Question: Inventory Case Study Nicole Matthews is the sol e owner of Nature's Cosmetics, Inc. In December, 2015, a supplier, Spa Manufacturing. Inc., asked her to

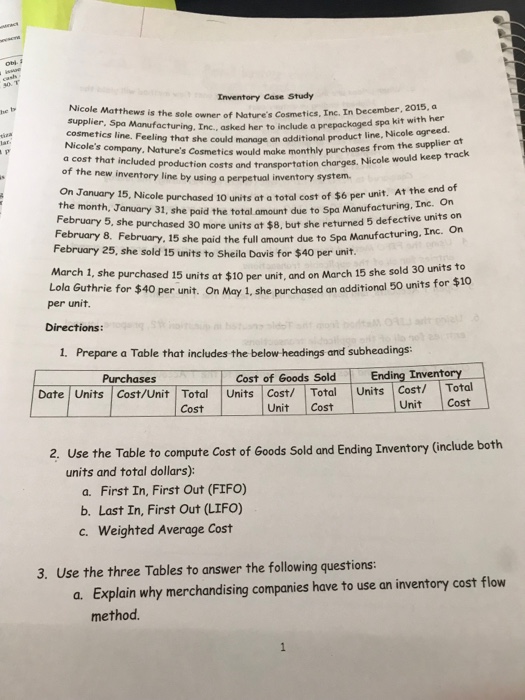

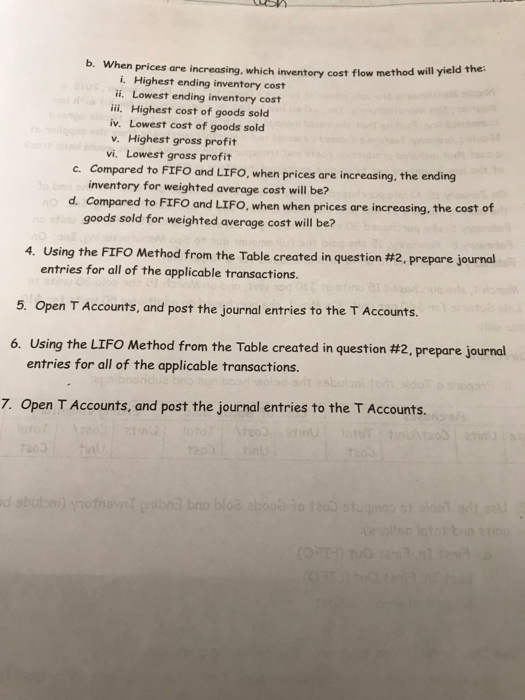

Inventory Case Study Nicole Matthews is the sol e owner of Nature's Cosmetics, Inc. In December, 2015, a supplier, Spa Manufacturing. Inc., asked her to include a pr cosmetics line. Feeling that she Nicole' could manage an additional product line, Nicole agreed. from the supplier at charges. Nicole would keep track s company, Nature's Cosmetics would make monthly purchases a cost that included production costs and transportation of the new inventory line by using a perpetual inventory ory system. On January 15, Nicole At the end of purchased 10 units at a total cost of $6 per unit. Inc. On the month, January 31, she paid the total amount due to Spa Manufacturing. Ed 30 more units at $8, but she returned 5 defective units on Spa Manufacturing, Inc. On February 8. February, 15 she paid the full amount due to February 25, she sold 15 units to Sheila Davis for $40 per unit March 1, she purchased 15 units at $10 per unit, and on March 15 she sold 30 units Lola Guthrie for $40 per unit. On May 1, she purchased an additional 50 units to per unit. r $10 1. Prepare a Table that includes the below headings and subheadings: Cost of Goods Sold Ending Inventory Date Units Cost/Unit Total Units Cost/ Total Units Cos/Total Unit Cost Cost Unit Cost 2, Use the Table to compute Cost of Goods Sold and Ending Inventory (include both units and total dollars): a. First In, First Out (FIFO) b. Last In, First Out (LIFO) c. Weighted Average Cost 3. Use the three Tables to answer the following questions a. Explain why merchandising companies have to use an inventory cost flow method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts