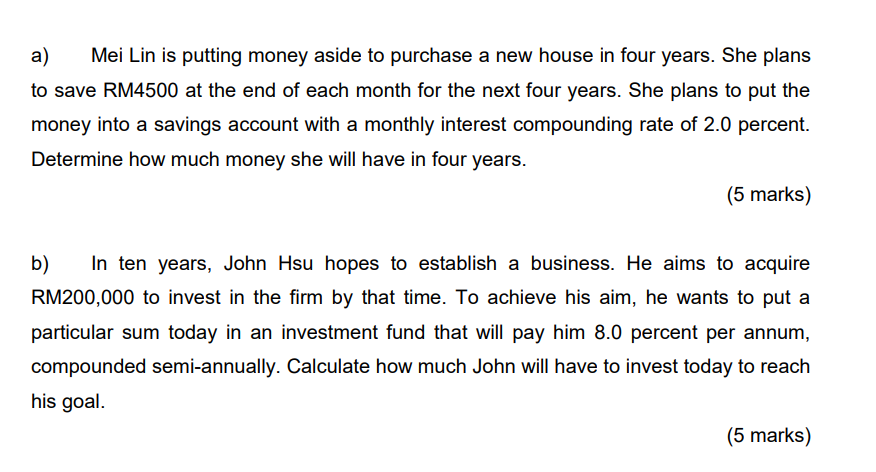

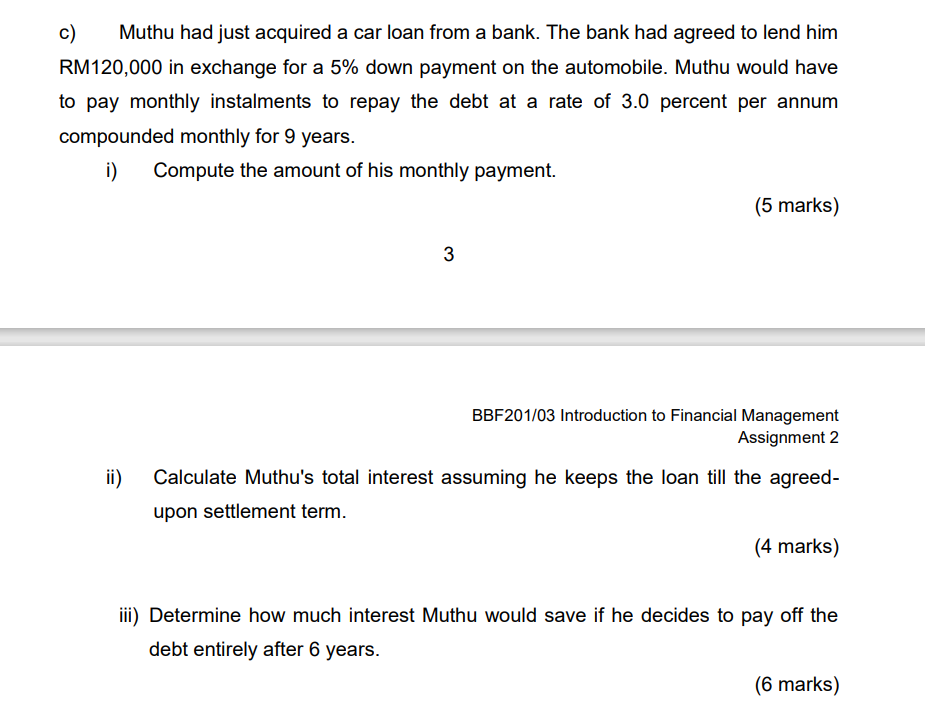

Question: INTRODUCTION TO FINANCIAL MANAGEMENT All answer need attach calculation table and explain. a) Mei Lin is putting money aside to purchase a new house in

INTRODUCTION TO FINANCIAL MANAGEMENT

All answer need attach calculation table and explain.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts