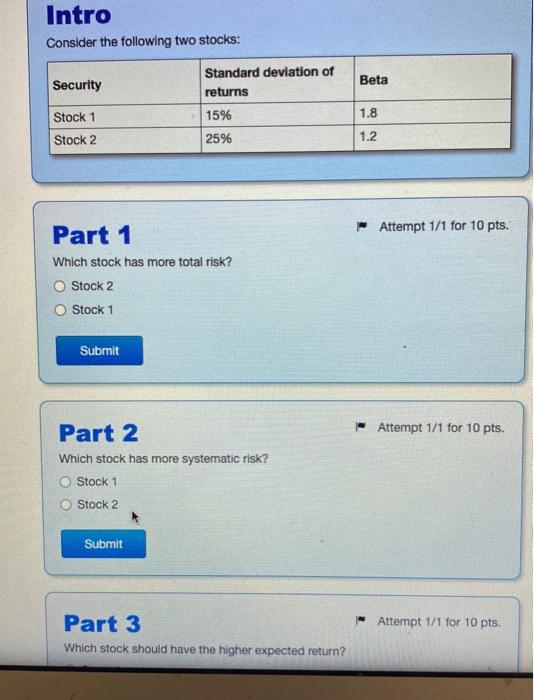

Question: Intro Consider the following two stocks: Security Beta Standard deviation of returns 15% 25% 1.8 Stock 1 Stock 2 1.2 Attempt 1/1 for 10 pts.

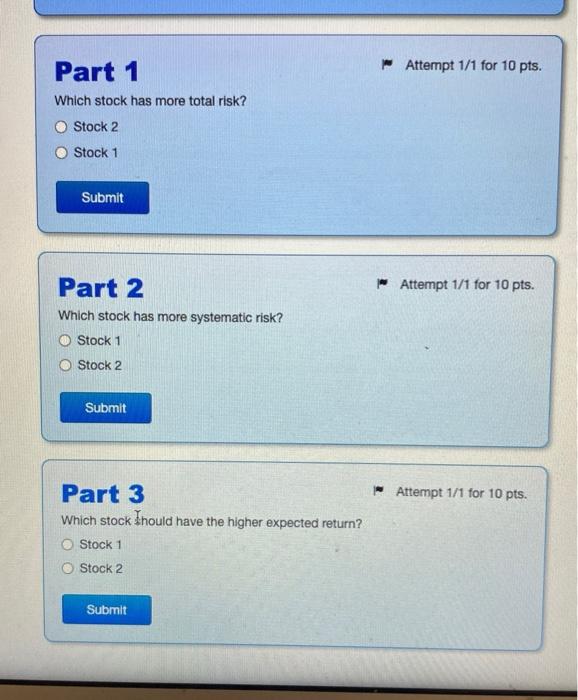

Intro Consider the following two stocks: Security Beta Standard deviation of returns 15% 25% 1.8 Stock 1 Stock 2 1.2 Attempt 1/1 for 10 pts. Part 1 Which stock has more total risk? Stock 2 Stock 1 Submit Attempt 1/1 for 10 pts. Part 2 Which stock has more systematic risk? Stock 1 O Stock 2 Submit Attempt 1/1 for 10 pts. Part 3 Which stock should have the higher expected return? ho Attempt 1/1 for 10 pts. Part 1 Which stock has more total risk? Stock 2 Stock 1 Submit Attempt 1/1 for 10 pts. Part 2 Which stock has more systematic risk? O Stock 1 O Stock 2 Submit Attempt 1/1 for 10 pts. Part 3 Which stock Ihould have the higher expected return? Stock 1 Stock 2 Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts