Question: Intro Suppose that the current exchange rate between the dollar and the euro is $1.19 per euro. Interest rates are 3.7% in dollars and 5%

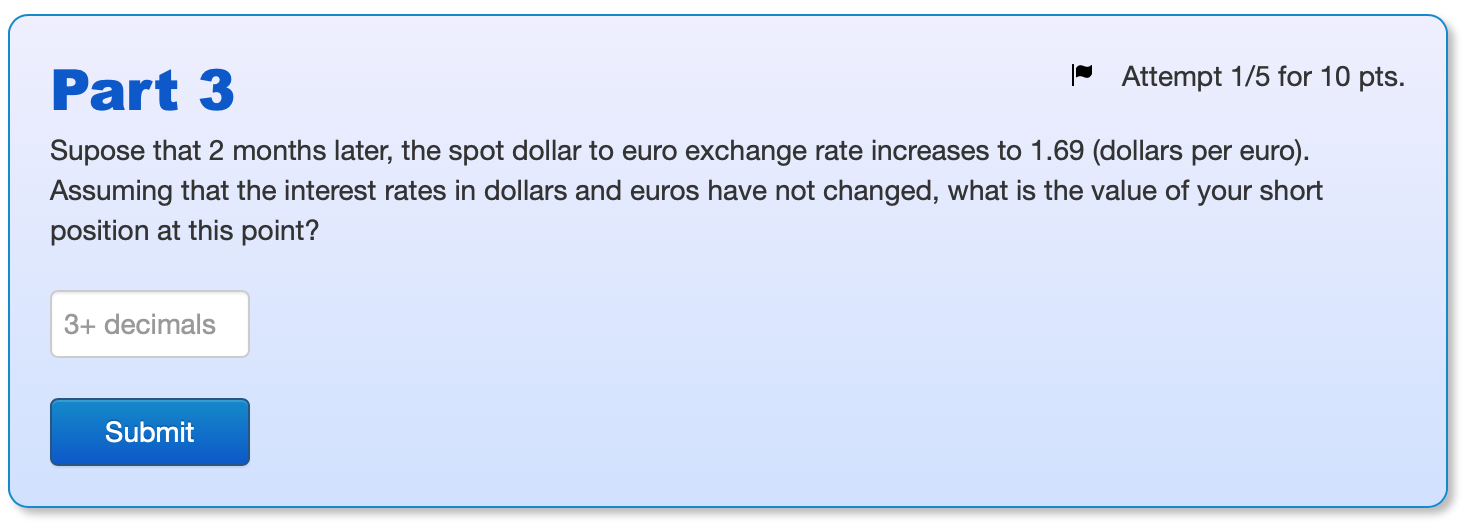

Intro Suppose that the current exchange rate between the dollar and the euro is $1.19 per euro. Interest rates are 3.7% in dollars and 5% in euros, for all maturities. The interest rates are quoted with continuous compounding. Part 1 Attempt 175 for 10 pts. What should be the forward exchange rate for delivery in 8 months (in dollars per euro)? 2+ decimals Submit - Attempt 1/5 for 10 pts. Part 2 Suppose you take a short position in the forward contract to deliver euros in exchange for dollars in 8 months. What is the value of the contract today? 0+ decimals Submit Part 3 | Attempt 1/5 for 10 pts. Supose that 2 months later, the spot dollar to euro exchange rate increases to 1.69 (dollars per euro). Assuming that the interest rates in dollars and euros have not changed, what is the value of your short position at this point? 3+ decimals Submit Intro Suppose that the current exchange rate between the dollar and the euro is $1.19 per euro. Interest rates are 3.7% in dollars and 5% in euros, for all maturities. The interest rates are quoted with continuous compounding. Part 1 Attempt 175 for 10 pts. What should be the forward exchange rate for delivery in 8 months (in dollars per euro)? 2+ decimals Submit - Attempt 1/5 for 10 pts. Part 2 Suppose you take a short position in the forward contract to deliver euros in exchange for dollars in 8 months. What is the value of the contract today? 0+ decimals Submit Part 3 | Attempt 1/5 for 10 pts. Supose that 2 months later, the spot dollar to euro exchange rate increases to 1.69 (dollars per euro). Assuming that the interest rates in dollars and euros have not changed, what is the value of your short position at this point? 3+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts