Question: Introduction to Comparable Valuation Analysis - Main Valuation Techniques Multiple valuation techniques are used to triangulate the value of a company. What are three common

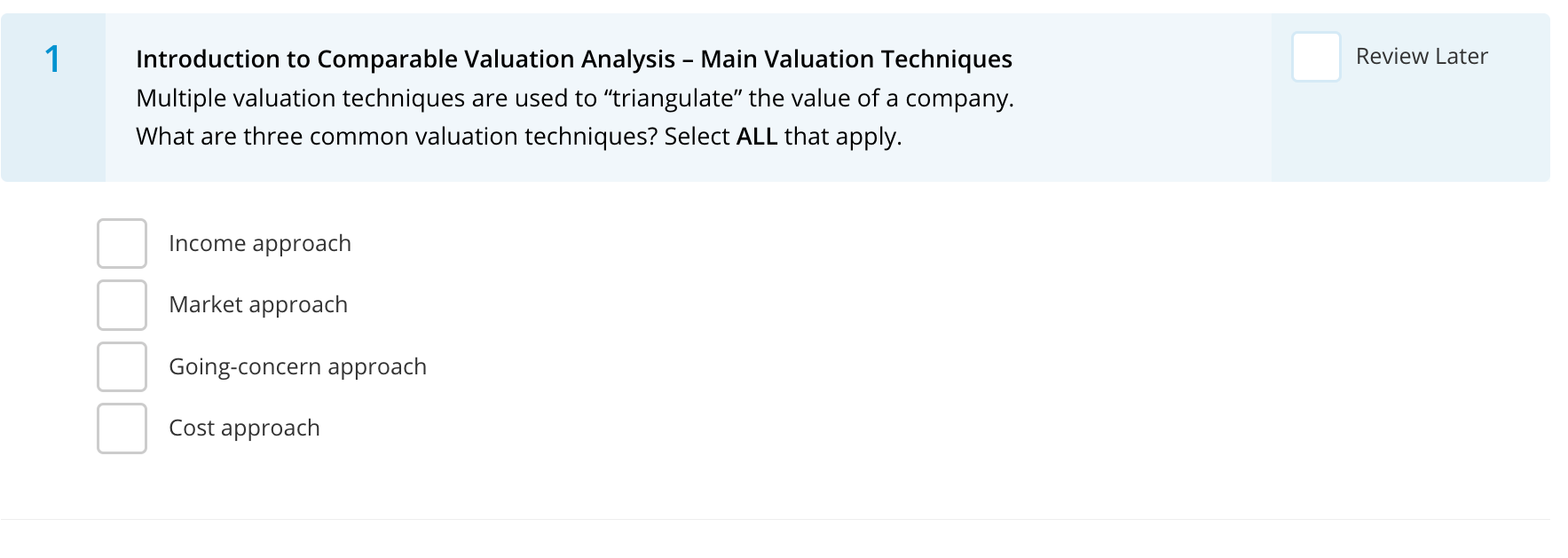

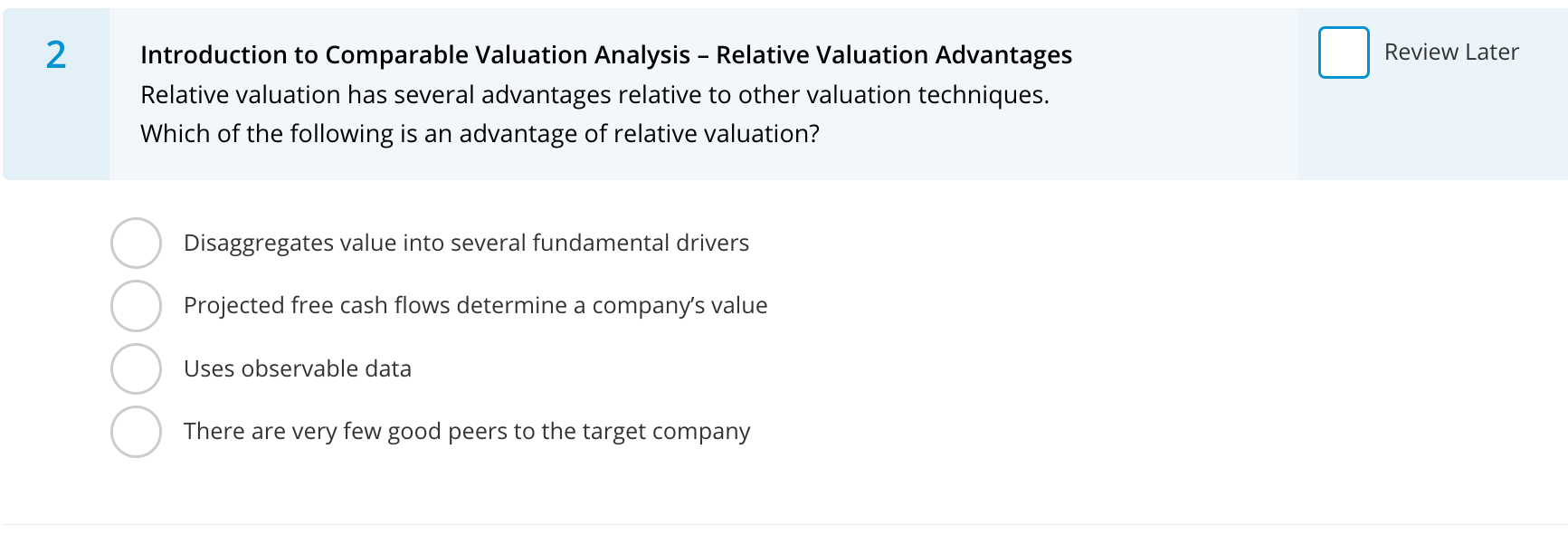

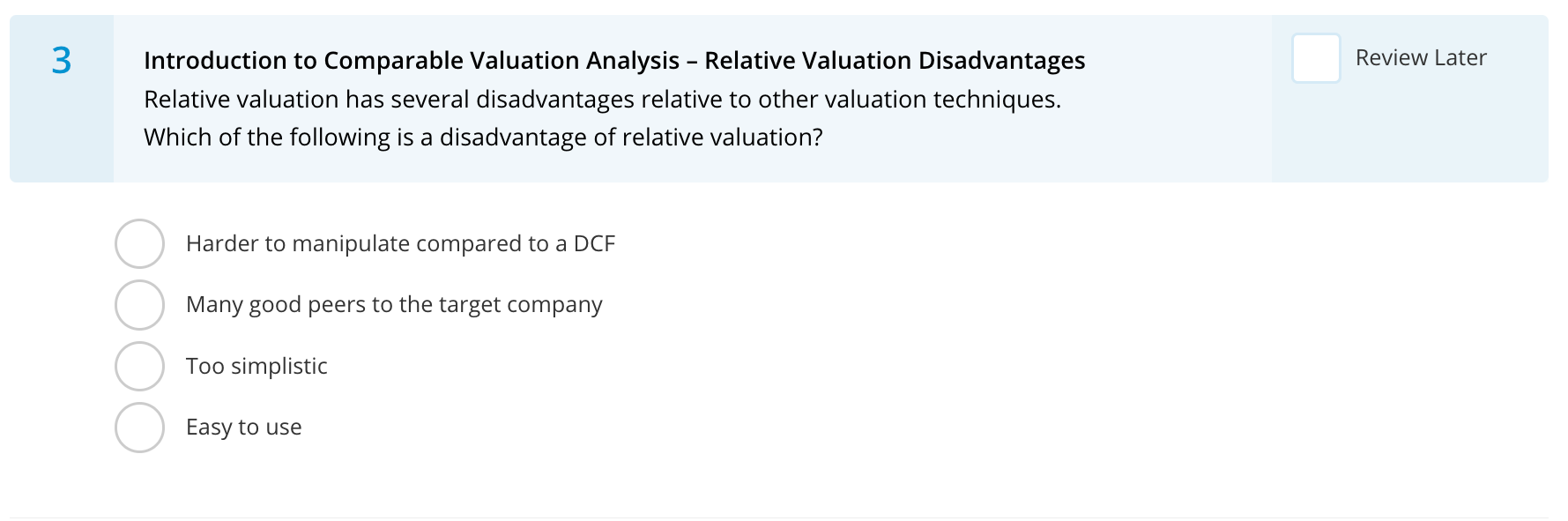

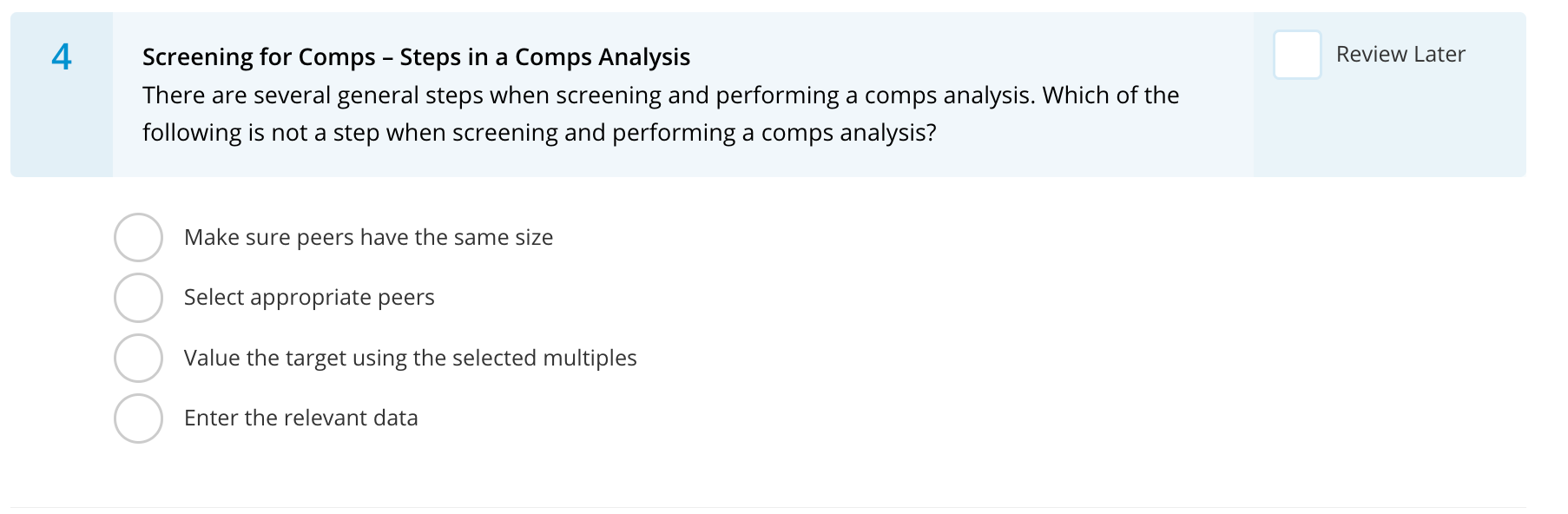

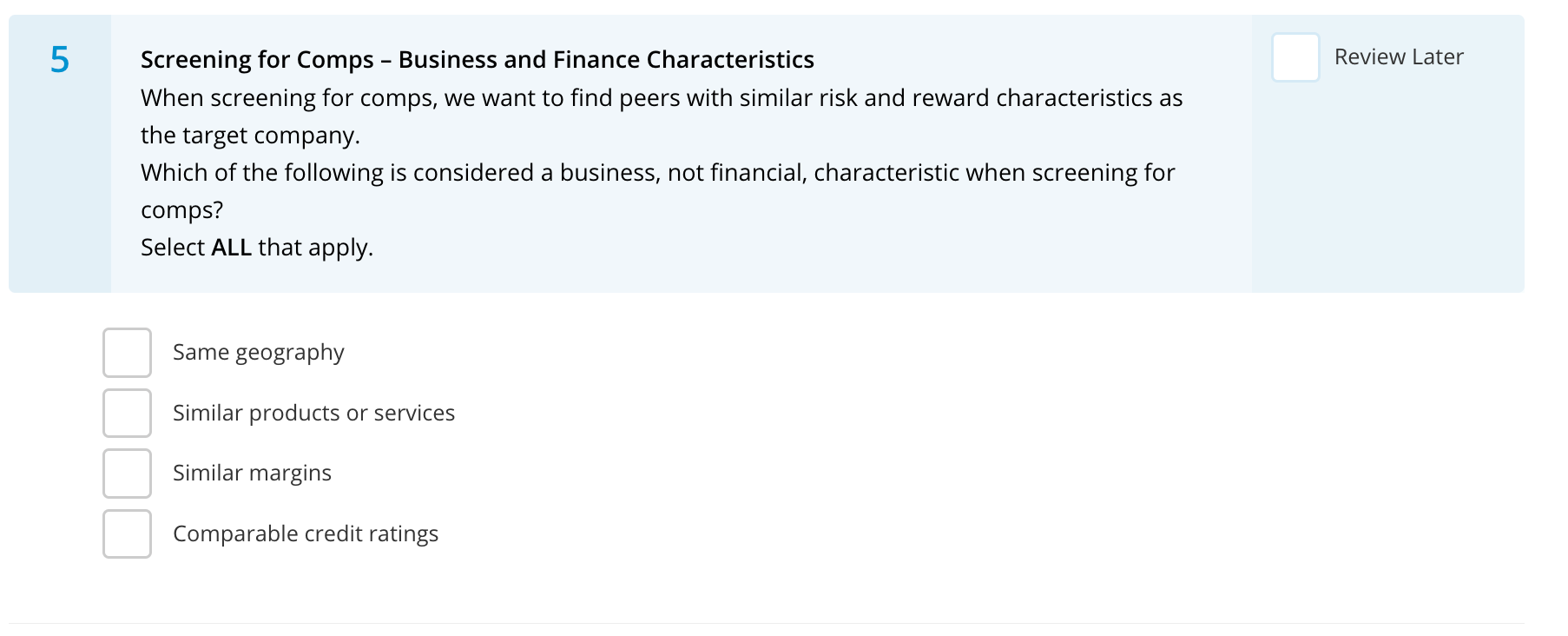

Introduction to Comparable Valuation Analysis - Main Valuation Techniques Multiple valuation techniques are used to "triangulate" the value of a company. What are three common valuation techniques? Select ALL that apply. Income approach Market approach Going-concern approach Cost approach Introduction to Comparable Valuation Analysis - Relative Valuation Advantages Review Later Relative valuation has several advantages relative to other valuation techniques. Which of the following is an advantage of relative valuation? Disaggregates value into several fundamental drivers Projected free cash flows determine a company's value Uses observable data There are very few good peers to the target company 3 Introduction to Comparable Valuation Analysis - Relative Valuation Disadvantages Relative valuation has several disadvantages relative to other valuation techniques. Which of the following is a disadvantage of relative valuation? Harder to manipulate compared to a DCF Many good peers to the target company Too simplistic Easy to use Screening for Comps - Steps in a Comps Analysis There are several general steps when screening and performing a comps analysis. Which of the following is not a step when screening and performing a comps analysis? Make sure peers have the same size Select appropriate peers Value the target using the selected multiples Enter the relevant data Screening for Comps - Business and Finance Characteristics Review Later When screening for comps, we want to find peers with similar risk and reward characteristics as the target company. Which of the following is considered a business, not financial, characteristic when screening for comps? Select ALL that apply. Same geography Similar products or services Similar margins Comparable credit ratings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts