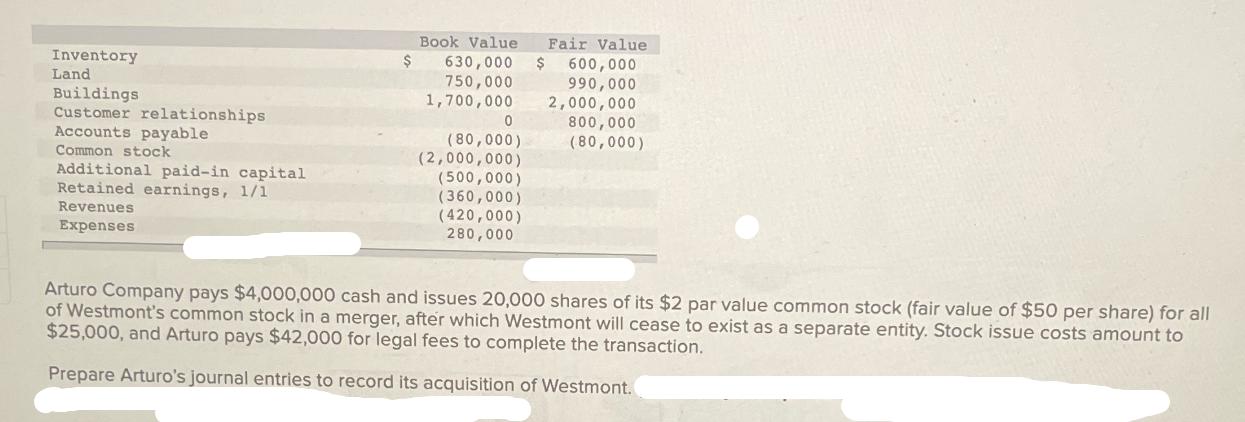

Question: Inventory Land Book Value Fair Value $ 630,000 $ 600,000 750,000 990,000 1,700,000 2,000,000 Buildings Customer relationships Accounts payable 0 (80,000) Common stock (2,000,000)

Inventory Land Book Value Fair Value $ 630,000 $ 600,000 750,000 990,000 1,700,000 2,000,000 Buildings Customer relationships Accounts payable 0 (80,000) Common stock (2,000,000) Additional paid-in capital (500,000) Retained earnings, 1/1 Revenues Expenses (360,000) (420,000) 280,000 800,000 (80,000) Arturo Company pays $4,000,000 cash and issues 20,000 shares of its $2 par value common stock (fair value of $50 per share) for all of Westmont's common stock in a merger, after which Westmont will cease to exist as a separate entity. Stock issue costs amount to $25,000, and Arturo pays $42,000 for legal fees to complete the transaction. Prepare Arturo's journal entries to record its acquisition of Westmont.

Step by Step Solution

There are 3 Steps involved in it

To prepare Arturos journal entries to record the acquisition of Westmont we need to take into accoun... View full answer

Get step-by-step solutions from verified subject matter experts