Question: INTRODUCTION TO FINANCIAL MANAGEMENT All answer need attach table form calculation and explain. Your company can invest in either, or both of two investments: Hitam

INTRODUCTION TO FINANCIAL MANAGEMENT

All answer need attach table form calculation and explain.

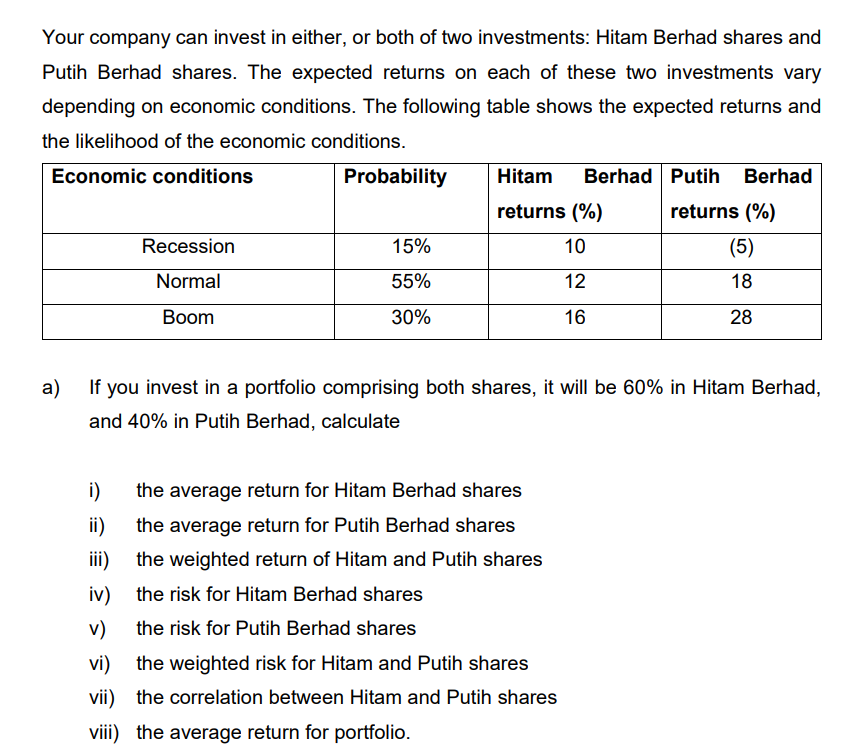

Your company can invest in either, or both of two investments: Hitam Berhad shares and Putin Berhad shares. The expected returns on each of these two investments vary depending on economic conditions. The following table shows the expected returns and the likelihood of the economic conditions. Economic conditions Probability Hitam Berhad Putin Berhad returns (%) returns (%) Recession 15% 10 (5) Normal 55% 12 18 Boom 30% 16 28 a) If you invest in a portfolio comprising both shares, it will be 60% in Hitam Berhad, and 40% in Putih Berhad, calculate i) the average return for Hitam Berhad shares ii) the average return for Putih Berhad shares iii) the weighted return of Hitam and Putin shares iv) the risk for Hitam Berhad shares V) the risk for Putih Berhad shares vi) the weighted risk for Hitam and Putih shares vii) the correlation between Hitam and Putih shares viii) the average return for portfolio.ix) the risk of the portfolio. {20 marks) b) Based on your response above, explain what occurred to the rate of return and risk when you moved from individual shares to a portfolio.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts