q - FC = (60 - 40) 15,000 - 40,000 = 260,000 DOL = 1 + 40,000/260,000 = 1.154 Part 2 Attempt 6/10 for 6 pts. Using the degree of operating leverage, what is the expected percentage change in operating cash flow if unit sales turn out to be 3,000 lower than expected? 3+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts