Question: Introduction Assignment 9 is based on Module 9 and should be completed at the end of Module 9. To solidify your understanding of the content

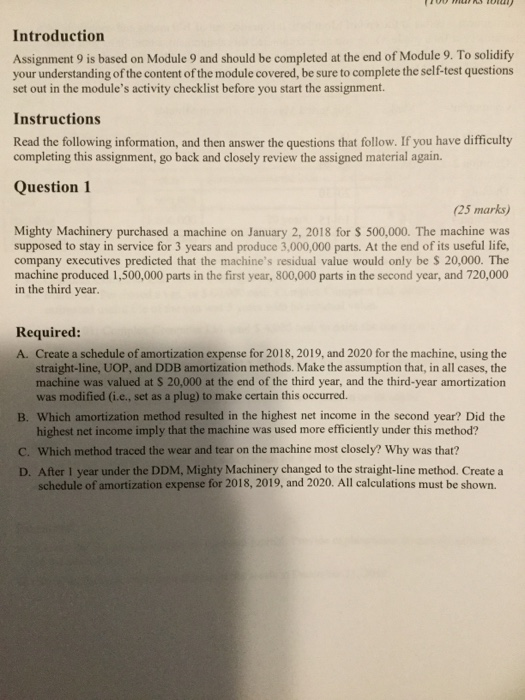

Introduction Assignment 9 is based on Module 9 and should be completed at the end of Module 9. To solidify your understanding of the content of the module covered, be sure to complete the self-test questions set out in the module's activity checklist before you start the assignment. Instructions Read the following information, and then answer the questions that follow. If you have difficulty completing this assignment, go back and closely review the assigned material again. Question 1 (25 marks) Mighty Machinery purchased a machine on January 2, 2018 for $ 500,000. The machine supposed to stay in service for 3 years and produce 3,000,000 parts. At the end of its useful life, company executives predicted that the machine's residual value would only be $ 20,000. The machine produced 1,500,000 parts in the first year, 800,000 parts in the second year, and 720,000 in the third year as Required: A. Create a schedule of amortization expense for 2018, 2019, and 2020 for the machine, using the straight-line, UOP, and DDB amortization methods. Make the assumption that, in all cases, the machine was valued at $ 20,000 at the end of the third year, and the third-year amortization was modified (i.e., set as a plug) to make certain this occurred. B. Which amortization method resulted in the highest net income in the second year? Did the highest net income imply that the machine was used more efficiently under this method? C. Which method traced the wear and tear on the machine most closely? Why was that? D. After 1 year under the DDM, Mighty Machinery changed to the straight-line method. Create a schedule of amortization expense for 2018, 2019, and 2020. All calculations must be shown

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts