Question: Intro Dell Computers sells computers and related electronics online. Year 2020 Income Statement and ending Balance Sheet are given below: Income statement ($ million) Balance

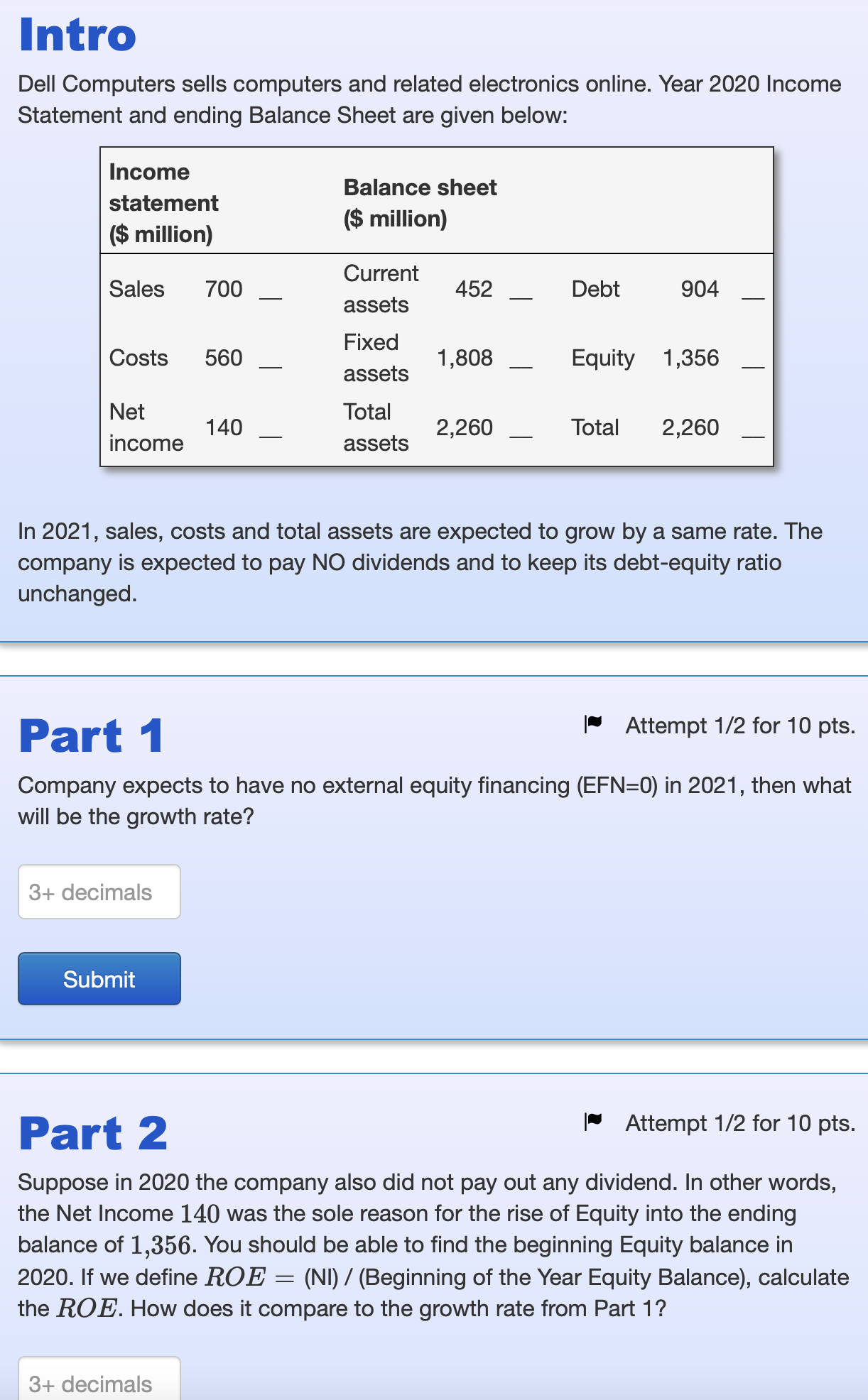

Intro Dell Computers sells computers and related electronics online. Year 2020 Income Statement and ending Balance Sheet are given below: Income statement ($ million) Balance sheet ($ million) Sales 700 Current assets 452 Debt 904 Costs 560 Fixed assets 1,808 Equity 1,356 Net income 140 Total assets 2,260 Total 2,260 In 2021, sales, costs and total assets are expected to grow by a same rate. The company is expected to pay NO dividends and to keep its debt-equity ratio unchanged. Part 1 | Attempt 1/2 for 10 pts. Company expects to have no external equity financing (EFN=0) in 2021, then what will be the growth rate? 3+ decimals Submit Part 2 | Attempt 1/2 for 10 pts. Suppose in 2020 the company also did not pay out any dividend. In other words, the Net Income 140 was the sole reason for the rise of Equity into the ending balance of 1,356. You should be able to find the beginning Equity balance in 2020. If we define ROE = (NI) / (Beginning of the Year Equity Balance), calculate the ROE. How does it compare to the growth rate from Part 1? 3+ decimals Intro Dell Computers sells computers and related electronics online. Year 2020 Income Statement and ending Balance Sheet are given below: Income statement ($ million) Balance sheet ($ million) Sales 700 Current assets 452 Debt 904 Costs 560 Fixed assets 1,808 Equity 1,356 Net income 140 Total assets 2,260 Total 2,260 In 2021, sales, costs and total assets are expected to grow by a same rate. The company is expected to pay NO dividends and to keep its debt-equity ratio unchanged. Part 1 | Attempt 1/2 for 10 pts. Company expects to have no external equity financing (EFN=0) in 2021, then what will be the growth rate? 3+ decimals Submit Part 2 | Attempt 1/2 for 10 pts. Suppose in 2020 the company also did not pay out any dividend. In other words, the Net Income 140 was the sole reason for the rise of Equity into the ending balance of 1,356. You should be able to find the beginning Equity balance in 2020. If we define ROE = (NI) / (Beginning of the Year Equity Balance), calculate the ROE. How does it compare to the growth rate from Part 1? 3+ decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts