Question: Introduction is needed for each question. Question has to be answered based on the mark allotted for each question with references if any idea or

Introduction is needed for each question. Question has to be answered based on the mark allotted for each question with references if any idea or information is taken from other source. * If assignment is case based then, Executive summary Table of content Introduction Body of assignment (questions related to case need to be answered) Conclusion / Recommendation if any References (in-text + citation) to be used. Total Marks / 90 PLAGIARISM Plagiarism is a form of cheating, by representing someone else's work as your own or using someone else's work (another student or author) without acknowledging it with a reference. This is a serious breach of the Academic Regulations and will be dealt with accordingly. Students found to have plagiarized can be excluded from the program. Plagiarism occurs whenever you do any of the following things without acknowledging the original source: Copy information from any source (including the study guide, books, newspapers, the internet) Use another person's concepts orideas Summarize or paraphrase another person's work. How do I avoid plagiarism? To ensure you are not plagiarizing, you must acknowledge with a reference whenever you: use another person's ideas, opinions or theory include any statistics, graphs or images that have been compiled or created by another person or organization

Paraphrase another's written or spokenword. What are the penalties? The penalties for plagiarism are: Deduction of marks, A mark of zero for the assignment or the unit, or Exclusion from the program. Plagiarism is dealt with on a case-by-case basis and the penalties will reflect the seriousness of the breach. Please note claiming that you were not aware of need to reference is no excuse

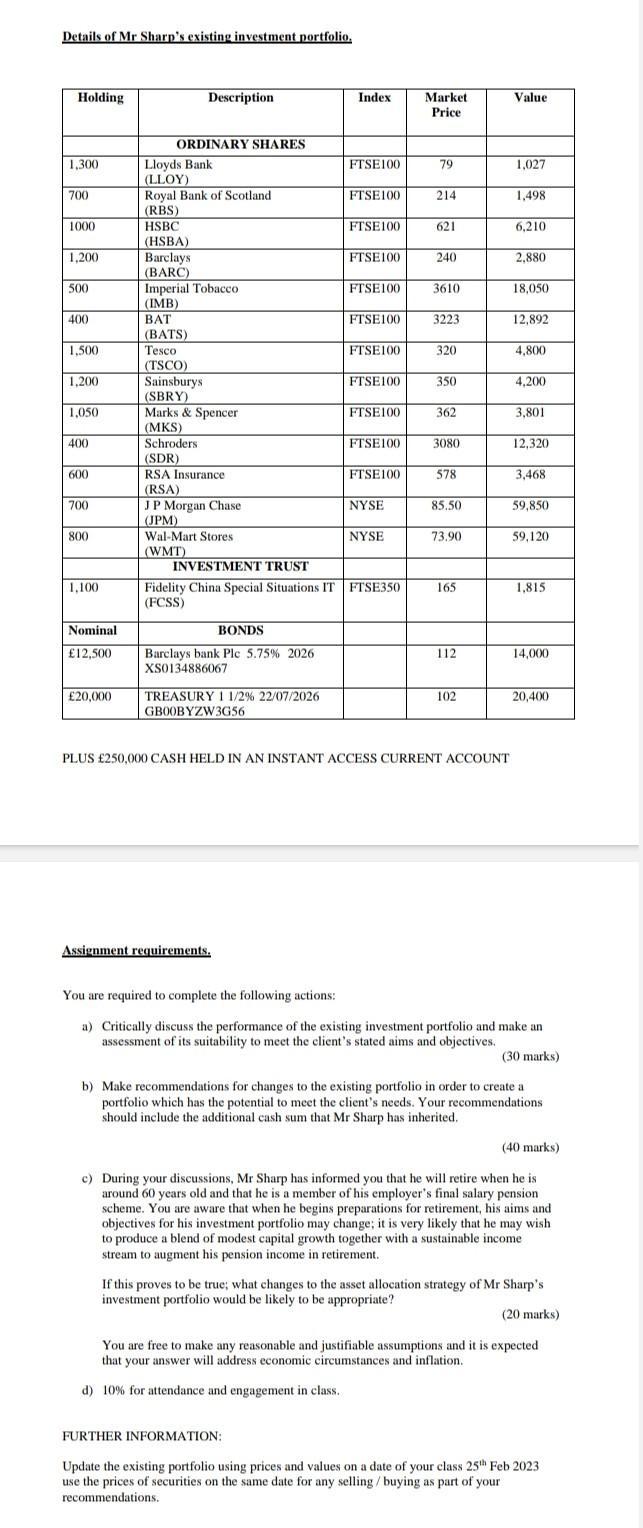

Details of Mr Sharp's existing investment portfolio. PLUS 250,000 CASH HELD IN AN INSTANT ACCESS CURRENT ACCOUNT Assignment requirements. You are required to complete the following actions: a) Critically discuss the performance of the existing investment portfolio and make an assessment of its suitability to meet the elient's stated aims and objectives. ( 30 marks) b) Make recommendations for changes to the existing portfolio in order to create a portfolio which has the potential to meet the client's needs. Your recommendations should include the additional cash sum that Mr Sharp has inherited. (40 marks) c) During your discussions, Mr Sharp has informed you that he will retire when he is around 60 years old and that he is a member of his employer's final salary pension scheme. You are aware that when he begins preparations for retirement, his aims and objectives for his investment portfolio may change; it is very likely that he may wish to produce a blend of modest capital growth together with a sustainable income stream to augment his pension income in retirement. If this proves to be true; what changes to the asset allocation strategy of Mr Sharp's investment portfolio would be likely to be appropriate? (20 marks) You are free to make any reasonable and justifiable assumptions and it is expected that your answer will address economic circumstances and inflation. d) 10% for attendance and engagement in class. FURTHER INFORMATION: Update the existing portfolio using prices and values on a date of your class 25thFeb2023 use the prices of securities on the same date for any selling / buying as part of your recommendations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts