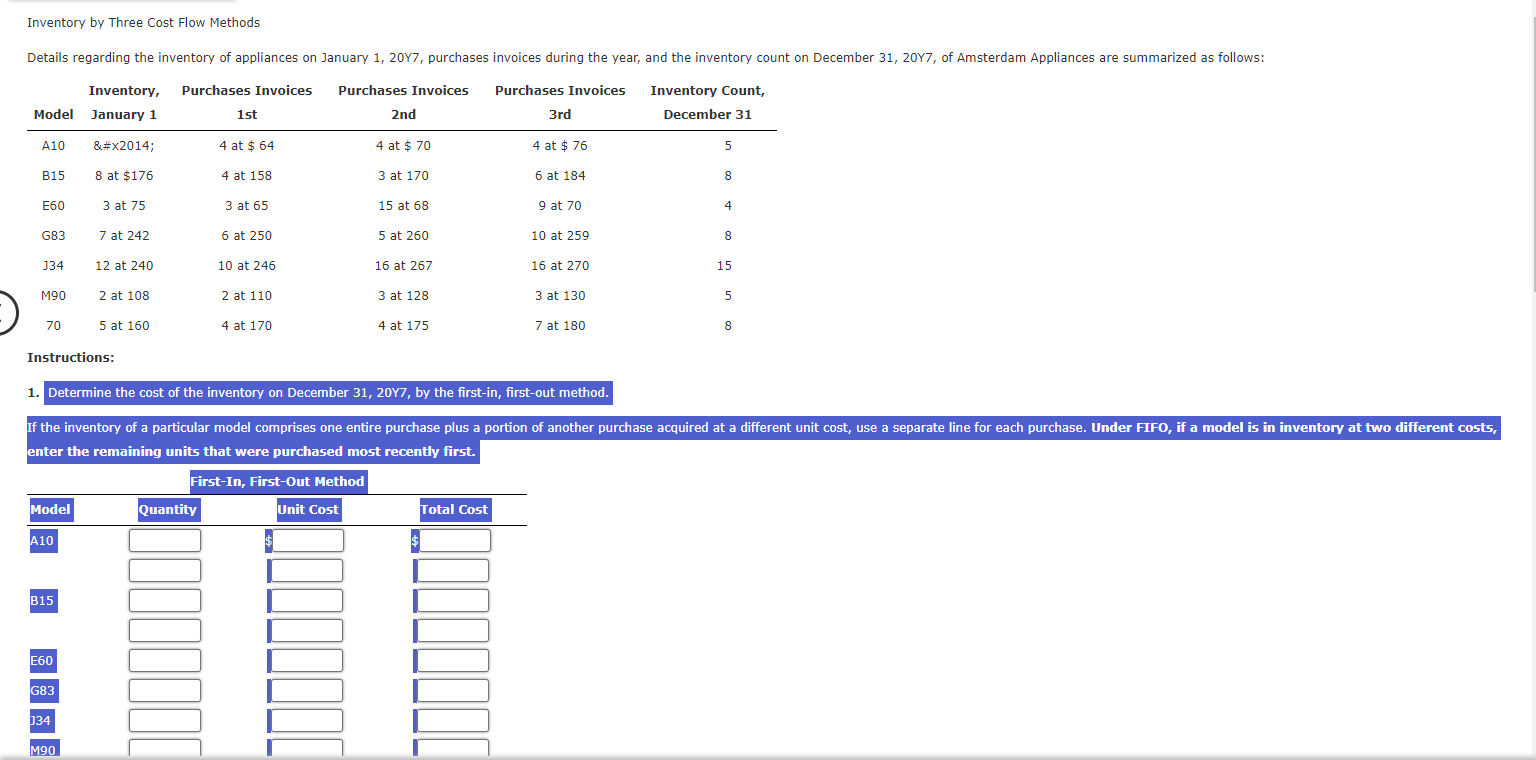

Question: Inventory by Three Cost Flow Methods begin{tabular}{|c|c|c|c|c|c|} hline Model & begin{tabular}{c} Inventory, January 1 end{tabular} & begin{tabular}{c} Purchases Invoices 1st end{tabular} & begin{tabular}{c}

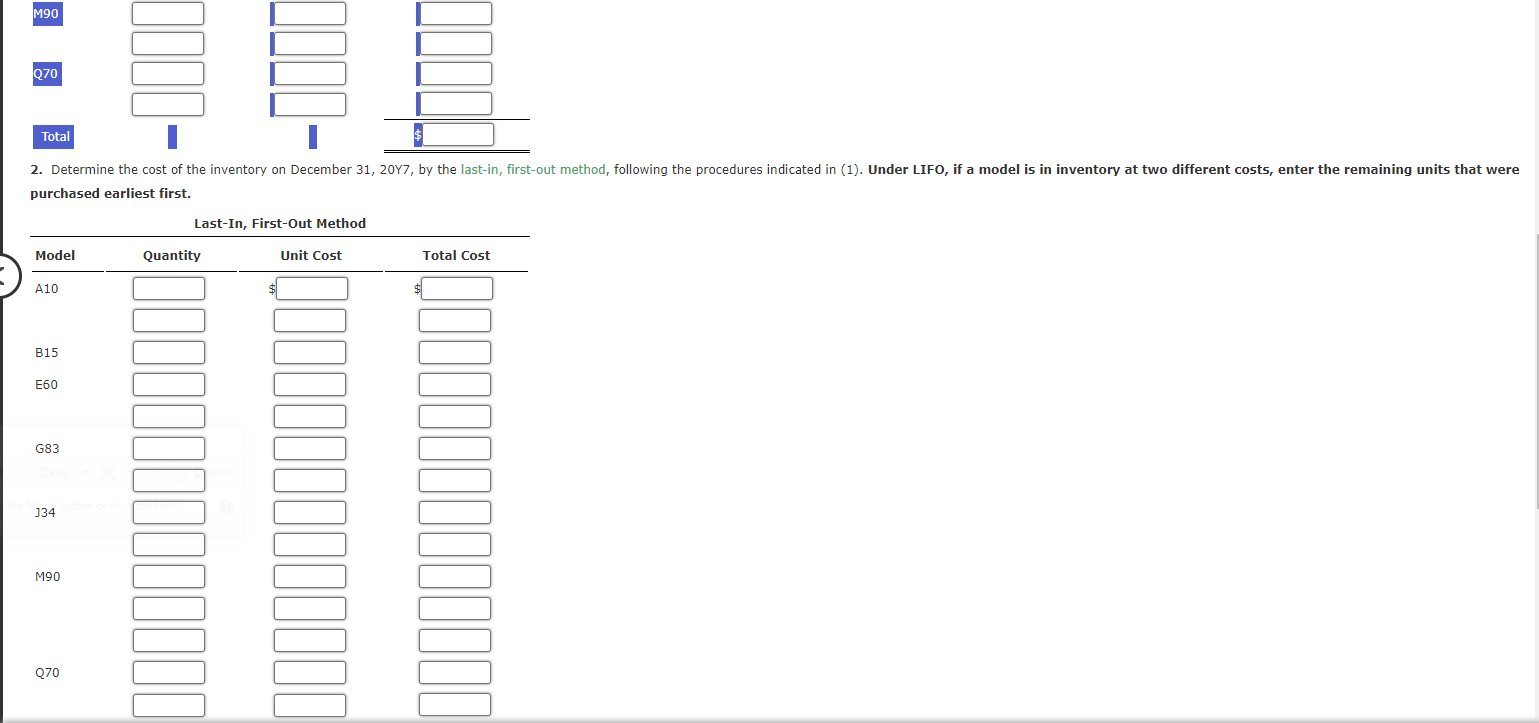

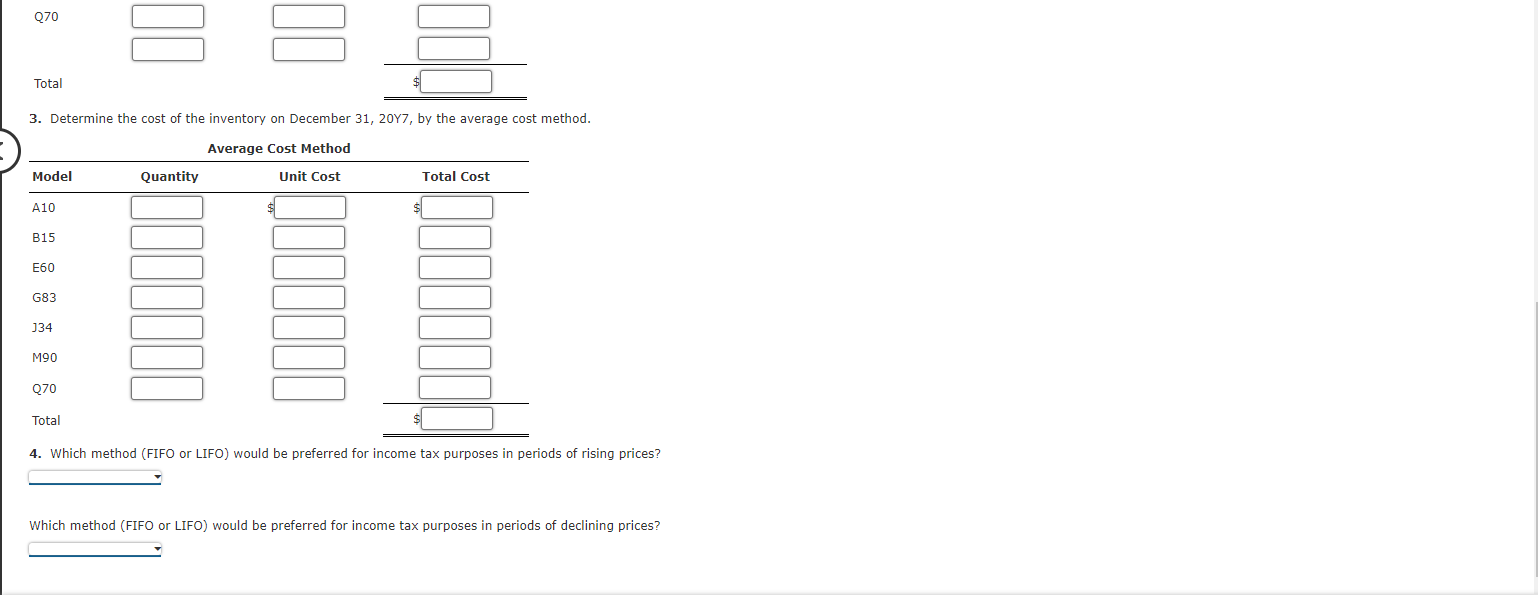

Inventory by Three Cost Flow Methods \begin{tabular}{|c|c|c|c|c|c|} \hline Model & \begin{tabular}{c} Inventory, \\ January 1 \end{tabular} & \begin{tabular}{c} Purchases Invoices \\ 1st \end{tabular} & \begin{tabular}{c} Purchases Invoices \\ 2nd \end{tabular} & \begin{tabular}{c} Purchases Invoices \\ 3rd \end{tabular} & \begin{tabular}{c} Inventory Count, \\ December 31 \end{tabular} \\ \hline A10 & \&\#x2014; & 4 at $64 & 4 at $70 & 4 at $76 & 5 \\ \hline B15 & 8 at $176 & 4 at 158 & 3 at 170 & 6 at 184 & 8 \\ \hline E60 & 3 at 75 & 3 at 65 & 15 at 68 & 9 at 70 & 4 \\ \hline G83 & 7 at 242 & 6 at 250 & 5 at 260 & 10 at 259 & 8 \\ \hline 334 & 12 at 240 & 10 at 246 & 16 at 267 & 16 at 270 & 15 \\ \hline M90 & 2 at 108 & 2 at 110 & 3 at 128 & 3 at 130 & 5 \\ \hline 70 & 5 at 160 & 4 at 170 & 4 at 175 & 7 at 180 & 8 \\ \hline \end{tabular} Instructions: 1. Determine the cost of the inventory on December 31,20Y7, by the first-in, first-out method. enter the remaining units that were purchased most recently first. M90 Q70 Total purchased earliest first. Last-In, First-Out Method 3. Determine the cost of the inventory on December 31,20Y7, by the average cost method. 4. Which method (FIFO or LIFO) would be preferred for income tax purposes in periods of rising prices? Which method (FIFO or LIFO) would be preferred for income tax purposes in periods of declining prices? Inventory by Three Cost Flow Methods \begin{tabular}{|c|c|c|c|c|c|} \hline Model & \begin{tabular}{c} Inventory, \\ January 1 \end{tabular} & \begin{tabular}{c} Purchases Invoices \\ 1st \end{tabular} & \begin{tabular}{c} Purchases Invoices \\ 2nd \end{tabular} & \begin{tabular}{c} Purchases Invoices \\ 3rd \end{tabular} & \begin{tabular}{c} Inventory Count, \\ December 31 \end{tabular} \\ \hline A10 & \&\#x2014; & 4 at $64 & 4 at $70 & 4 at $76 & 5 \\ \hline B15 & 8 at $176 & 4 at 158 & 3 at 170 & 6 at 184 & 8 \\ \hline E60 & 3 at 75 & 3 at 65 & 15 at 68 & 9 at 70 & 4 \\ \hline G83 & 7 at 242 & 6 at 250 & 5 at 260 & 10 at 259 & 8 \\ \hline 334 & 12 at 240 & 10 at 246 & 16 at 267 & 16 at 270 & 15 \\ \hline M90 & 2 at 108 & 2 at 110 & 3 at 128 & 3 at 130 & 5 \\ \hline 70 & 5 at 160 & 4 at 170 & 4 at 175 & 7 at 180 & 8 \\ \hline \end{tabular} Instructions: 1. Determine the cost of the inventory on December 31,20Y7, by the first-in, first-out method. enter the remaining units that were purchased most recently first. M90 Q70 Total purchased earliest first. Last-In, First-Out Method 3. Determine the cost of the inventory on December 31,20Y7, by the average cost method. 4. Which method (FIFO or LIFO) would be preferred for income tax purposes in periods of rising prices? Which method (FIFO or LIFO) would be preferred for income tax purposes in periods of declining prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts