Question: INTRO TAX - HOMEWORK # 1 has a $ 3 , 0 0 0 RRSP deduction available as a subdivision e deduction. Two years ago,

INTRO TAX HOMEWORK #

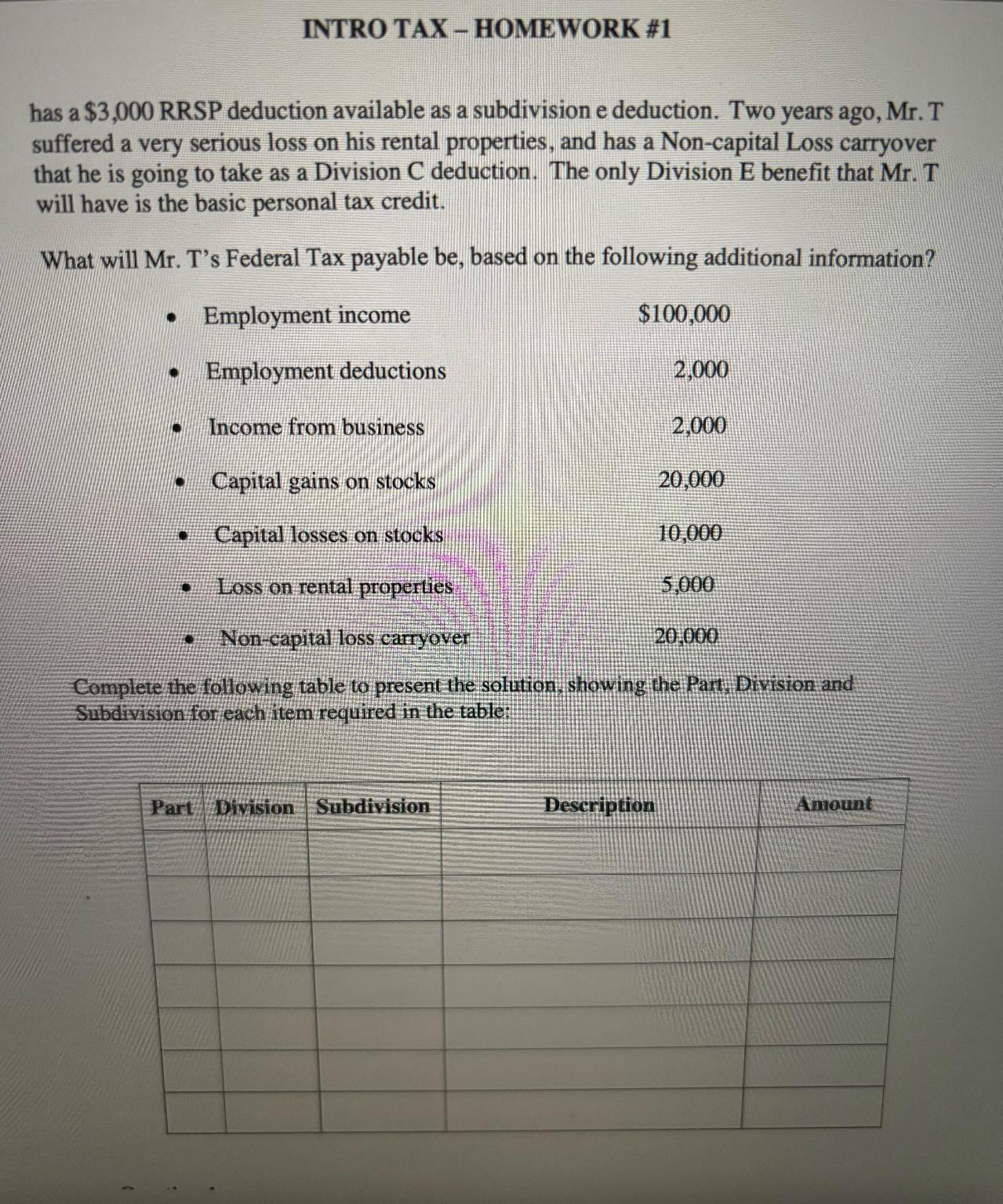

has a $ RRSP deduction available as a subdivision e deduction. Two years ago, Mr T suffered a very serious loss on his rental properties, and has a Noncapital Loss carryover that he is going to take as a Division C deduction. The only Division E benefit that Mr T will have is the basic personal tax credit.

What will Mr Ts Federal Tax payable be based on the following additional information?

Employment income

Employment deductions

Income from business

Capital gains on stocks

Capital losses on stocks

Loss on rental properties

Noncapital loss carryover

$

Complete the following table to present the solution, showing the Part. Division and Subdivision for each item required in the table:

Part Division

Subdivision

Description

Amount

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock