Question: Introduction This assignment will assess your critical thinking, creativity, and written communication. As a future management accountant, it is essential to think critically, creatively and

Introduction

This assignment will assess your critical thinking, creativity, and written communication. As a future management accountant, it is essential to think critically, creatively and communicate effectively to avoid losing any valuable opportunities to create value for shareholders and customers.

Instructions:

AF201 Chapter References: Chapters 12, 13 & 14 of the textbook

Case Study

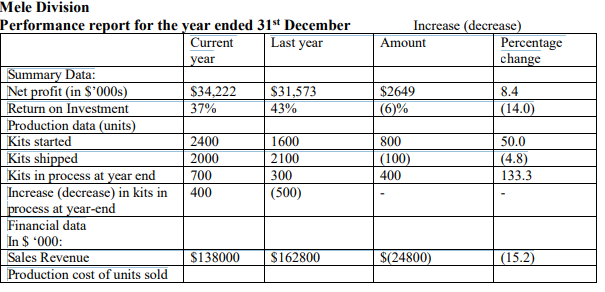

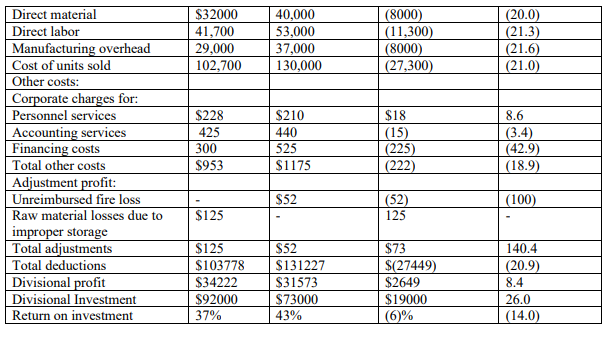

Vanuatu Housing Ltd is a major producer of prefabricated beach houses. The company consist of two divisions: the Mele division, which acquires the raw materials to manufacture the basic house components and assembles them into kits, and the Pango division which takes the kits and constructs the homes for the ultimate buyers. The company is decentralized, and the performance of each of the management of each division is measured by divisional profit and return on investment. The Mele division assembles seven separate houses kits using raw materials purchased at the prevailing market prices. The seven kits are sold to Pango for prices ranging from $45,000 to $98,000. The prices are set by Vanuatu Housings corporate management using prices paid by Pango when it buys comparable units from outside sources. The smaller kits with lower prices have become the larger portion of the units sold, because the ultimate house buyer is faced with prices that are increasing more rapidly than personal income. The kits are manufactured and assembled in a new plant purchased by Mele this year. The division had been located in a leased plant for the past four years. All kits are assembled upon receipt of an order from the Pango division. When the kit is completely assembled, it is loaded immediately onto a Pango truck. Thus, the Mele division does not have any finished goods inventory. The Mele divisions accounts and reports are prepared on an actual cost basis. There is no budget and standards have not been developed for any product. A manufacturing overhead rate is calculated at the beginning of each year. The rate is designed to change all overhead to the production each year. Any underapplied or overapplied overhead is closed into the cost of goods sold account. The Mele divisions annual performance report follows. It forms the basis of the evaluation of the division and its management.

Additional information regarding corporate and divisional practices follows:

The company head office does all the personnel and accounting work for each division

Head office personnel costs are allocated to divisions on the basis of the number of employees in each division

Accounting costs are allocated to divisions on the basis of total costs, excluding corporate charges

Divisional administration costs are included in overhead

The financing charges include a corporate imputed interest charge on divisional assets.

The divisional investment used in the ROI calculation includes divisional inventory and plant and equipment measured at acquisition cost.

Required

1. Discuss the value of the annual performance report presented to the Mele division in evaluating the division and its management in terms of:

a. Accounting techniques employed in the measurement of divisional activities

b. Manner of presentation

c. Effectiveness with which it discloses differences and similarities within years. Use the information in the case to illustrate your answer.

2. Present specific recommendations for the management of Vanuatu Housing ltd that would improve its accounting and financial reporting system.

3. Suppose that the Mele divisions chief accountant Takee Kersley was approached on 28 December by the divisional general manager with the following request:

Takee weve got a firm order for 50kits that wont be finished and shipped until 8th January. I want you to book the sales before the end of the year. The total sales figure on the order is $850,000. That will bump this years net profit up over $35,000,000. The division will look better, and we will all get a bonus.

What are Takee Kersleys ethical obligations in this situation?

Mele Division \begin{tabular}{|l|l|l|l|l|} \hline Direct material & $32000 & 40,000 & (8000) & (20.0) \\ \hline Direct labor & 41,700 & 53,000 & (11,300) & (21.3) \\ \hline Manufacturing overhead & 29,000 & 37,000 & (8000) & (21.6) \\ \hline Cost of units sold & 102,700 & 130,000 & (27,300) & (21.0) \\ \hline Other costs: & & & & \\ \hline Corporate charges for: & & & & \\ \hline Personnel services & $228 & $210 & $18 & 8.6 \\ \hline Accounting services & 425 & 440 & (15) & (3.4) \\ \hline Financing costs & 300 & 525 & (225) & (42.9) \\ \hline Total other costs & $953 & $1175 & (222) & (18.9) \\ \hline Adjustment profit: & & & & \\ \hline Unreimbursed fire loss & - & $52 & (52) & (100) \\ \hline Rawmateriallossesduetoimproperstorage & $125 & - & 125 & - \\ \hline Total adjustments & $125 & $52 & $73 & 140.4 \\ \hline Total deductions & $103778 & $131227 & $(27449) & (20.9) \\ \hline Divisional profit & $34222 & $31573 & $2649 & 8.4 \\ \hline Divisional Investment & $92000 & $73000 & $19000 & 26.0 \\ \hline Return on investment & 37% & 43% & (6)% & (14.0) \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts