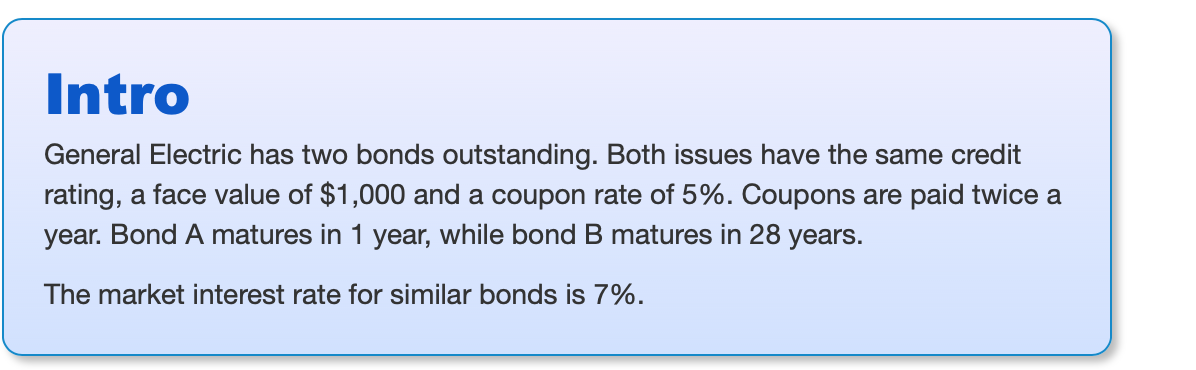

Question: Intro General Electric has two bonds outstanding. Both issues have the same credit rating, a face value of $1,000 and a coupon rate of 5%.

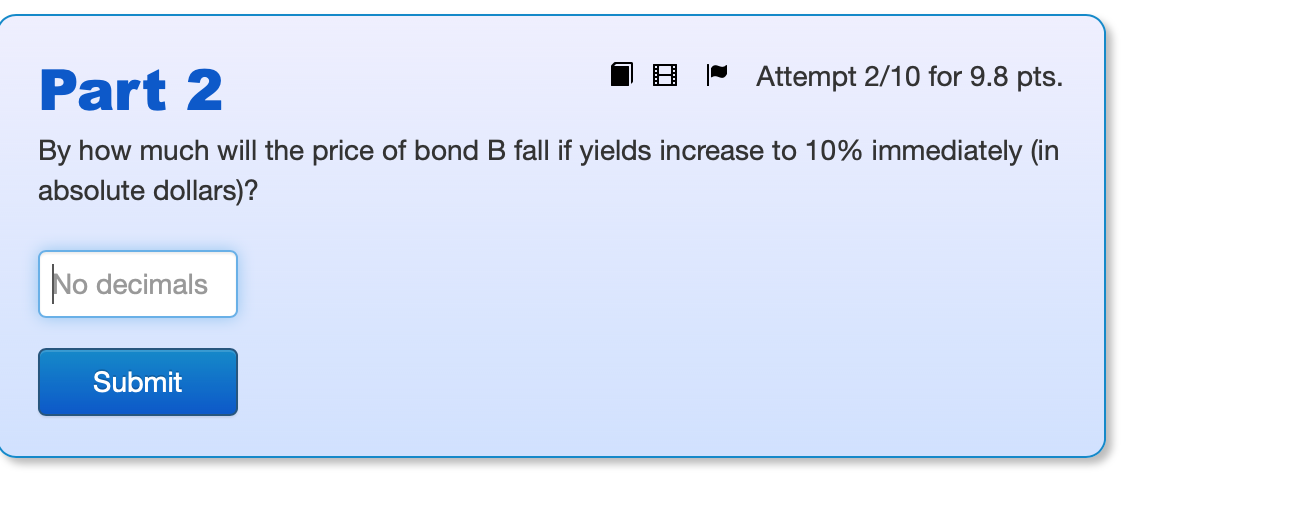

Intro General Electric has two bonds outstanding. Both issues have the same credit rating, a face value of $1,000 and a coupon rate of 5%. Coupons are paid twice a year. Bond A matures in 1 year, while bond B matures in 28 years. The market interest rate for similar bonds is 7%. Part 2 18 Attempt 2/10 for 9.8 pts. By how much will the price of bond B fall if yields increase to 10% immediately (in absolute dollars)? No decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts