Question: Introduction to Accounting An Integrated Approach Eighth Edition Chapter 4 E4.17 make or buy the vases? Why? Roccabruna Corporation currently produces 5,000 tablecloths per period.

Introduction to Accounting An Integrated Approach Eighth Edition Chapter 4 E4.17

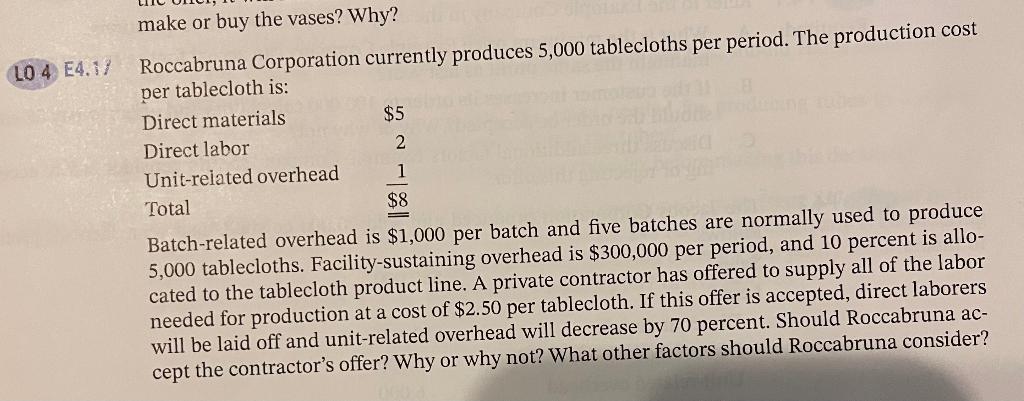

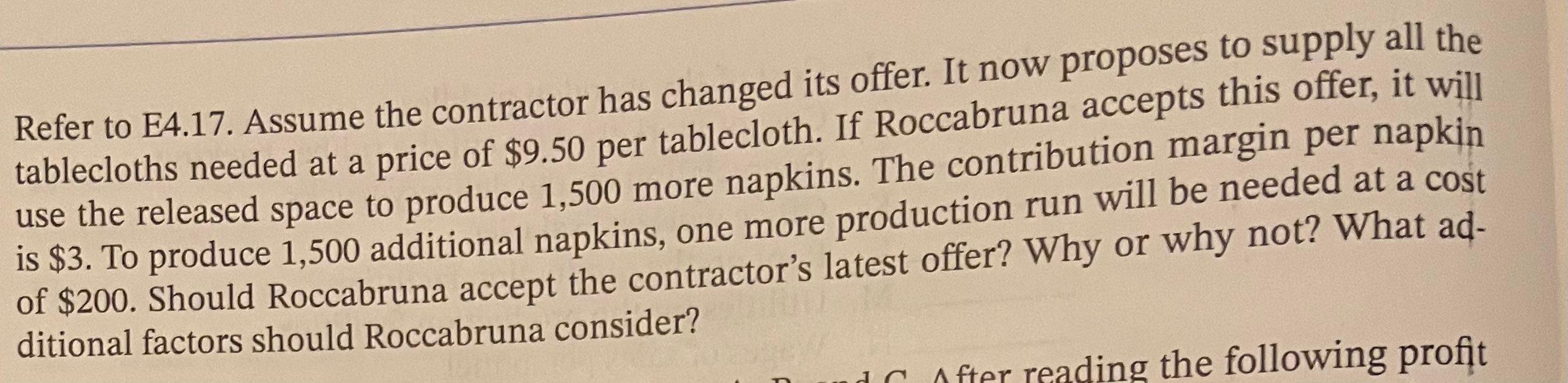

make or buy the vases? Why? Roccabruna Corporation currently produces 5,000 tablecloths per period. The production cost ner tablecloth is: Batch-related overhead is $1,000 per batch and five batches are normally used to produce 5,000 tablecloths. Facility-sustaining overhead is $300,000 per period, and 10 percent is allocated to the tablecloth product line. A private contractor has offered to supply all of the labor needed for production at a cost of $2.50 per tablecloth. If this offer is accepted, direct laborers will be laid off and unit-related overhead will decrease by 70 percent. Should Roccabruna accept the contractor's offer? Why or why not? What other factors should Roccabruna consider? Refer to E4.17. Assume the contractor has changed its offer. It now proposes to supply all the tablecloths needed at a price of $9.50 per tablecloth. If Roccabruna accepts this offer, it will use the released space to produce 1,500 more napkins. The contribution margin per napkin is $3. To produce 1,500 additional napkins, one more production run will be needed at a cost of $200. Should Roccabruna accept the contractor's latest offer? Why or why not? What additional factors should Roccabruna consider

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts