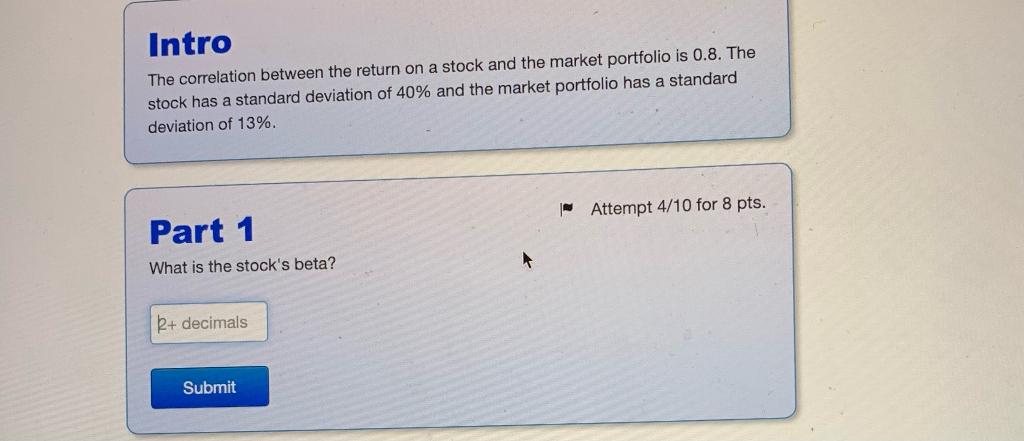

Question: Intro The correlation between the return on a stock and the market portfolio is 0.8. The stock has a standard deviation of 40% and the

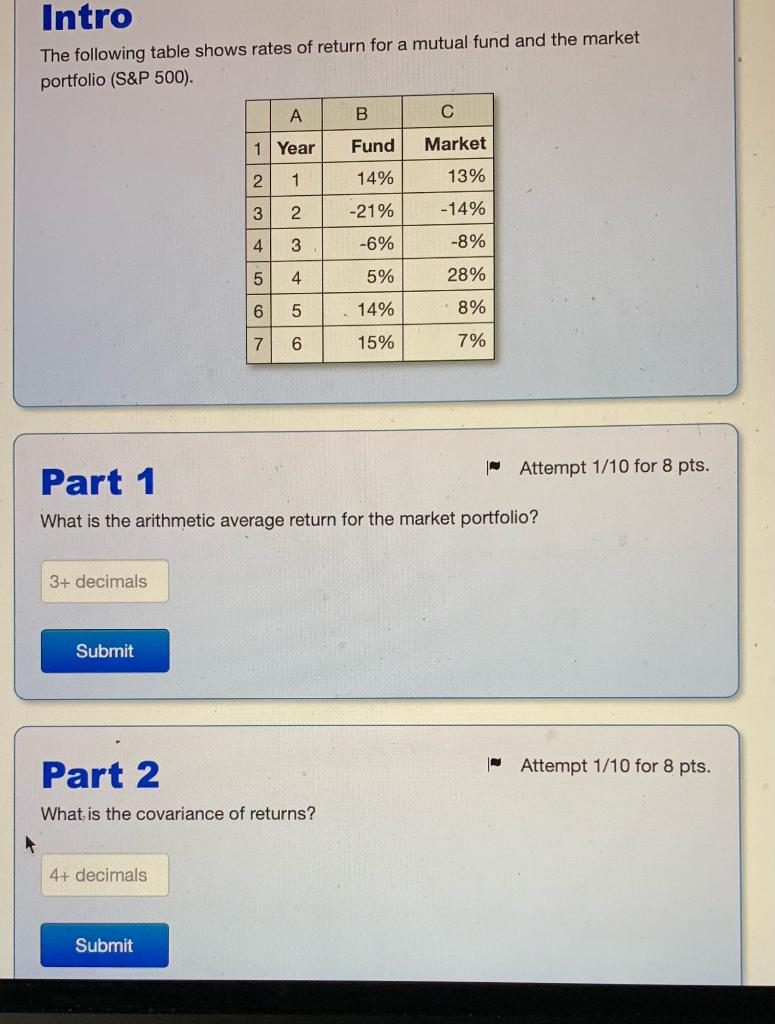

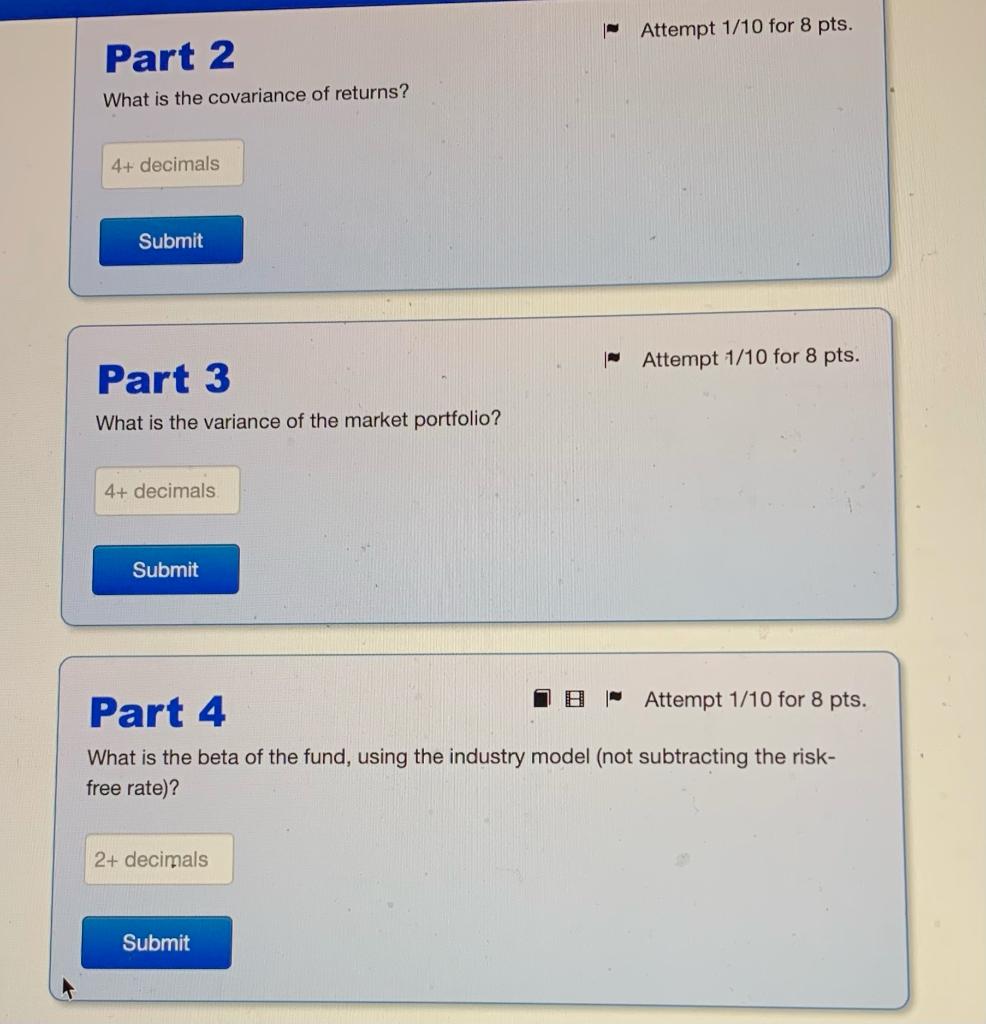

Intro The correlation between the return on a stock and the market portfolio is 0.8. The stock has a standard deviation of 40% and the market portfolio has a standard deviation of 13%. | Attempt 4/10 for 8 pts. Part 1 What is the stock's beta? 2+ decimals Submit Intro The following table shows rates of return for a mutual fund and the market portfolio (S&P 500). B C 1 Year Fund Market 2 1 14% 13% 3 2 -21% -14% 4 3 -6% -8% VOOR AWN 5 4 5% 28% 6 5 14% 8% 7 6 15% 7% Part 1 - Attempt 1/10 for 8 pts. What is the arithmetic average return for the market portfolio? 3+ decimals Submit - Attempt 1/10 for 8 pts. Part 2 What is the covariance of returns? 4+ decimals Submit Attempt 1/10 for 8 pts. Part 2 What is the covariance of returns? 4+ decimals Submit Attempt 1/10 for 8 pts. Part 3 What is the variance of the market portfolio? 4+ decimals Submit Part 4 IB | Attempt 1/10 for 8 pts. What is the beta of the fund, using the industry model (not subtracting the risk- free rate)? 2+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts