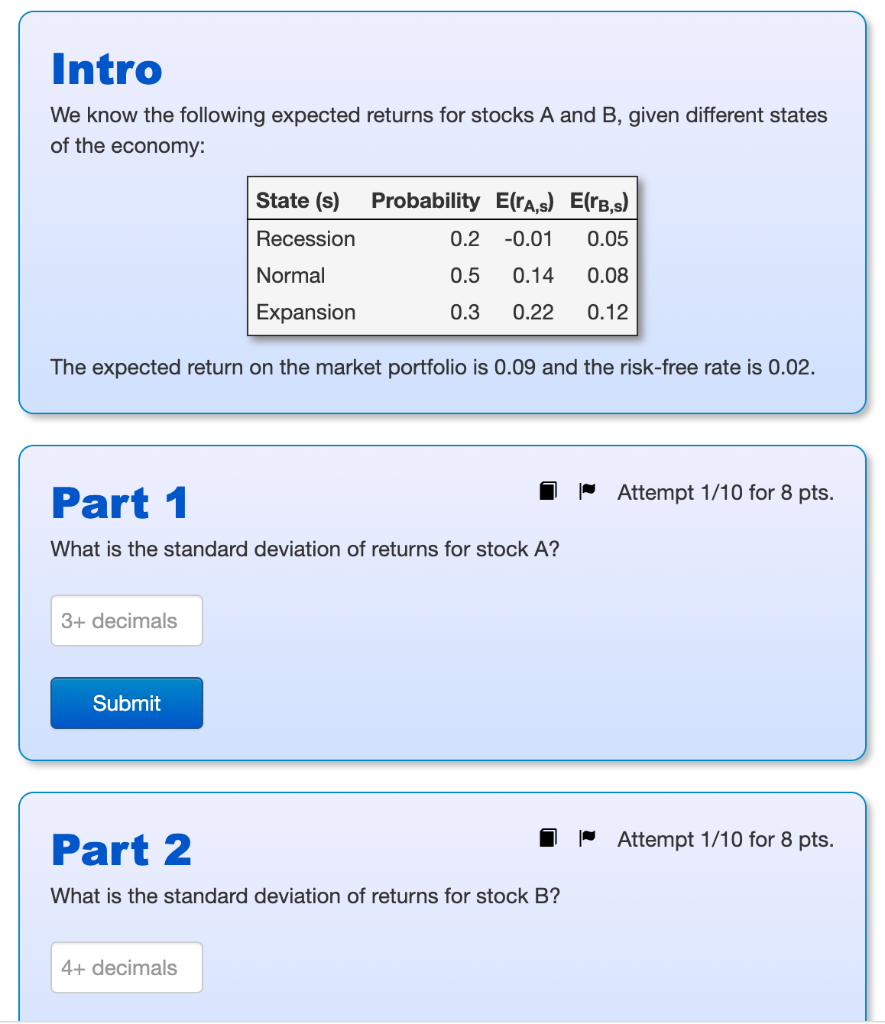

Question: Intro We know the following expected returns for stocks A and B, given different states of the economy: State (s) Probability E(ra,s) E(rs,s) 0.2 -0.01

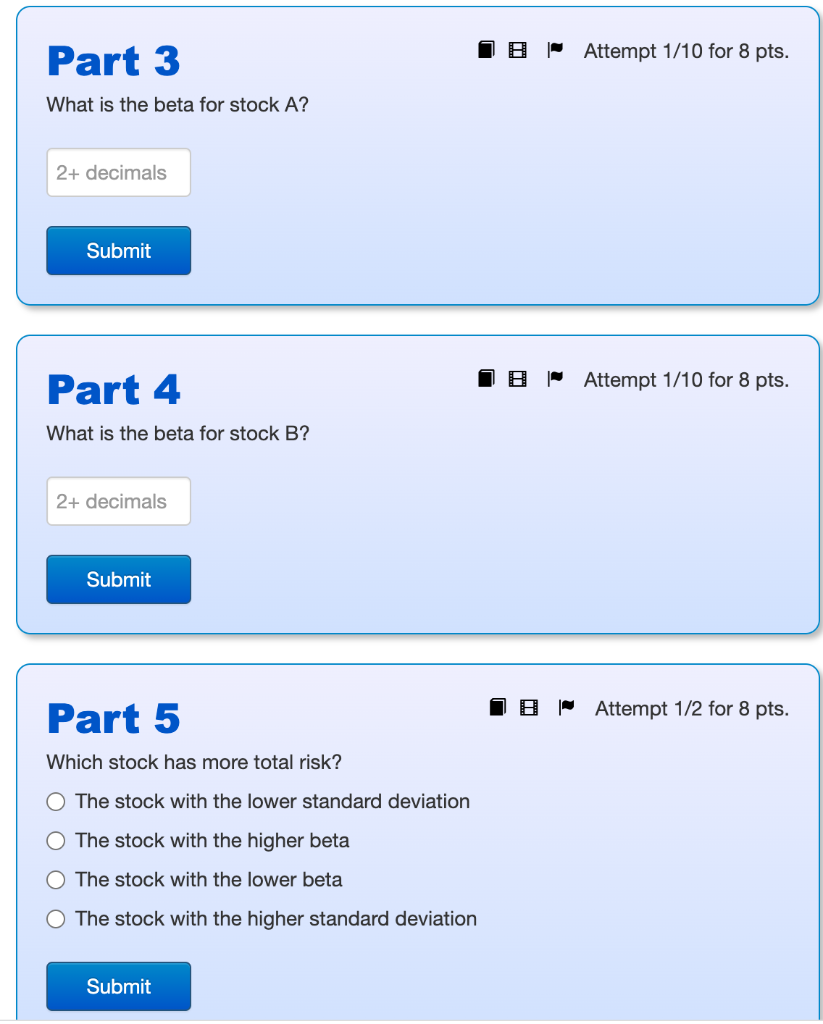

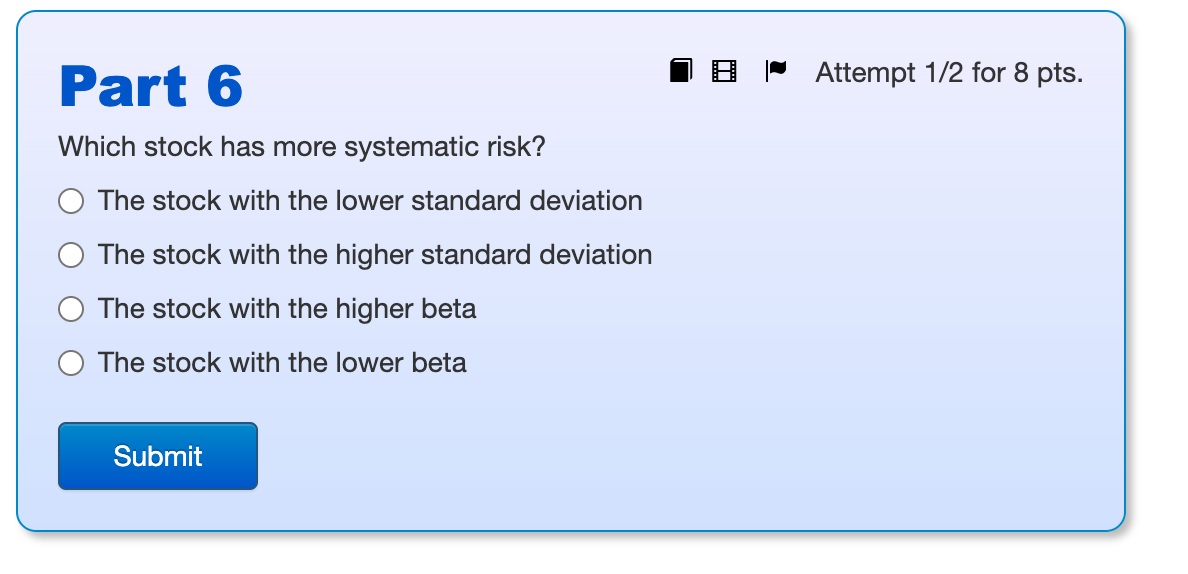

Intro We know the following expected returns for stocks A and B, given different states of the economy: State (s) Probability E(ra,s) E(rs,s) 0.2 -0.01 0.05 Recession 0.5 0.14 0.08 Normal Expansion 0.3 0.22 0.12 The expected return on the market portfolio is 0.09 and the risk-free rate is 0.02. | Attempt 1/10 for 8 pts. Part 1 What is the standard deviation of returns for stock A? 3+ decimals Submit Part 2 | Attempt 1/10 for 8 pts. What is the standard deviation of returns for stock B? 4+ decimals Part 3 8 Attempt 1/10 for 8 pts. What is the beta for stock A? 2+ decimals Submit Part 4 B Attempt 1/10 for 8 pts. What is the beta for stock B? 2+ decimals Submit Part 5 | Attempt 1/2 for 8 pts. Which stock has more total risk? The stock with the lower standard deviation The stock with the higher beta The stock with the lower beta The stock with the higher standard deviation Submit Part 6 Attempt 1/2 for 8 pts. Which stock has more systematic risk? The stock with the lower standard deviation The stock with the higher standard deviation The stock with the higher beta The stock with the lower beta Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts