Question: INVENTORIES TRUE-FALSE STATEMENTS 1. The inventory amount has no effect on net income, 2. Raw materials inventories are the goods that a manufacturer has completed

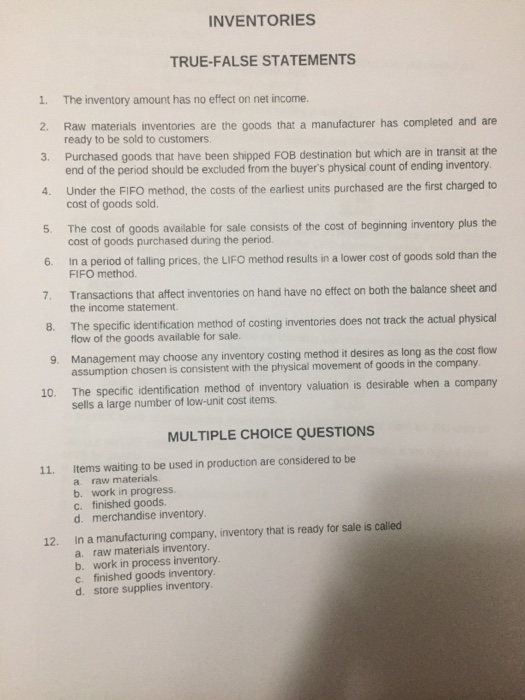

INVENTORIES TRUE-FALSE STATEMENTS 1. The inventory amount has no effect on net income, 2. Raw materials inventories are the goods that a manufacturer has completed and are ready to be sold to customers. 3. Purchased goods that have been shipped FOB destination but which are in transit at the end of the period should be excluded from the buyer's physical count of ending inventory 4. Under the FIFO method, the costs of the earliest units purchased are the first charged to cost of goods sold. 5. The cost of goods available for sale consists of the cost of beginning inventory plus the cost of goods purchased during the period. 6. in a period of falling prices, the LIFO method results in a lower cost of goods sold than the FIFO method. 7. Transactions that affect inventories on hand have no effect on both the balance sheet and the income statement. 8. The specific identification method of costing inventories does not track the actual physical flow of the goods available for sale. 9. Management may choose any inventory costing method it desires as long as the cost flow assumption chosen is consistent with the physical movement of goods in the company 10. The specific identification method of inventory valuation is desirable when a company sells a large number of low-unit cost items MULTIPLE CHOICE QUESTIONS 11. Items waiting to be used in production are considered to be a raw materials b. work in progress c. finished goods. d. merchandise inventory in a manufacturing company, inventory that is ready for sale is called a raw materials inventory. b. work in process inventory. c. finished goods inventory. d. store supplies inventory 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts