Question: Intro Simple Corp. has one bond issue oustanding, with a maturity of 10.5 years, a coupon rate of 4% and a yield to maturity of

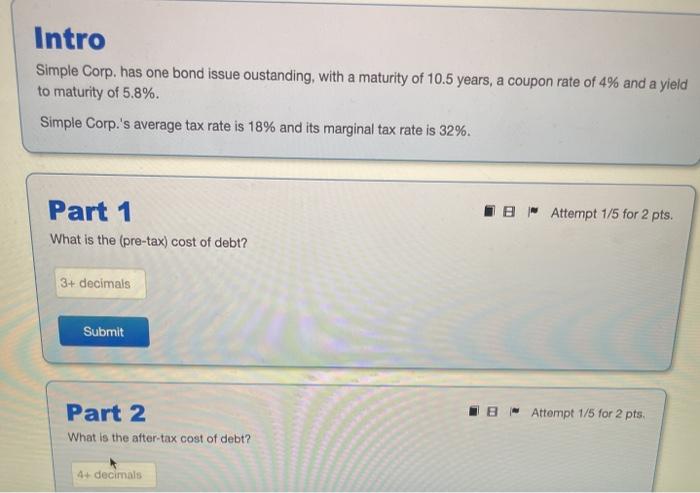

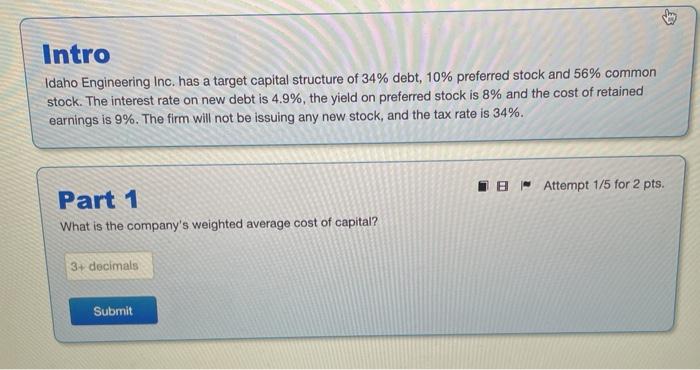

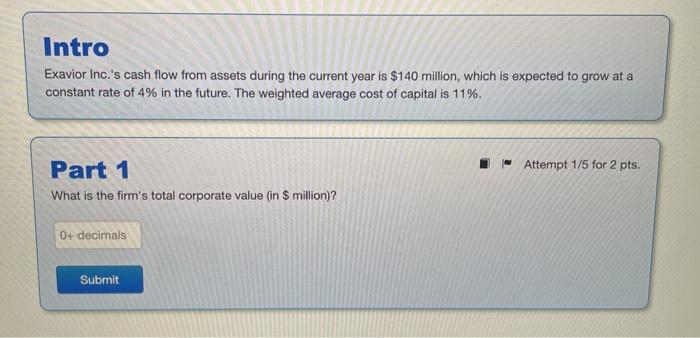

Intro Simple Corp. has one bond issue oustanding, with a maturity of 10.5 years, a coupon rate of 4% and a yield to maturity of 5.8%. Simple Corp.'s average tax rate is 18% and its marginal tax rate is 32%. IB Attempt 1/5 for 2 pts. Part 1 What is the (pre-tax) cost of debt? 3+ decimals Submit 28 Attempt 1/5 for 2 pts. Part 2 What is the after-tax cost of debt? 4decimals Intro Idaho Engineering Inc. has a target capital structure of 34% debt, 10% preferred stock and 56% common stock. The interest rate on new debt is 4.9%, the yield on preferred stock is 8% and the cost of retained earnings is 9%. The firm will not be issuing any new stock, and the tax rate is 34%. IB- Attempt 1/5 for 2 pts. Part 1 What is the company's weighted average cost of capital? 3+ decimals Submit Intro Exavior Inc.'s cash flow from assets during the current year is $140 million, which is expected to grow at a constant rate of 4% in the future. The weighted average cost of capital is 11%. - Attempt 1/5 for 2 pts. Part 1 What is the firm's total corporate value in $ million)? 04. decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts