Question: Introduction In this problem set, you will have the opportunity to apply some of the concepts learned in previous modules this semester in the context

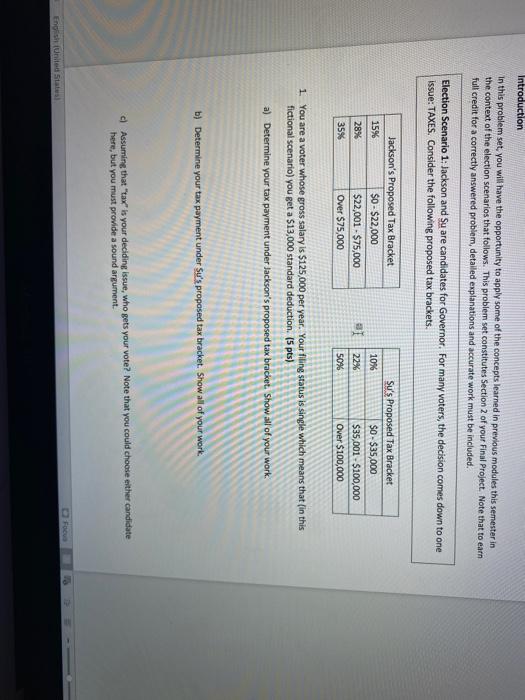

Introduction In this problem set, you will have the opportunity to apply some of the concepts learned in previous modules this semester in the context of the election scenarios that follows. This problem set constitutes Section 2 of your Final Project. Note that to earn full credit for a correctly answered problem, detailed explanations and accurate work must be included. Election Scenario 1: Jackson and Su are candidates for Governor. For many voters, the decision comes down to one Issue: TAXES. Consider the following proposed tax brackets. Jackson's Proposed Tax Bracket 15% $0 - $22,000 28% $22,001 - $75,000 35% Over $75,000 10% 22% Su's Proposed Tax Bracket $0-$35,000 $35,001 - $100,000 Over $100,000 50% 1 You are a voter whose gross salary is $125,000 per year. Your filing status is single which means that in this fictional scenario) you get a $13,000 standard deduction (5 pts) a) Determine your tax payment under Jackson's proposed tax bracket Show all of your work. b) Determine your tax payment under Su's proposed tax bracket. Show all of your work. Assuming that "tax" is your deciding issue, who gets your vote? Note that you could choose either candidate here, but you must provide a sound argument. Focus English (United States

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts