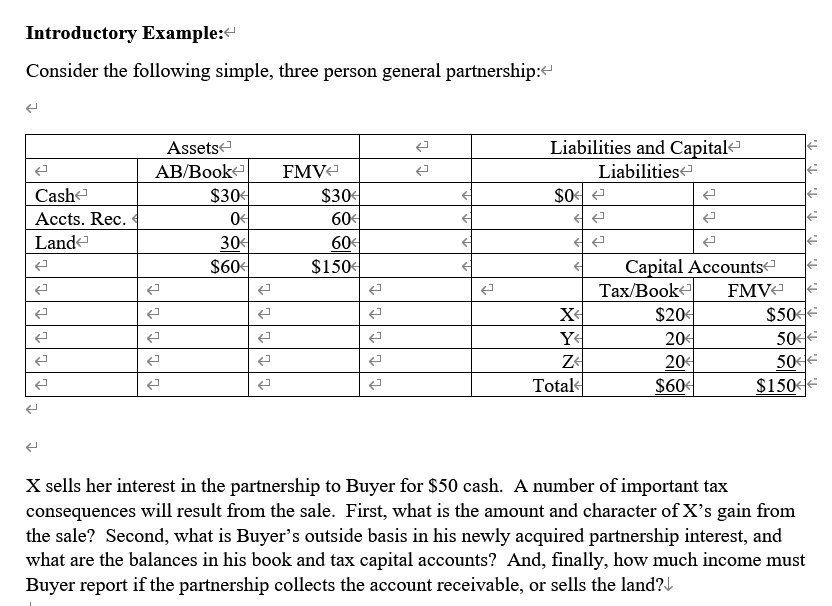

Question: Introductory Example: Consider the following simple, three person general partnership: X sells her interest in the partnership to Buyer for $50 cash. A number of

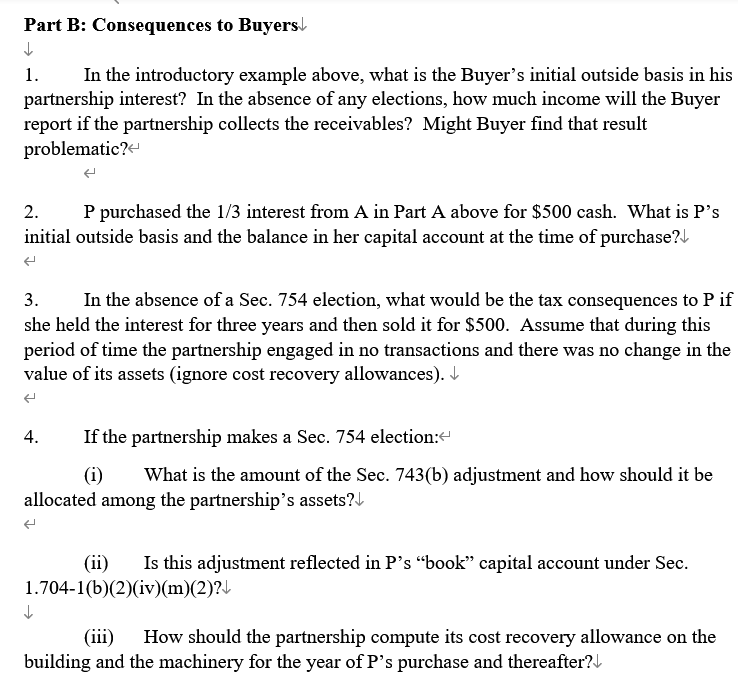

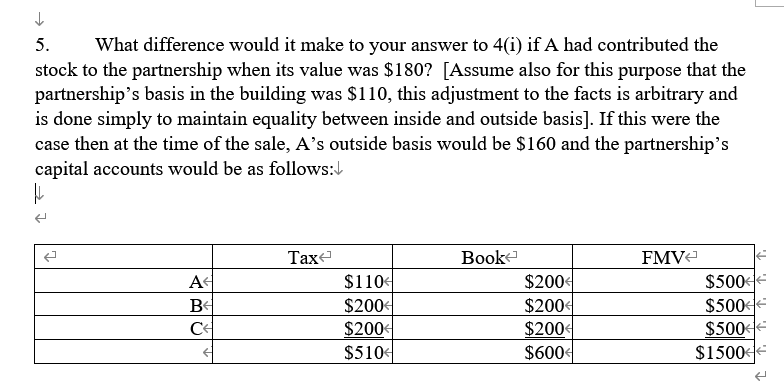

Introductory Example: Consider the following simple, three person general partnership: X sells her interest in the partnership to Buyer for $50 cash. A number of important tax consequences will result from the sale. First, what is the amount and character of X 's gain from the sale? Second, what is Buyer's outside basis in his newly acquired partnership interest, and what are the balances in his book and tax capital accounts? And, finally, how much income must Buyer report if the partnership collects the account receivable, or sells the land? Part B: Consequences to Buyers 1. In the introductory example above, what is the Buyer's initial outside basis in his partnership interest? In the absence of any elections, how much income will the Buyer report if the partnership collects the receivables? Might Buyer find that result problematic? 2. P purchased the 1/3 interest from A in Part A above for $500 cash. What is P's initial outside basis and the balance in her capital account at the time of purchase? 3. In the absence of a Sec. 754 election, what would be the tax consequences to P if she held the interest for three years and then sold it for $500. Assume that during this period of time the partnership engaged in no transactions and there was no change in the value of its assets (ignore cost recovery allowances). 4. If the partnership makes a Sec. 754 election: (i) What is the amount of the Sec. 743(b) adjustment and how should it be allocated among the partnership's assets? (ii) Is this adjustment reflected in P's "book" capital account under Sec. 1.7041(b)(2)(iv)(m)(2)? 5. What difference would it make to your answer to 4(i) if A had contributed the stock to the partnership when its value was $180 ? [Assume also for this purpose that the partnership's basis in the building was $110, this adjustment to the facts is arbitrary and is done simply to maintain equality between inside and outside basis]. If this were the case then at the time of the sale, A's outside basis would be $160 and the partnership's capital accounts would be as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts