Question: Inventory Valuation Methods INVENTORY COSTING - After a company has determined the quantity of units of ending inventory, it applies unit costs to the quantities

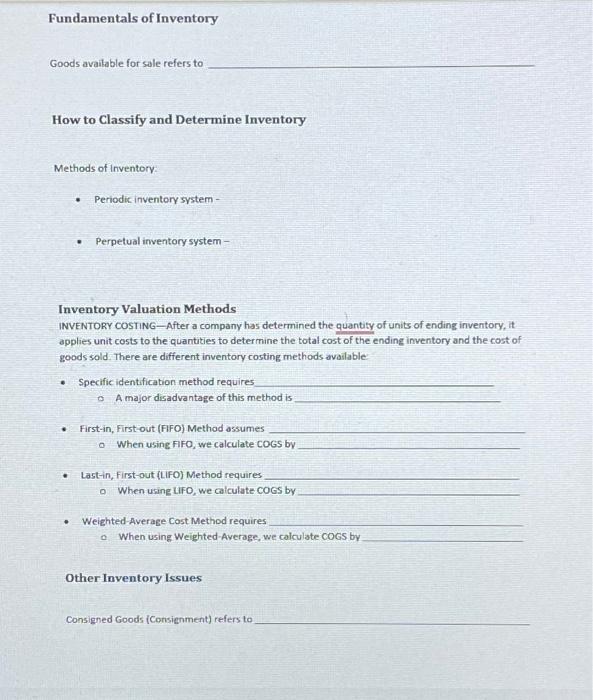

Inventory Valuation Methods INVENTORY COSTING - After a company has determined the quantity of units of ending inventory, it applies unit costs to the quantities to determine the total cost of the ending inventory and the cost of goods sold. There are different inventory costing methods available: - Specific identification method requires - A major disadvantage of this method is - First-in, First-out (FIFO) Method assumes - When using FIFO, we calculate COGS by - Last-in, First-out (LIFO) Method requires - When using UFO, we calculate coGs by - Weighted-Average Cost Method requires o. When using Weighted-Average, we calculate COGS by Other Inventory Issues Consigned Goods (Consienment) refers to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts